This piece was written by FTMA’s Kat Welsh with FTMA Strategic Partner, AB Phillips.

Being a small business owner is a bit like being a parent. It doesn’t always come with a manual of what you’re up against, there’s a lot you’re expected to know and have in place, but don’t always find out about until you face it. Generally most people want to be the best parent that they can, and most people want their business to be a thriving success.

Workplace health and safety laws and requirements have been around for a long time but are constantly being updated, and new legislation brought in. It can be hard to keep up with what the requirements are and how best to factor them into your business. Plus, if something goes wrong, claiming ignorance over required policies or procedures, is not an option.

One major consideration in business, is Workers’ Compensation insurance. The constant responsibility of employee safety, wellbeing, liability, and meeting legal requirements is time consuming and can be costly. I met with Brenda Garrard-Forster, General Manager from HRAnywhere (pictured right) – to discuss what their service does to assist businesses with Workers’ Compensation insurance and how, in some cases, can get thousands of dollars back for clients. In a nutshell their services range from general advice, to case managing Workers’ Compensation claims and, reviewing insurance premiums. With the premiums going up substantially across Australia, Brenda and her team know all the fine details to support their clients.

“Legally every business, if it employs workers, must have a Workers’ Compensation Insurance policy. A lot of people don’t realise they have to have it. Some people say it’s another insurance I don’t want to pay for, but if they get audited, not only will they have to pay the premium, but a fine of 2 and a half times the premium as well,” Brenda said.

With a lot of changes having come in since the Albanese government took over, it can be a lot to get your head around when the primary focus is day to day operations, dealing with staff shortages, and trying to provide a service. “With the Workers’ Compensation side, we can do the insurance side of things. If they have a claim we can manage the claim for them. We have tight relationships with the insurers and we know a lot of case managers. And we know where to push, whereas the businesses don’t and claims can go on and on. It’s our job to work with our clients to get the injured worker back to work as soon as possible or let the insurer work with the injured worker to find suitable other employment.”

Brenda talked about a recent client that came to them, who had been paying an employee for 5 years, through Workers’ Compensation. Brenda reviewed the situation and advised the client that they were only obliged to do that for 52 weeks. Brenda navigated this for the client and worked with the insurer to support the employee in finding suitable alternative work. The business had fulfilled their obligations, as the employee was not able to fulfill the inherent requirements of the role. The service that Brenda provided was key in providing experienced case management between all the elements involved – negotiating with the insurer, and supporting the client in moving forward as a business.

Another side to Brenda’s role is looking at insurance premium costs. For instance, “the Victorian Government has increased premiums by between 42% and 75%. Some businesses have seen a 100% increase in their premium.” The premiums will change depending on different factors, previous claims history, or being a high-risk industry, but also it can be related to how your business is coded.

“We’re being inundated with being asked to do premium reviews,” Brenda said, “we can look at the industry codes as sometimes the business is classified under the incorrect code. Sometimes the business changes what it does or adds on a particular product or service and they don’t think to look at the industry code or talk to the insurer. They end up paying more than what they should be.” Brenda also mentioned that every year, businesses have to declare their wages and if they haven’t been adjusted appropriately, businesses can end up paying incorrect premiums.

In some cases, after reviewing codes, the premiums and financial declarations, Brenda and the team have been successful in getting thousands of dollars back for their clients. “We had one client recently that we secured a $218,000 refund for less than a month after they’d signed our Letter of Appointment,” Brenda said, “once we had their authority, we did an audit of their last 5 years premiums and discovered a combination of mis-classification and over-estimated renumeration, presented that to the insurer and negotiated the reimbursement for the client.”

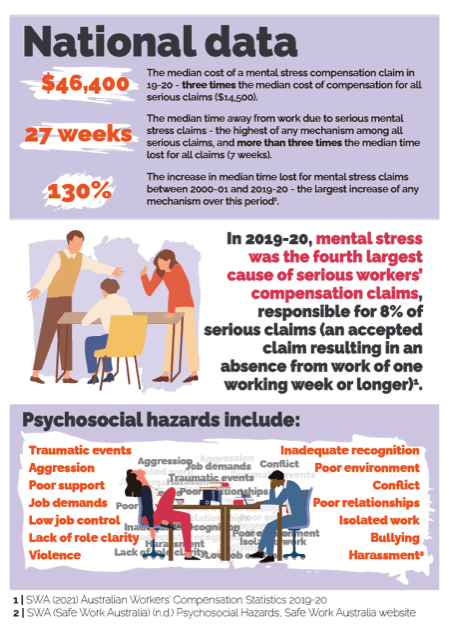

With the federal psychosocial model regulations, developed by Safe Work Australia, being incorporated into state policies, it’s leaving some business owners frenzied about what they might be liable for. “The psychosocial focus is aimed at a healthier workplace and ultimately to reduce future claims. It’s forcing employers to have a much greater focus on the mental wellbeing as well as the physical wellbeing of their employees. Employers need to make sure they have a workplace behaviour policy, they also have to make sure their staff understand that policy, so they will need to run a training session to make sure everybody understands their responsibilities.” The purpose of the new legislation ultimately would be, that claims for psychological injuries will decrease over time, once more responsibility to look after employees gets cemented into workplace culture. Workplaces that operate in a psychologically safe way, are proven to have a lower rate of sick leave, and higher work rates, even if there are high risks to safety or e.g. understaffing issues. If there is a good work culture and employees feel mentally supported, it reduces the rates of burnout and workers’ claims.

Another side to how Brenda assists clients is in a preventative role, and helps implement proper Safety Management Systems. In one case they took on a client where an employee had had a significant physical injury working in a timber mill – losing 2 fingers when a safety guard had been disabled, to cater for non-standard wood sizes. “The business initially saw it as a box ticking exercise to keep WorkSafe off their back, but we uncovered a number of other issues they didn’t even realise were there. When they fully implemented our recommendations the change for their business was remarkable. They’ve had a 75% reduction in injuries, and an 85% reduction in lost days of work. On top of that, the workplace culture has improved immensely.”

HRAnywhere is based in Victoria, but they have clients all over Australia. And Brenda particularly comes with a strong background in HR, Workers’ Compensation claims, and understanding the needs of small business. “I love helping small businesses, generally they don’t have any Workers’ Compensation support or maybe even a OH&S person sometimes. We’re really good at problem solving and we consider ourselves as professional and really practical.” Brenda spoke passionately about being the bridge between a legal system that is hard to navigate and understand, and translating it for clients so they comprehend the process and are well supported for best outcomes. Even in cases where the business might have a HR employee, the requirements and process can be overwhelming, and Brenda is able to offer support and be that advisory go-to person.

In a system that baffles the best of us, Brenda and her team are a great source to engage. They can tailor their service offerings to suit your business needs. When it comes to Workers’ Compensation Premium Reviews “we offer a No-Win-No-Fee service. We save a lot of our clients a lot of money, plus help show them that, thanks to our service across HR, OH&S, and Workers’ Compensation there are plenty of other ways HRAnywhere offers to make sure your people are no problem.”

Massive thanks to Brenda for taking the time to meet up and talk candidly about her role, and the ins and outs of what they can offer for clients. If you want to contact Brenda and the team with any questions, you can reach them on 1300 208 828, or email info@hranywhere.com.au.

Our Principal Partners