This piece was written and provided by Alares.

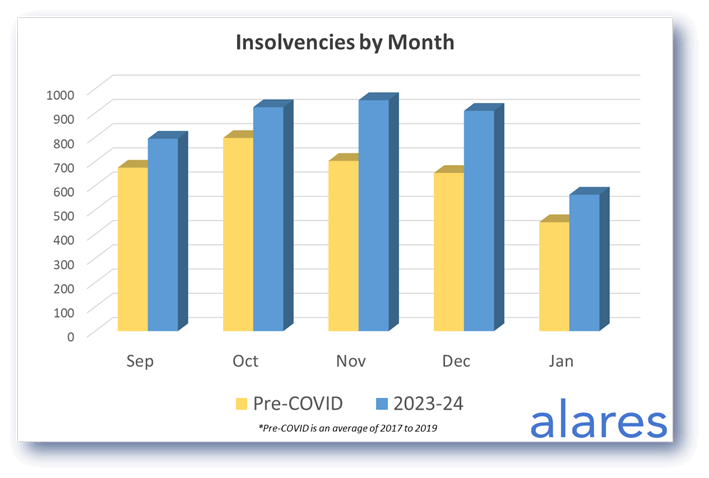

Insolvencies in January were 25% above pre-COVID levels – this follows a consistent trend from the second half of 2023. December and January are historically quiet months in terms of Court recoveries and insolvency activity – stay tuned for next month’s update to see what trends begin to emerge in 2024.

Key highlights in January

- Insolvencies remain well above pre-COVID levels.

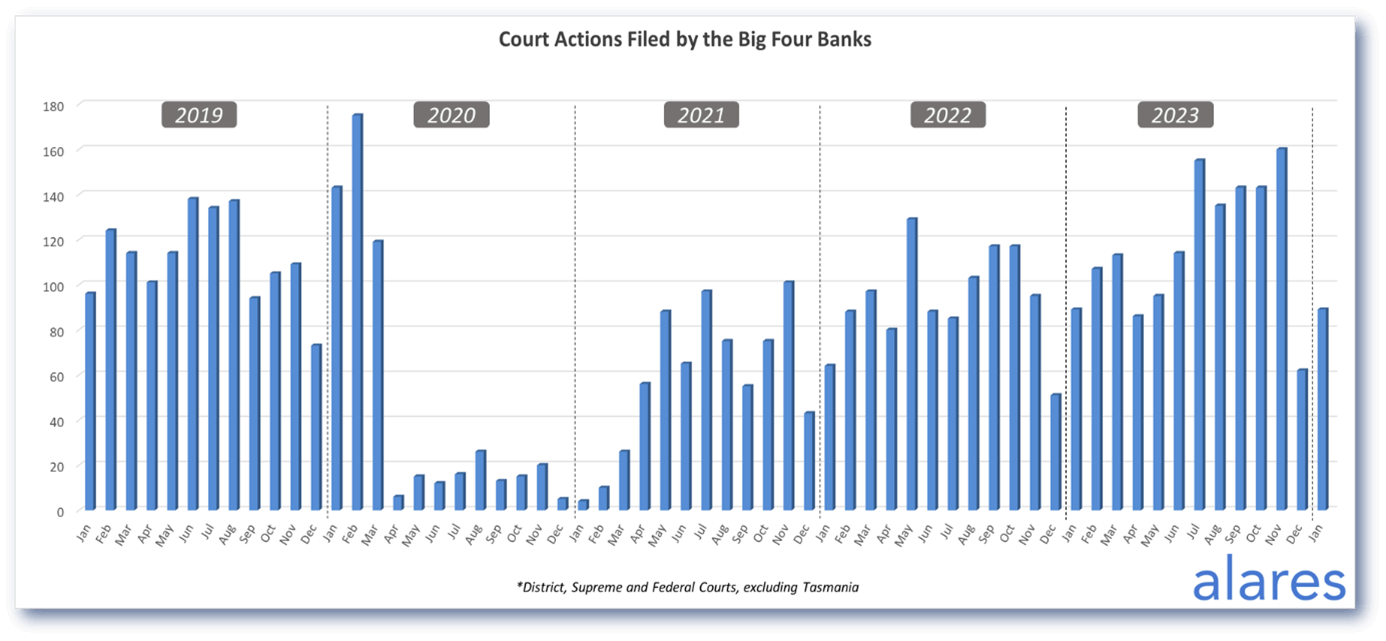

- Court recoveries from the big four banks remain well above pre-COVID levels.

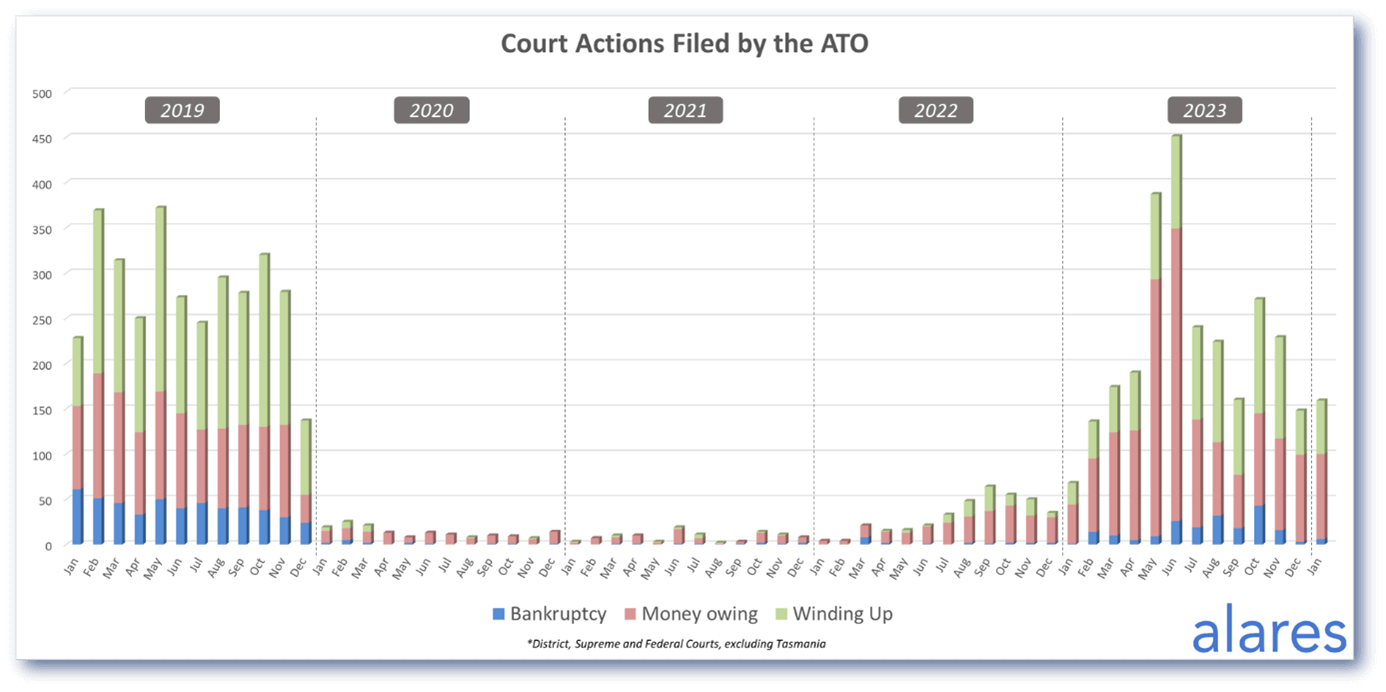

- The ATO and big banks remain active despite the typical Dec-Jan lull in recovery activity.

Insolvencies in January were again well above pre-COVID levels

This continues the consistent trend from the second half of 2023.

The big four banks remain active in-line with typical Dec-Jan levels

The second half of 2023 saw a large increase in big four bank Court recoveries. The coming months will be critical to see if this trend continues in 2024.

Similarly, the ATO remained active relative to historical levels.

Aside from personal bankruptcy petitions which remain at historical lows, Winding Up applications and money owing claims filed by the ATO in January were on-par with pre-COVID totals.

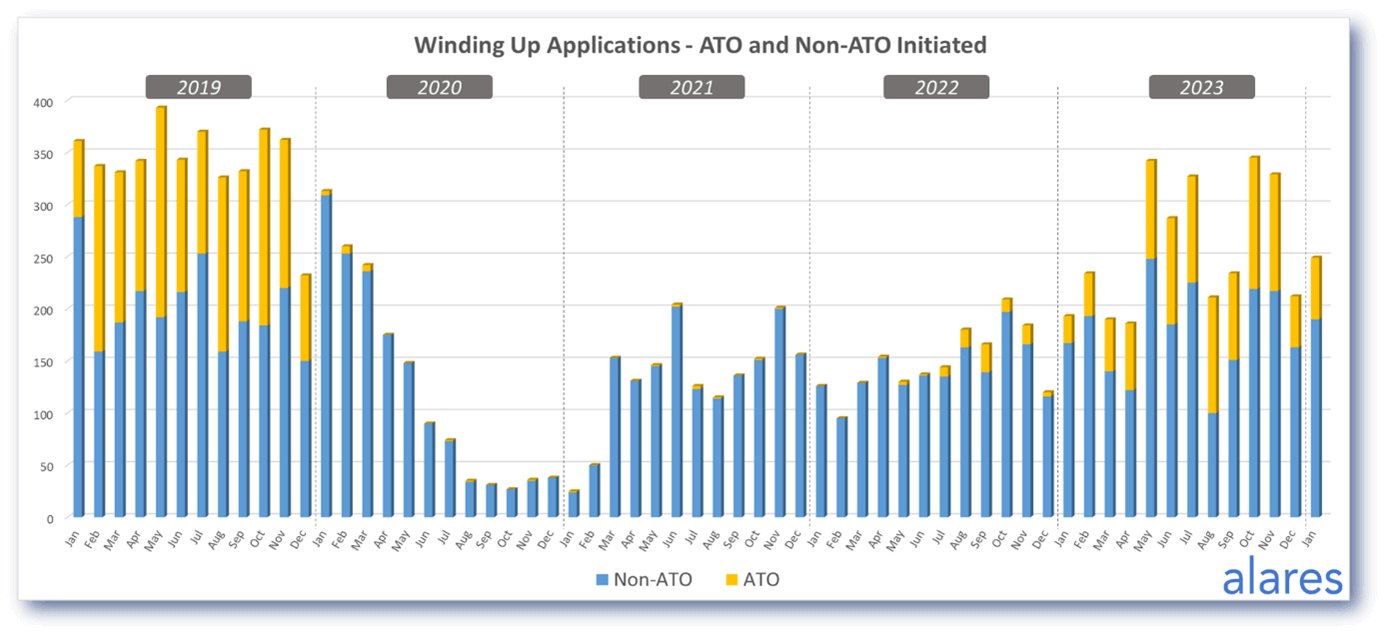

Winding up applications remain slightly below historical levels

The overall trend remains slightly upwards – again the next couple of months will likely shed more light on what to expect as 2024 unfolds.

Alares provides critical credit risk data that is NOT captured by other providers

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners