Australia’s new house building pipeline appears to be stable in mid-April, with construction work able to continue in most situations. The rush by builders to complete work to the next payment stage, over concern of an imminent sector or site closure is reportedly flowing through the supply chain.

A variety of fabricators report they are particularly busy as a result. Frame and truss manufacturers, cabinet-makers, even floor-sanders and finishers are reporting they are busy.

That is good news for those businesses and the people working in them and great news for the economy as a whole.

While it lasts.

The new housing pipeline is not endless, and it requires constant replenishing with new dwelling commitments by people forming new households. Right now, all the evidence is that new commitments have more or less stalled.

That means some time in the future – probably around the final quarter of 2020, in six months or thereabouts – work will slow and there is every possibility that new work will also stall.

As businesses consider their response to what seems an almost inevitable demand-shock, there are two scenarios IndustryEdge thinks are likely – and they can operate together.

Pent up demand will add a spike to new commitments

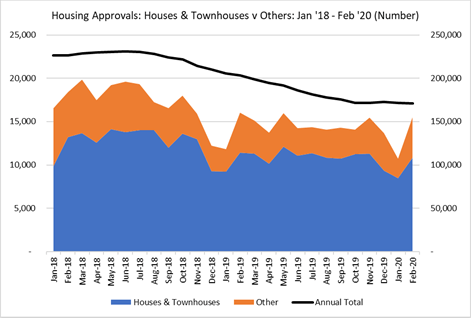

Evidence in the early part of 2020 suggested that new dwelling approvals were turning the corner, with a recovery in demand just becoming evident. We can see that in the chart below. It is still the case that Houses & Townhouse approvals were down 4.8% in February 2020, compared with 2019, and the Other formats in total were up 0.5%. On an annualised basis, total approvals were down 15.8% to a total 171,205 dwellings.

Source: IndustryEdge, derived from ABS data

We will not know for a month, but we have to anticipate that from March, new housing commitments will fall back sharply.

What that will mean is that when there is some form of recovery and return to ‘normal’, there will be ‘pent-up’ demand. That is, there will be people very keen to get their long-desired new dwelling started.

There are some pretty large caveats on this. Households will have to demonstrate a capacity to pay and a lot of people are not currently working and it may be some time before they are again. We expect plenty of those out of work are right at the stage in life where they were due to make their first housing commitment.

Second, and again, it is an expectation only, but the appetite for larger dwellings is likely to reduce. Households are not going to over commit and are likely to reassess their appetite for larger loans (and therefore larger houses) in the future. We saw that post-GFC, and this current crisis is far more serious and deeper and impacting more people for longer.

So, the housing economy will hold its breath, but we have to expect that recovery will see some demand, but we don’t know how much and we cannot predict how that will be different to just a couple of months ago.

Population growth will crash for the next year: long-term impact

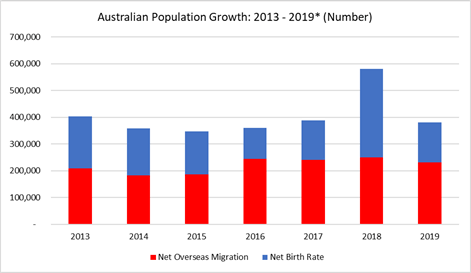

Every year, Australia’s population grows by about 1.7%. That amounted to an average of about 390,000 people over the decade to the end of 2019. What sometimes comes as a surprise is that close to two-thirds of population growth comes from net overseas migration, and one-third from the net positive birth rate.

The chart below shows Australia’s population growth from 2013 to 2019.

Source: IndustryEdge, derived from ABS

* 2019 extrapolated from data to end of September 2019

As an example, to the end of September 2019, 62% of population growth came from net overseas migration (arrivals less departures), with 38% coming from net births (births less deaths).

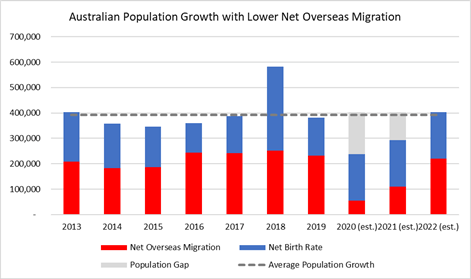

Australia’s borders are closed right now and will be for the foreseeable future. That means no one is coming, and no one is going either. That seems a reasonable assumption through to the middle of 2021, so what happens if we assume that net overseas migration just stops at the end of the March quarter, and it is halved for 2021?

The total impact of that would be something like 276,000 less people living in Australia by the middle of 2021 – just fifteen months away! We can see the effect in this chart.

Source: IndustryEdge, including derived from ABS

We know that on average, there are 2.63 people in each dwelling in Australia. So applying that simple measure, if there are 276,000 less people in the country, there will be about 105,000 less dwellings at some point in the future.

If we apply that to the historical ratio of dwelling types, what we might see is shown in the table below.

Source: IndustryEdge

To summarise this, at some point in the future, we can anticipate there will be quite a bit less demand for new dwellings because the population is lower than we would normally have expected.

This is not a forecast and we cannot be clear how long it will take for a lower population to be felt in the housing market. Migrants typically arrive in household groups, so the effect is probably taken up relatively quickly.

Equally, we might find that the net birth rate rises quite a bit over the next year, or there is a big spike in later net overseas migration that wipes out the deficit fairly quickly.

In the meantime, as we consider the future for our businesses, it seems likely we will need to factor in less new dwellings for some time, with a lumpy recovery thereafter.

This article was written and provided by Tim Woods, Managing Director of IndustryEdge, Australia’s leading market data and trade analyst for the forestry and wood products industry.

Follow IndustryEdge on LinkedIn or www.industryedge.com.au

Contact tim@industryedge.com.au