This piece was written by Dr Harley D Dale, Independent Economist and Advisor; Headnote Speaker..

A couple of weeks before the budget was brought down on May 14th, I quipped to some other prominent budget analysts that regardless of political stripes, no government would really want to have to produce the 2024/25 budget for quids. That comment was met with universal agreement. Getting this budget ‘right enough’ under current economic and geo-political circumstances was like my beloved North Melbourne winning a game in 2024.

Here are some starting headlines:

- The latest budget produced a $9.3 billion surplus, the second consecutive positive outcome in over ten years.

- In a survey I gave last year’s budget a B. I gave this one a C+.

- Cost of living pressure relief needed to be front and centre and the headline policy was the $300 energy rebate, $325 for small businesses.

- Stage 3 tax cuts, that we already knew about, come into effect on July 1st.

- The budget is modestly inflationary.

- Conjecture is rife about what happens to interest rates next. This is bad for economic confidence and housing demand.

- Economic growth forecasts were predictably downgraded.

- Housing was a priority, as it needed to be. A total of $36.3 billion was committed.

The latest budget produced a $9.3 billion surplus.

This is a fortunate surplus not produced by the government itself. However, any government would claim it because that’s politics. The high prices for commodities (not so much now) helped through a significant part of the result. Plus, the labour market has remained stronger than expected. That means more income tax receipts and thus more revenue for the government. That golden window is now closing, and budget deficits are projected for as far as the eye can see. It begins with a projected deficit of $47.1 billion for 2025/26. I’m not going to enter the argument here about the GST allocation to Western Australia, a state requiring binoculars to find the end of their budget surpluses!

Stage 3 tax cuts, that we already knew about, come into effect on July 1st.

This will be welcome relief for low-and middle-income households. It was correct for the government to pare them back, but the handling of that policy change was messy for the government. It was a broken promise and the Opposition rightly seized on that. However, the original policy from the Coalition government, which Labor reluctantly supported, was always a step too far amidst what was clearly going to be a deteriorating economic environment.

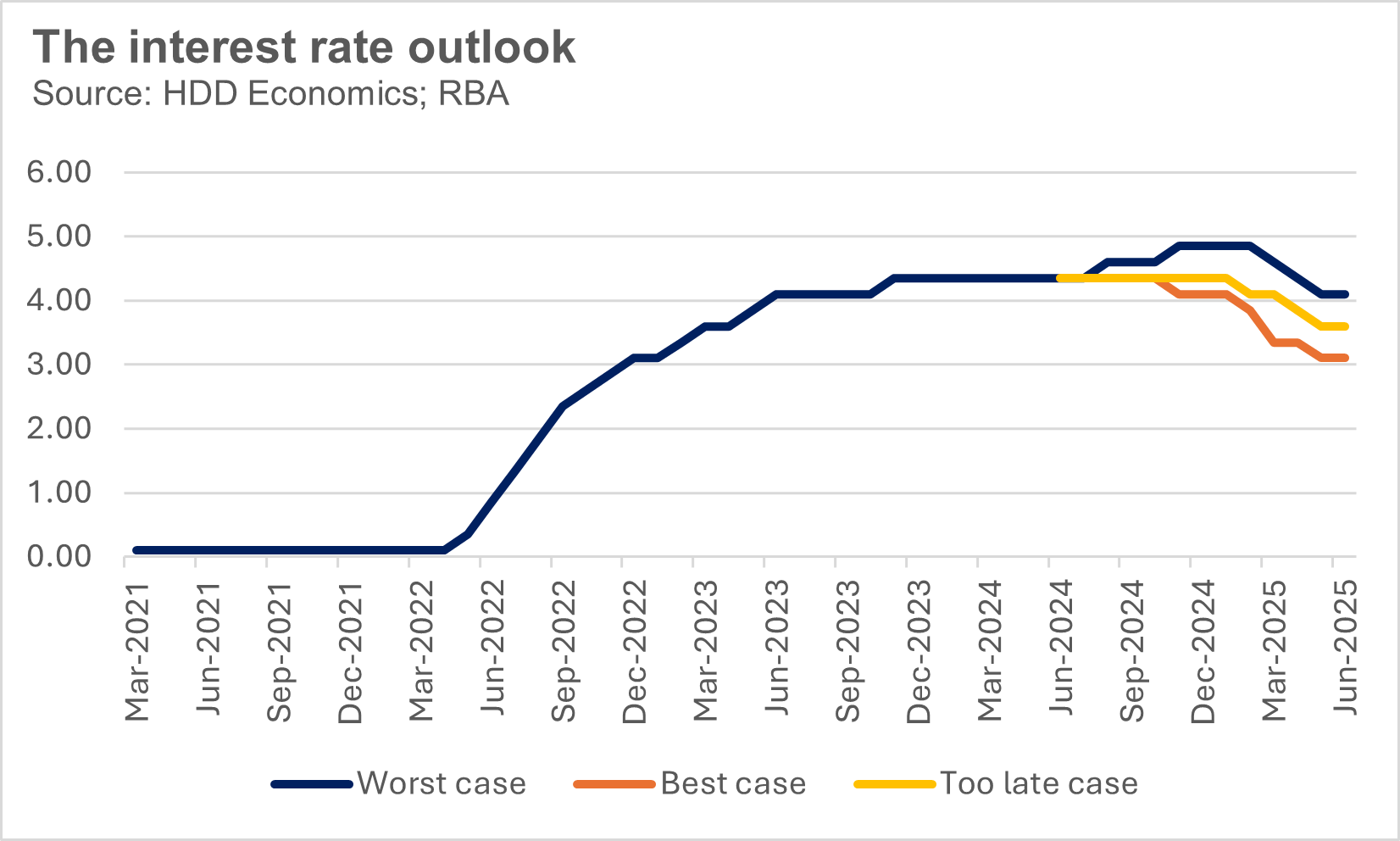

Conjecture is rife about what happens to interest rates next.

The budget has been widely, but not universally, touted as adding to inflation. I think it is mildly inflationary, but I don’t buy in to some of the histrionics as to just how much we need to worry. An inflationary budget increases the chances of further increases in interest rates. This is bad for confidence and housing demand.

Right now, there are 3 camps of view: rates to go higher in 2024H2; rates to stay steady until 2025Q1; rates to fall once by the end of 2024.

I’m in the final camp because I think economic weakness will override everything else. I must admit that right now I feel like I might be pushing a keg up hill.

The feds desperately need an interest cut. If one isn’t forthcoming by the end of 2024 then you can kiss goodbye any lingering prospect of Labor forming a majority government in 2025H1.

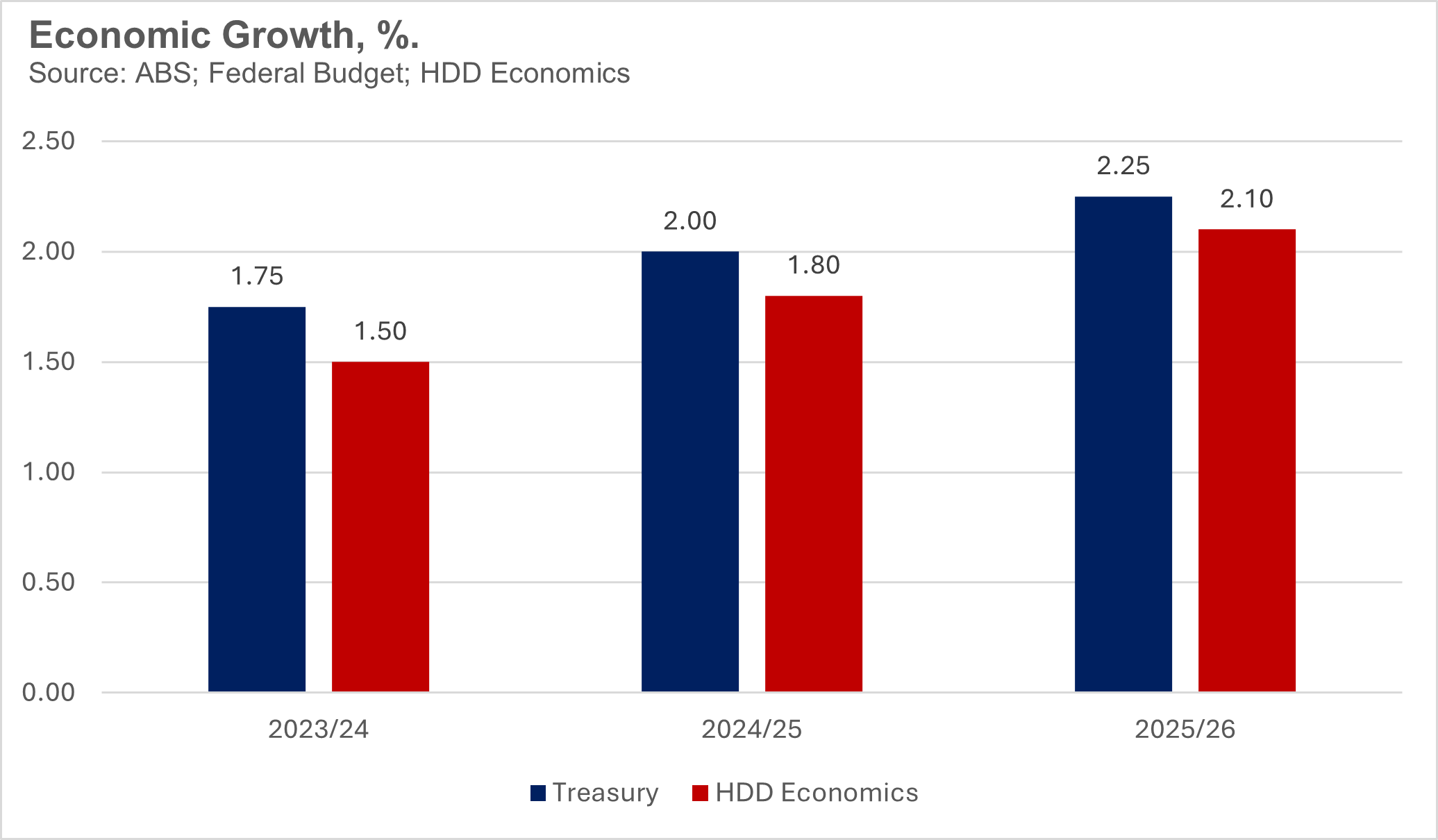

Economic growth forecasts were predictably downgraded.

Economic activity is soft and growth forecasts were predictably downgraded. This is primarily due to household consumption being weak because of cost-of-living pressures and high mortgage repayments, especially for those who have come off fixed rates over the last 12 to 18 months. This dynamic is not good for housing demand.

Housing was a priority, as it needed to be. A total of $36.3 billion was committed.

A focus on housing supply was required 20 years ago, following GST being imposed on new housing over 20 years ago. The Howard government paid no attention. The Abbott – Turnbull years featured some laudable objectives, but they fell over. The Albanese government has a focus on housing and is doing reasonably well, but the focus is only there because it’s a policy imperative.

So, what do we know about housing from the budget? …

For the first time in almost living memory there is a chapter in the budget papers dedicated to housing, numbering 41 pages. bp1_bs-4.pdf (budget.gov.au) Where was that 20 years ago?!

All-up the government has made a $36.3 billion commitment to housing.

There are a multitude of policies involved. Some policies included are:

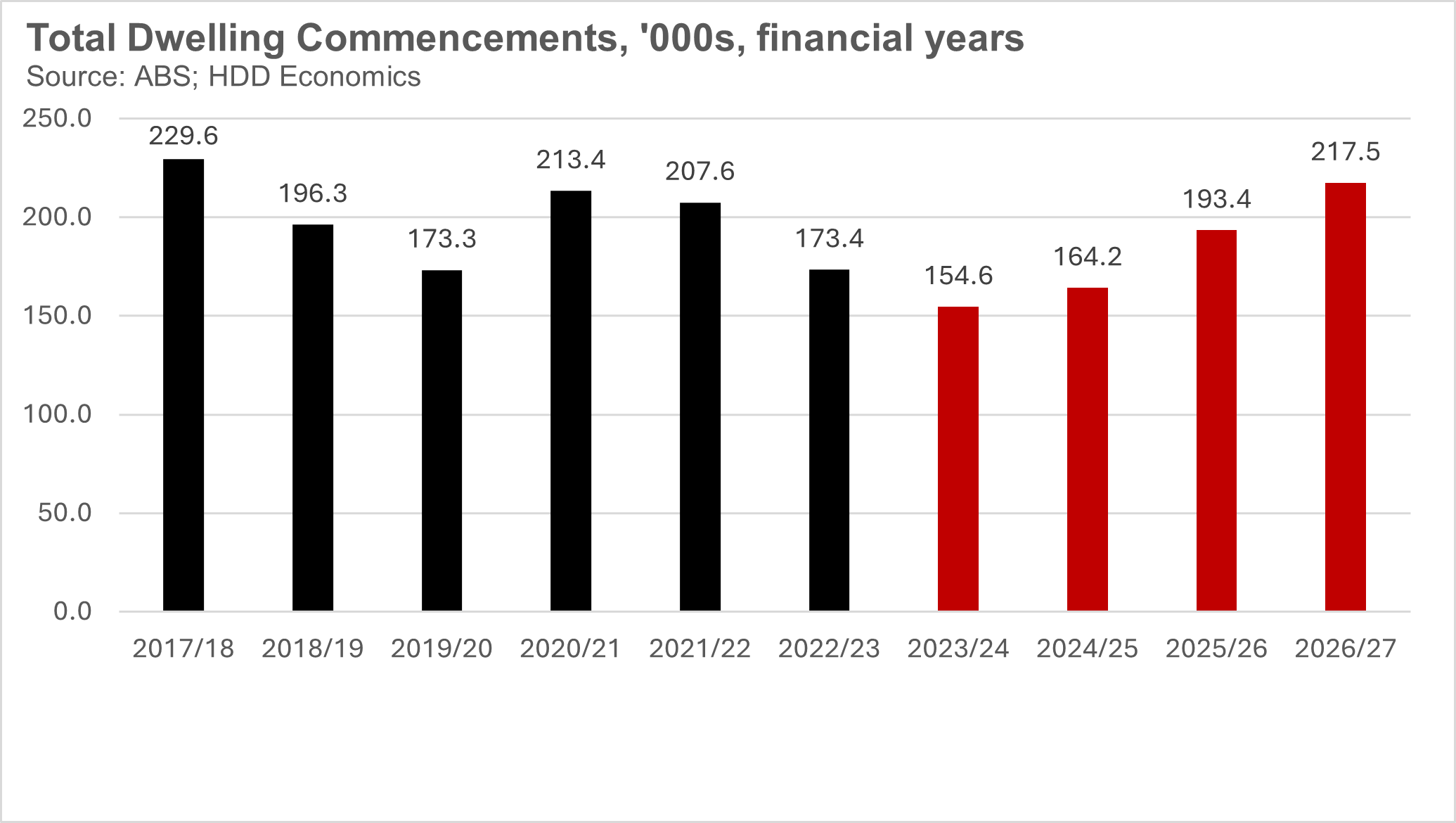

- The signature policy, familiar to all, is the plan to build 1.2 million new homes over a 5 year period from 2024/25. Involving all levels of government plus (ostensibly) industry this comes under the umbrella of the National Housing Accord.

- To reach the total of $36.3 billion the government committed an extra $11.3 billion on the Saturday before the budget, targeted at public and social housing.

- All up the government is looking to fund 40,000 new social and affordable homes.

- The feds are offering $3 billion in incentive payments through the New Homes Bonus to be shared amongst all states and territories to reach their share of the 1.2 million target.

- To help the planning system more effectively facilitate the number of new homes needed, National Cabinet has agreed (to) the National Planning Reform Blueprint. The Blueprint brings state and territory planning ministers together twice a year to progress 17 reforms to deliver more homes. Twice a year – don’t knock yourselves out!

This is where my already frayed patience really runs out.

- The most acute trade shortages in the first quarter of 2024 existed in bricklaying, ceramic tiling, plastering, carpentry and roofing.

No shit, Sherlock. Twenty years ago, I was meeting with ministers, advisors, and bureaucrats, armed with empirical evidence, warning that Australia had a shortage of skilled labour in the residential building industry. The evidence was based on the trades above. Over time the list extended to bricklayers, water proofers, designers, architects, to name just a few. The government has some commendable skills and training policies, but how long will they take to work in terms of helping build 1.2 million homes by 2028/29?

- Fixing supply and improving affordability will require concerted, cooperative, and substantive efforts from all levels of government.

- Yes, indeed. At present any progress seems to be happening at a glacial pace.

- As I said on The Business the other week, all 3 levels of government need to be working together on the same page. This is simply not happening fast enough.

Based on my forecasts, Australia will commence 164.2 thousand new homes in 2024/25 and 193.4 thousand in 2005/06. That means Australia needs to average 280.8 thousand new homes over 2026/07 – 2028/09 to meet the target. It’s likely that as further direct and anecdotal information comes to hand, I will revise down my 2024/05 forecast.

What does all this mean?

- There is a huge pipeline of work to be commenced and completed but right now it is log jammed.

- What is required to be built over 2024/25 to 2025/26 will be limited relative to demand.

- The government needs to escalate new housing reforms. It also needs to look outside the box for innovative solutions and timber can have a big role to play in that.

Look for niche opportunities that will present themselves amidst a weak aggregate picture. Semi-detached dwellings is one example.

If I can be of further assistance, then please contact Kersten Gentle or you can reach me directly through the details below.

Dr Harley D Dale

Independent Economist and Advisor; Headnote Speaker.

0414 994 186

hddconsulting60@gmail.com

Our Principal Partners