Strong result for domestic softwood but import rise all the more impressive

Little more than six months on from the closure of the Morwell sawmill, domestic sales of sawn softwood are higher, and have recovered some ground, at least on an annualized basis. For the year-ended April 2018, sales of domestically produced sawn softwood rose to 3.146 million m3, up 1.3% on a year earlier. Looking a little deeper, softer monthly comparisons suggest annualized sales will decline over the coming months, but probably not by as much as the volume lost from the closure.

That implies – and it is good news for domestic producers – that some of the sales gap lost when Morwell closed has been picked up by other producers finding capacity and taking up opportunities.

The chart below shows total sawn softwood sales over the last five years, with the stability and slight improvement in the annual data (the red line) evident, but the softness in monthly sales data (the blue bars) also evident.

To go straight to the dashboard and take a closer look at the data, click here.

To underscore the strength of the aggregate sales number we need look only at the first four months of 2018. Sales from January to April totalled 999,577 m3, up 3.9% on the first four months of 2017. There may be some inventory wash-through still occurring, but industry advice is this is not the case.

So solid numbers in the first four months might suggest sales will continue on at these near-record levels, despite a significant closure. Maybe, but unlikely. Mainly that is because the strength in production and sales in the middle of 2017 was itself remarkably strong and included the Morwell mill. Time will tell, however.

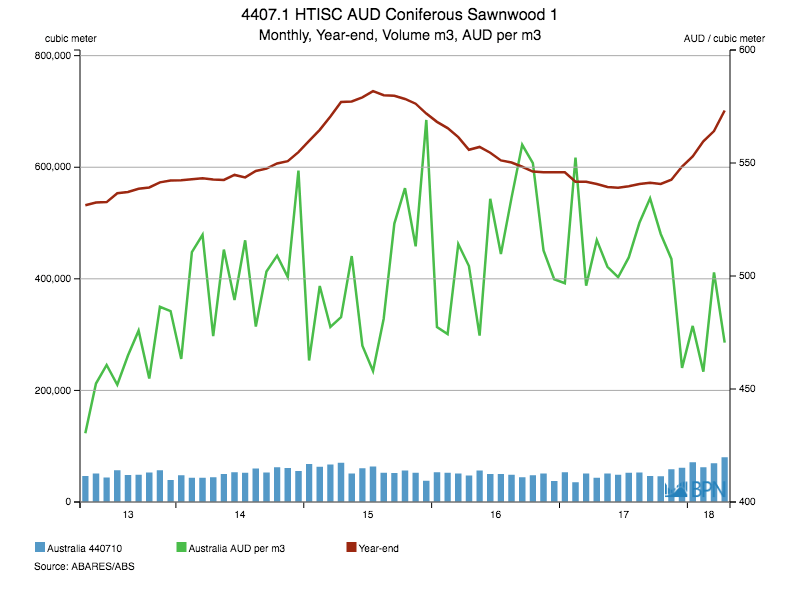

Local producers have not had the situation all their own way of course. Imports of sawn softwood products have grown significantly over the last year, as the chart below shows.

To go straight to the dashboard and take a closer look at the data, click here.

Growth in imports is plain to see, but the numbers over the last year are the main event of interest at this time. Sawn softwood imports, although still below their peak, of 736,479 m3 (year-ended July 2015) rose 23.1% over the year-ended April 2018, totalling 701,702 m3.

But, perhaps more importantly, imports totaled a record 80,420 m3 in April 2018, up almost 85% on April 2017. A new total import record does not seem far away.

The import situation warrants more detailed examination.

Below, we can see the same data as that outlined above, but presented so as to accentuate average import prices. What the chart demonstrates is that in the recent periods when the volume of imports have risen, the average price of those imports has declined.

Indeed, there is a remarkable similarity between the annual import record (year-ended June 2015) and the year-ended April 2018. For the year-ended June 2018, imports totalled 725,221 m3 and the average price of those sawnwood imports was AUDFob469/m3. Most recently, imports totalled 701,702 m3, at an average price of AUDFob470/m3.

To go straight to the dashboard and take a closer look at the data, click here.

However, as discussed in previous newsletters this price trend is misleading and reflects of the broad spectrum of products covered. One therefore needs to drill down into the specific products to see what the actual price trends are.

Three grades make up close to two-thirds of all imports, and it is unsurprising that they are essentially the structural grades.

The largest volume of all of the grades is ‘Dressed Structural, other than Radiata, <120mm’ (essentially European and North American lumber). For the year-ended April 2018, imports totalled 215,833 m3, up a substantial 25.1% on the prior year’s imports, as the chart below shows.

But what the chart also shows is that almost all the rise in imports occurred in the last six months. For the six months from November 2017 to April 2018, imports averaged 23,653 m3 per month. For the six months prior, imports averaged just 52% of that, or 12,318 m3 per month.

To go straight to the dashboard and take a closer look at the data, click here.

Importantly, despite the average price of all sawn softwood imports falling over the period, this main Structural grade saw prices leap as volumes rose.

The situation is similar for price, but not for volume, for the second largest import grade – ‘Roughsawn pine, other than Radiata <120mm’. Import volumes rose just 0.3% over the year-ended April 2018, reaching 138,199 m3. Nothing to see there perhaps, but the average price, in April 2018 was AUDFob370.16/m3, up a strong 15.8% on the prior year, and clearly at record levels.

To go straight to the dashboard and take a closer look at the data, click here.

Overall, we think it is reasonable to assert that after the Morwell closure, the market identified a situation requiring more imports, promptly supplied additional imported material and moved the price up accordingly. They may not enjoy the additional volume and market share held by the importers, but the domestic producers might well be pleased at the impact on prices.

This article was written by Jim Houghton for FWPA’s latest StatisticsCount.