This piece was written and provided by Alares.

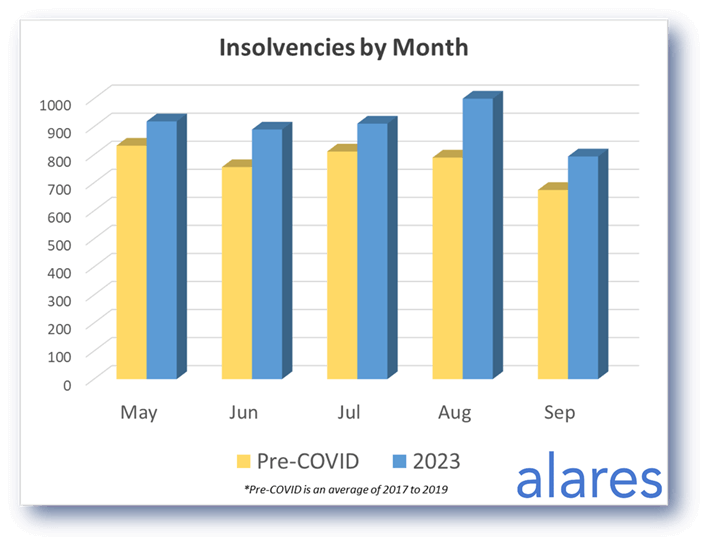

Insolvencies in September remained slightly above pre-COVID levels. This follows a consistent trend throughout 2023.

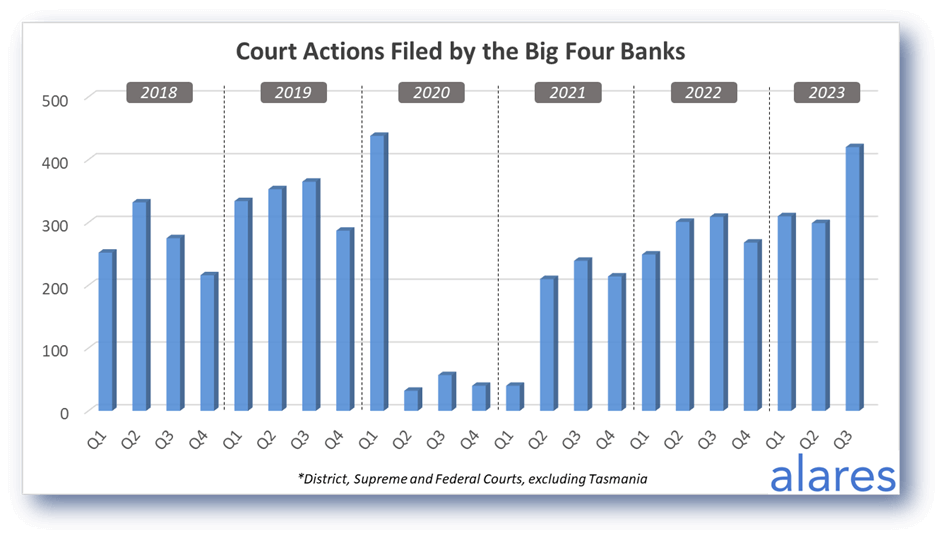

Court recoveries from the big four banks remain high while the ATO subsides from its recent peak – this coincides with a significant uptick in Small Business Restructuring appointments.

Key highlights in September

- Court activity from the big four banks has increased significantly in recent months.

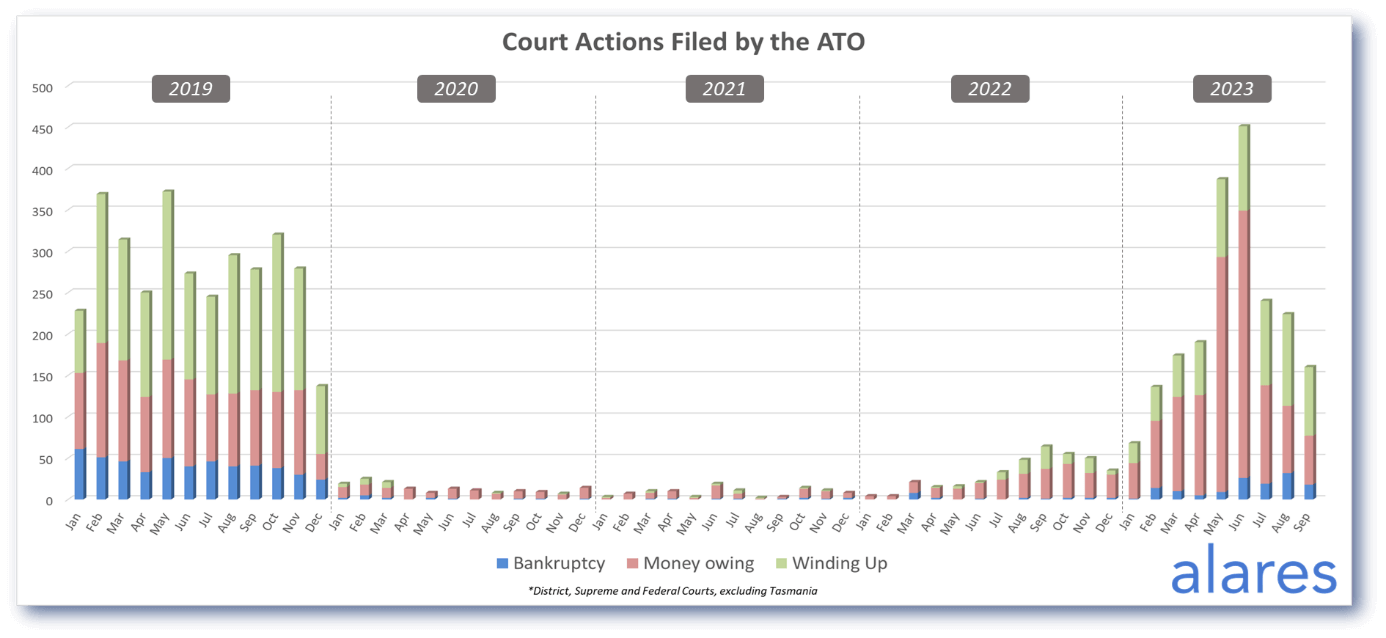

- ATO Court activity has subsided from the May-June peak.

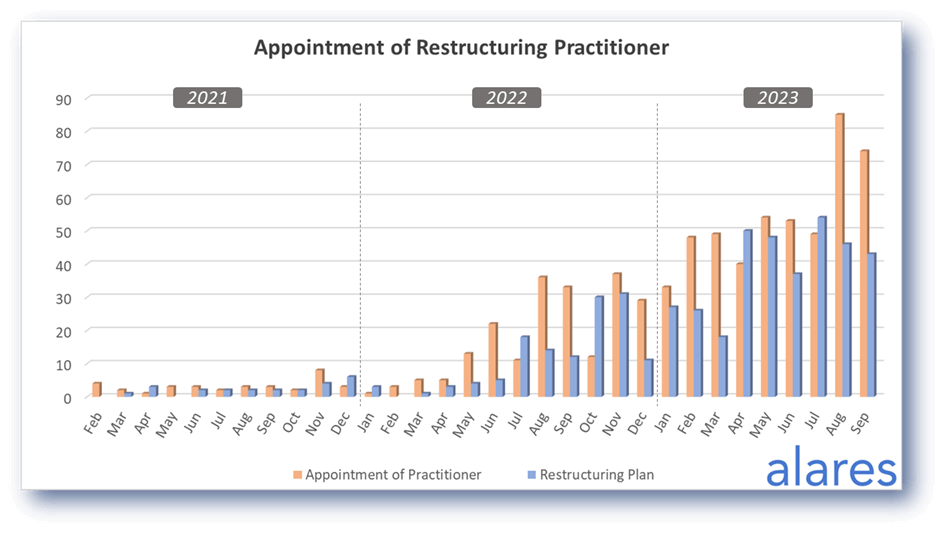

- Small business restructuring appointments continue to increase.

Insolvencies in September remained above pre-COVID levels

This continues the trend we have seen throughout 2023.

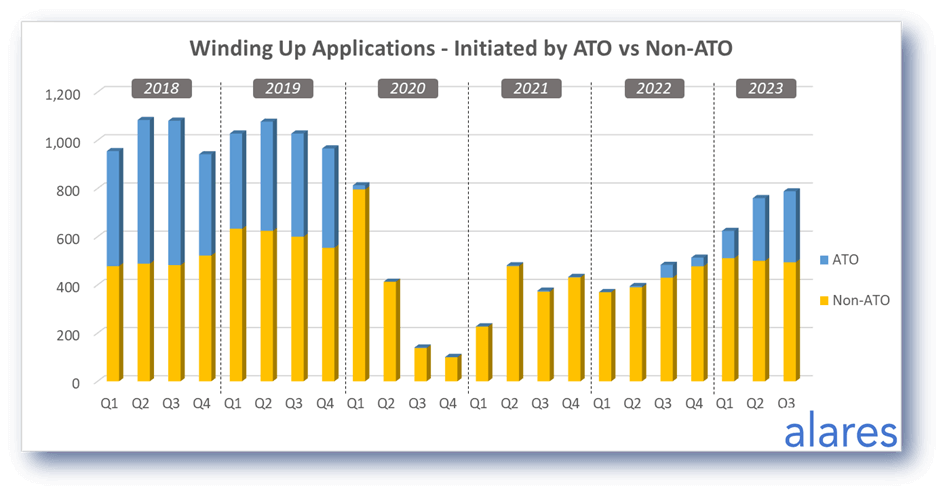

ATO Court activity in September continued to subside since the May-June peak

The ATO may be pursuing outstanding debts in various phases which can explain the recent peaks and troughs. Many recent ATO initiated Winding Up and Bankruptcy petitions have prior ATO monetary claims dating back to 2019 which also suggests the ATO is clearing its pre-COVID backlog. The coming months will no doubt provide more insight into these trends.

Small business restructuring appointments have spiked in the past two months

This may also explain the recent drop in ATO Court activity as more small business owners are seeking help via the small business restructuring process.

The big four banks have significantly increased their Court recoveries in recent months

Is this a clear sign that higher interest rates are starting to bite? Stay tuned to next month’s update to see if this trend continues.

Winding up applications continue their steady upwards trajectory

Winding up applications have been trending upwards since the beginning of 2022 and are starting to approach historical levels.

Alares provides critical credit risk data that is NOT captured by other providers

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners