This piece was written and provided by Alares.

Insolvencies in July again remained above pre-COVID levels, continuing the trend throughout 2023. Interestingly ATO Court dropped in July, in particular money owning claims filed against individuals.

However, this reprieve was offset by a significant increase in Court recovery from the big four banks. Are higher interest rates starting to bite? And how will these trends play out in the coming months? Stay tuned to find out.

Key highlights in July

- Drop in ATO Court activity after a significant ramp-up in May and June.

- Increase in big four bank Court recoveries.

- Winding Up applications remain high.

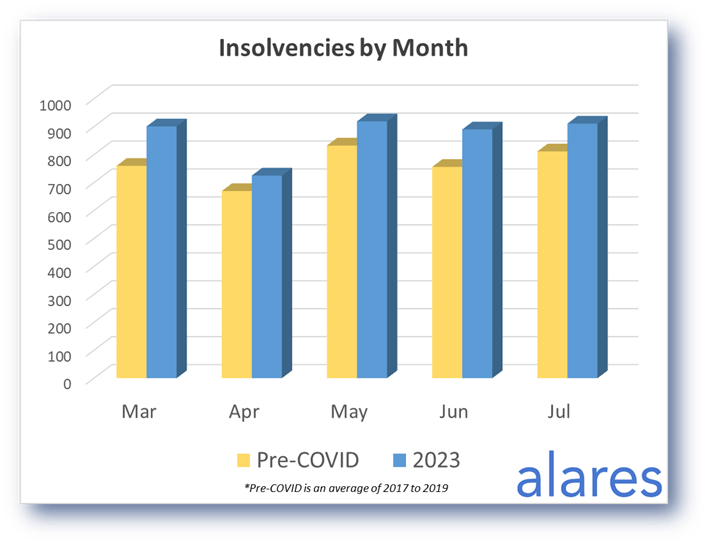

Insolvencies continue to track above pre-COVID levels

Insolvencies in July continued to track above historical levels, maintaining a consistent trend throughout 2023.

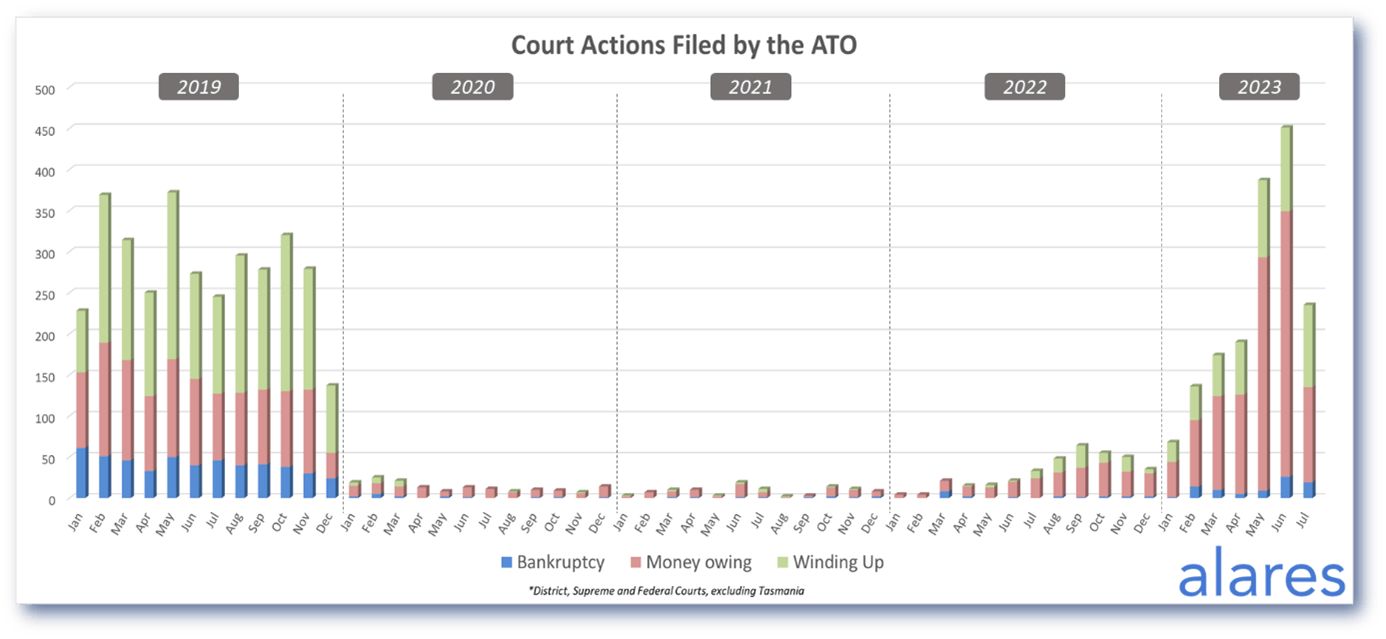

The ATO reduced its Court activity in July after a major ramp-up in May and June

The July reduction in ATO Court activity was specific to money owing claims filed against individuals (winding up applications filed against companies remained steady). Is this a momentary reprieve or a change in strategy by the ATO? We will continue to watch this closely in the coming months to find out.

Winding up applications in July remained high and in-line with pre-COVID levels

July Winding Ups continued the May-June trend – well above the totals from the past two years – and well in-line with historical levels.

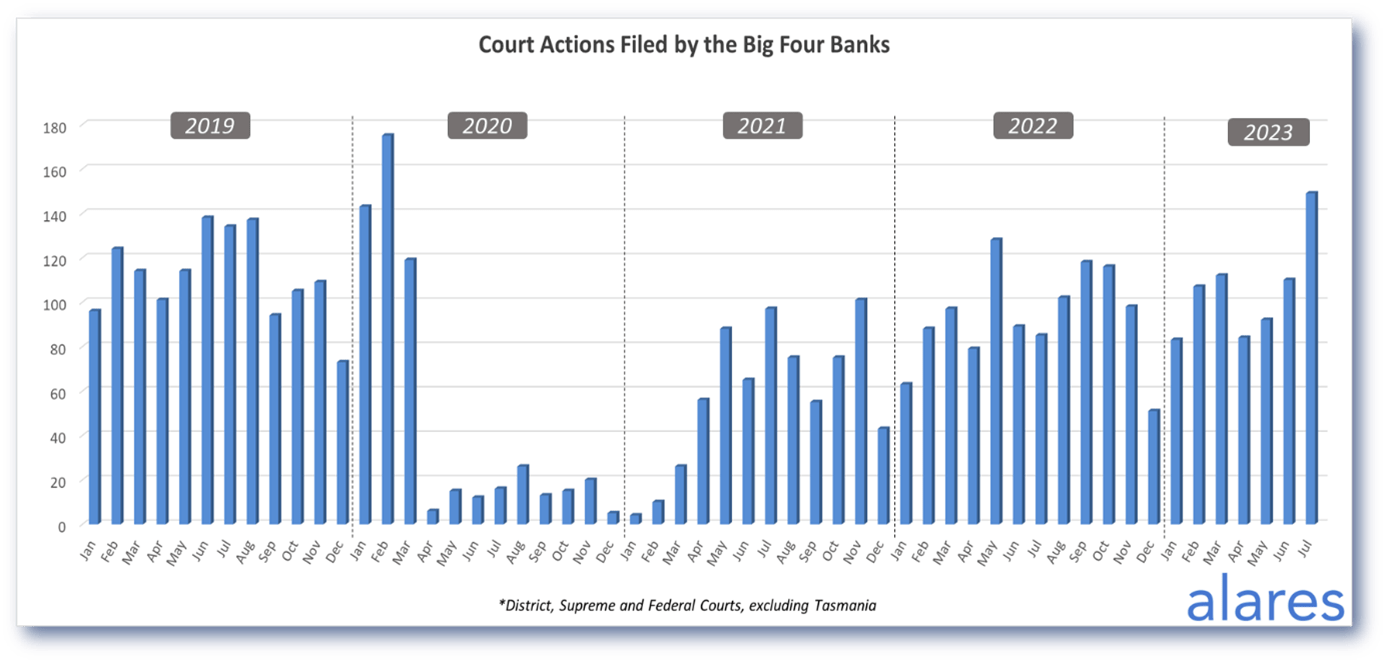

The big four banks had a significant increase in Court activity in July

This is a change from recent history where Court activity had remained fairly steady. Again – is this a momentary increase or are we seeing higher interest rates starting to take their toll? Data over the coming months will be very telling.

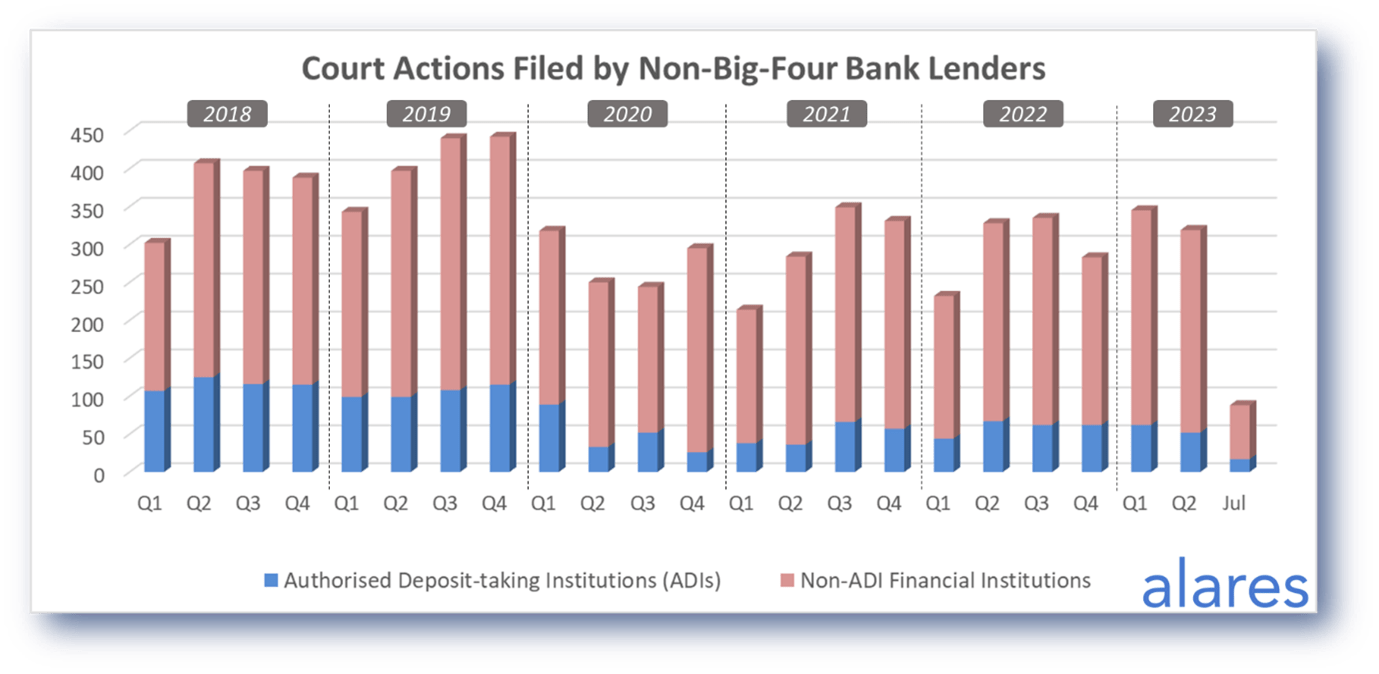

While the big four banks increased their Court recoveries, the non-big four lenders remained steady

So far in 2023 we have still not seen any major changes to Court recoveries from the non-big four lenders.

Alares provides key credit risk insights that are NOT captured in credit reports

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners