This piece was written and provided by Alares.

Insolvencies in June remained above pre-COVID levels, continuing the trend for 2023. As we enter the new financial year we can see that the ATO Court activity and Winding Up applications both remain high.

Key highlights in June

- Continued increase in ATO Court activity.

- Winding Up applications remain high.

- Continued business-as-usual for the big banks and non-bank lenders.

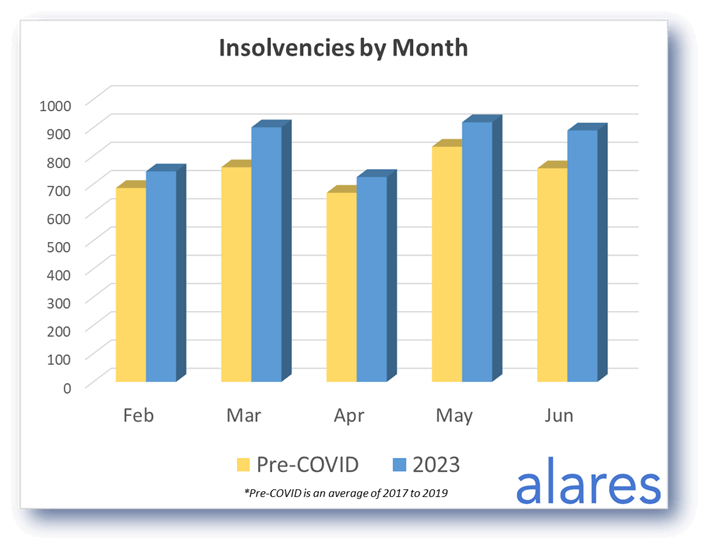

Insolvencies continue to track above pre-COVID levels

Insolvencies in June continued to track above historical levels, continuing the 2023 trend.

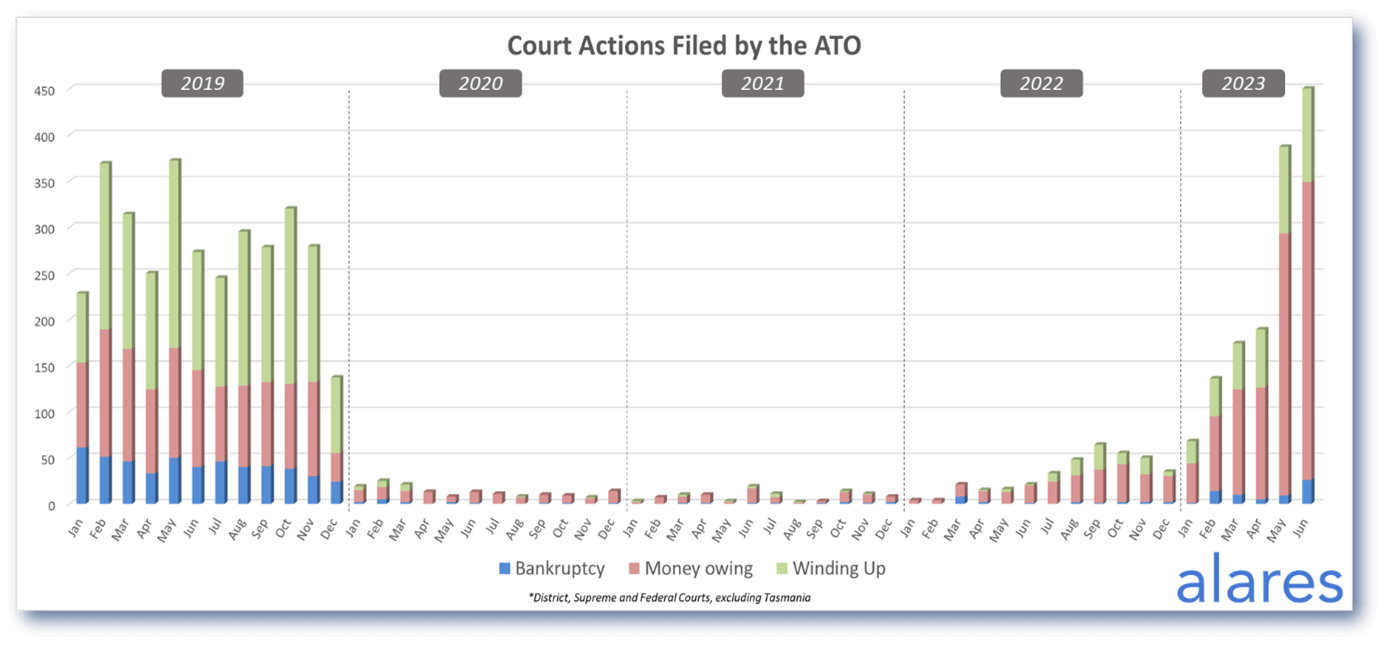

The ATO continues to increase its Court activity, now well above historical monthly totals

As was the case in May, the majority of the increase in ATO Court activity is in Money Owing claims. However, company Winding Ups and personal Bankruptcy petitions are also showing continued month-on-month increases.

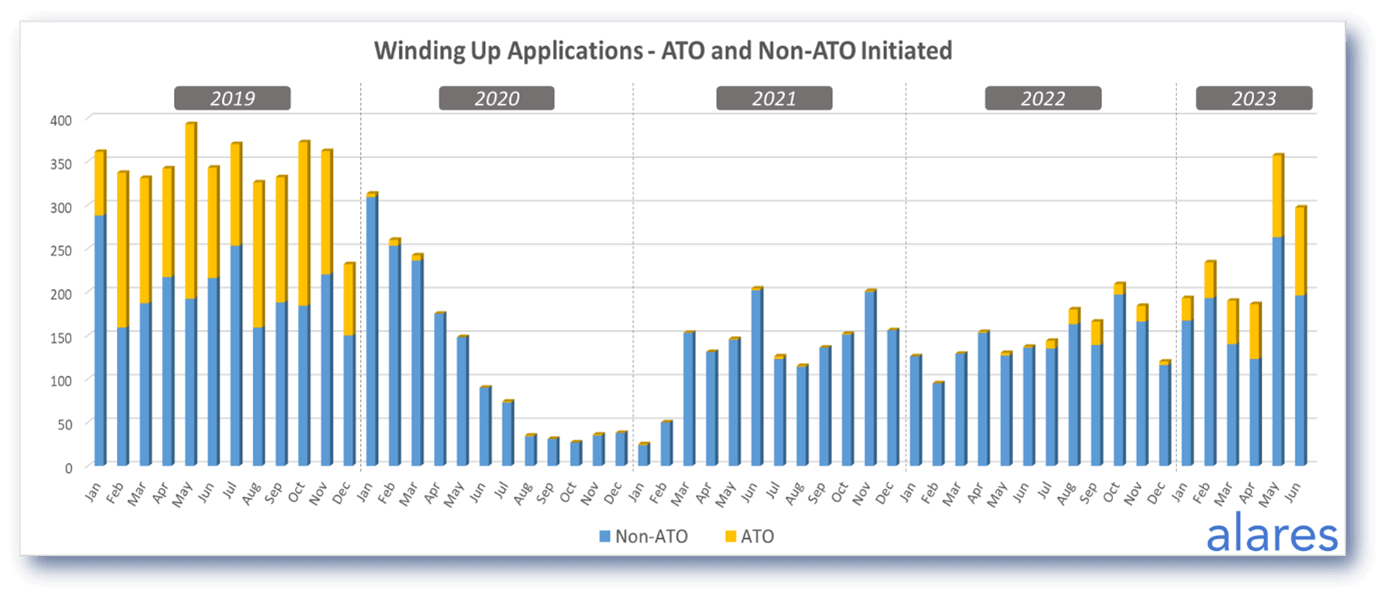

Winding Up applications in June remained well above the trend-line for the past two years

While the overall numbers dipped slightly from the May peak, non-ATO initiated Winding Up applications remain well inline with historical numbers.

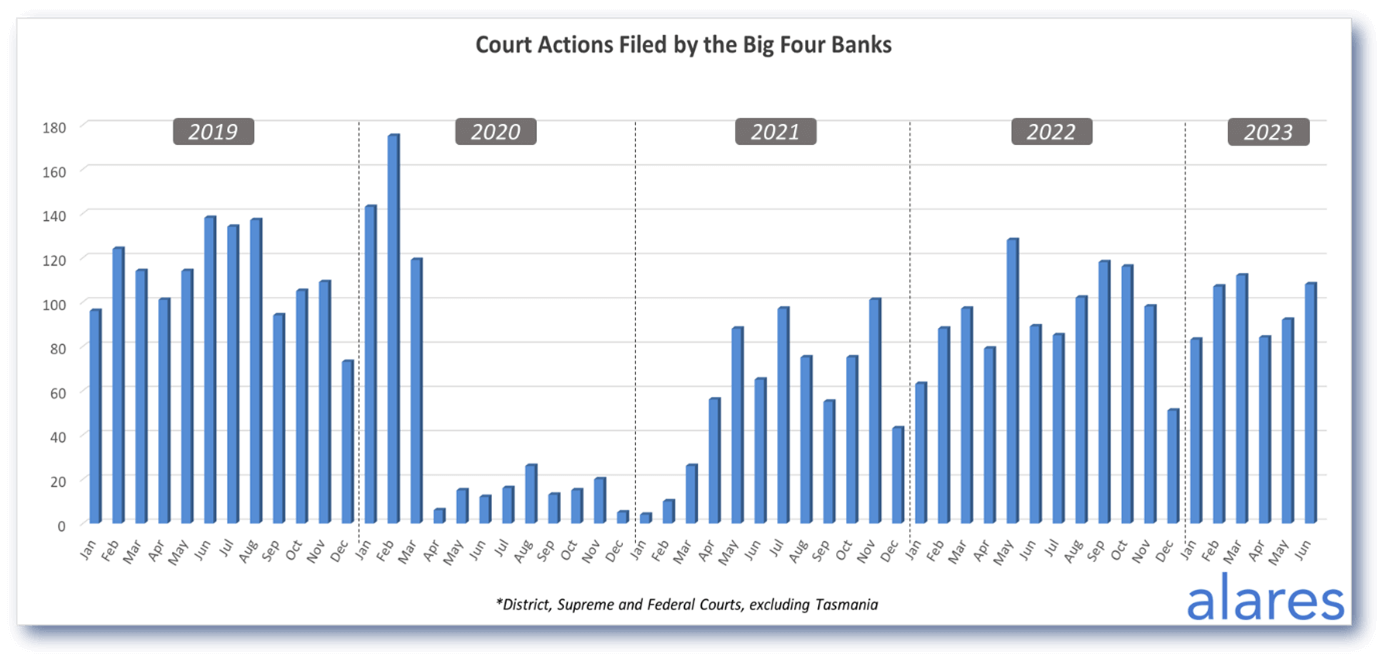

The big four banks remain steady as usual with no major changes from prior months

So far in 2023 we have not seen any significant increase in Court recoveries from the big banks. Will this change in the coming months as higher interest rates start to take their toll?

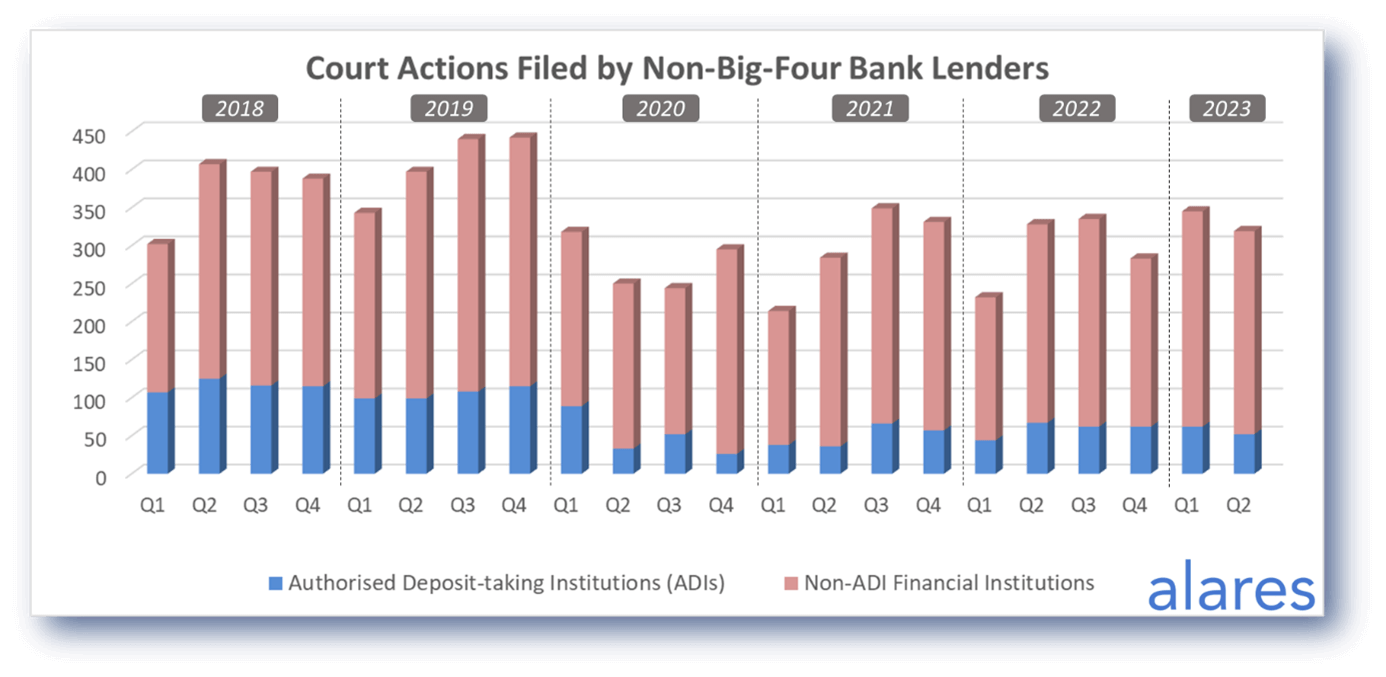

Similarly, the non-bank lenders have maintained a steady level of Court activity

As with the big banks, we have seen no major changes so far in 2023.

Alares provides key credit risk insights that are NOT captured in credit reports

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners