This piece was written and provided by Alares.

Insolvencies in May remained above pre-COVID levels and marked the highest monthly total in many years. A number of key risk indicators also increased sharply, notably ATO Court activity and Winding Up applications.

Key highlights in May:

- Major uptick in ATO Court activity.

- Significant increase in Winding Up applications.

- Continued business-as-usual for the big banks and non-bank lenders.

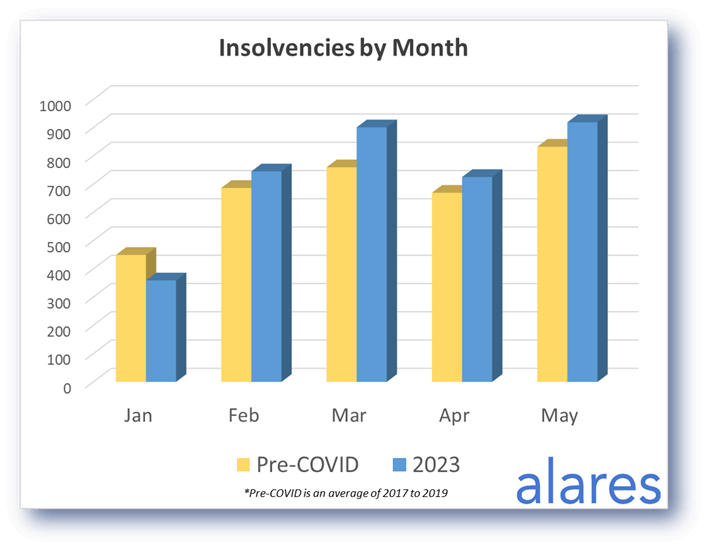

Insolvencies continue to track above pre-COVID levels

May is historically a busy month for insolvencies and this trend continued in 2023.

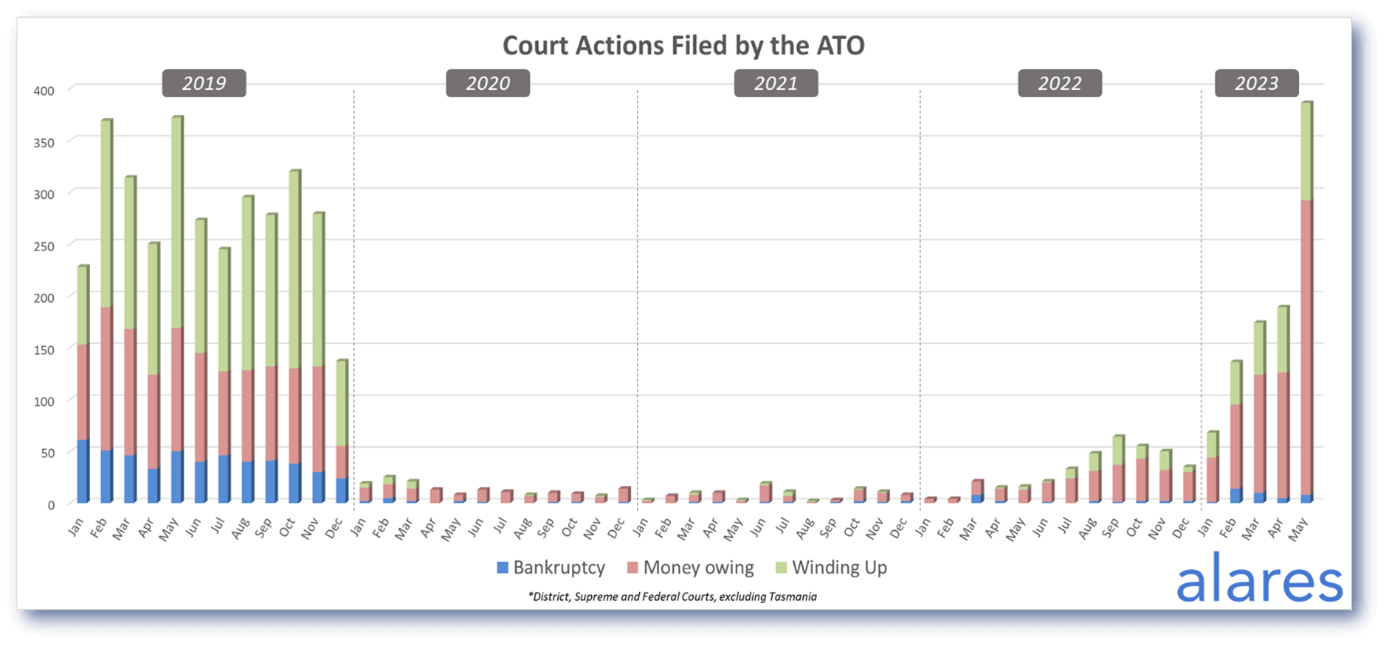

The ATO had a major uptick in Court activity, surpassing historical monthly totals

Bankruptcy petitions and Winding Up applications remain lower than pre-COVID levels, however the number of money owing claims surged in May. Will this trend continue? And what does this mean for insolvencies in the coming months? Stay tuned to next month’s update.

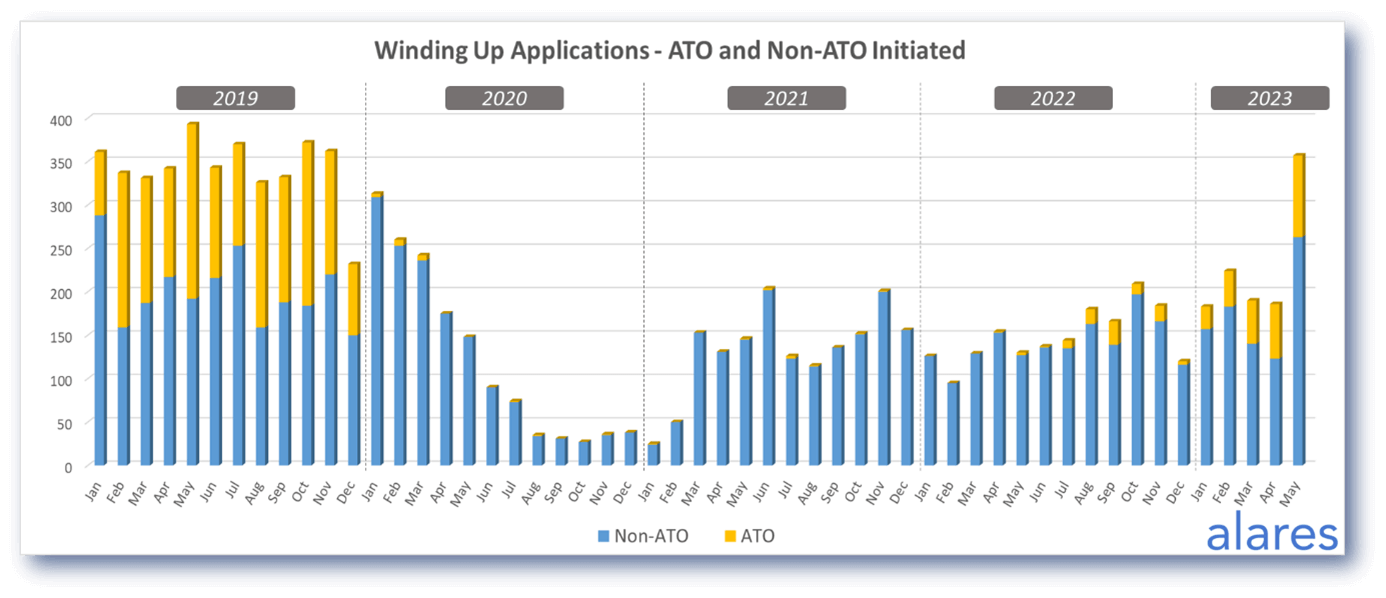

Winding up applications also spiked in May, almost doubling from prior months

Winding Ups in May were in-line with historical levels for the first time since the onset of COVID. While there was a clear increase in ATO-initiated Winding Up applications, there was an even bigger increase in non-ATO initiated applications.

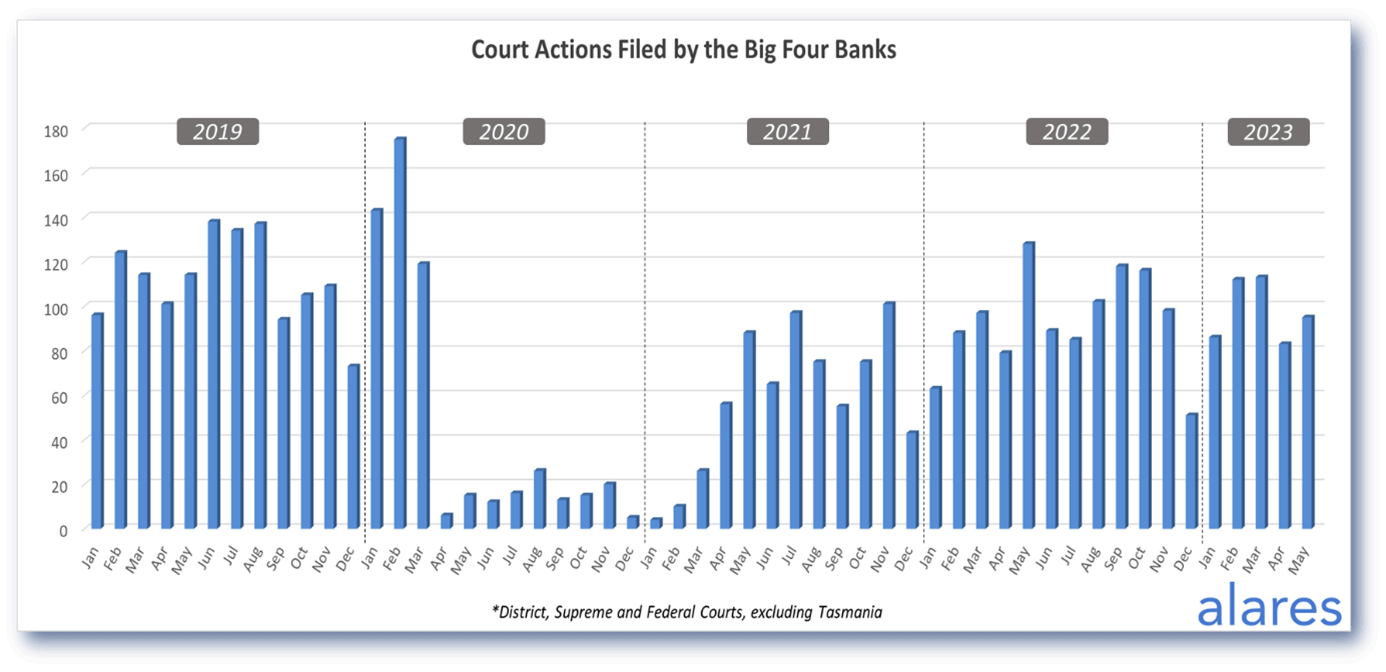

The big four banks remain steady as usual with no major changes from prior months

So far in 2023 we have not seen any significant increase in Court recoveries from the big banks. Will this change in the coming months as higher interest rates start to take their toll?

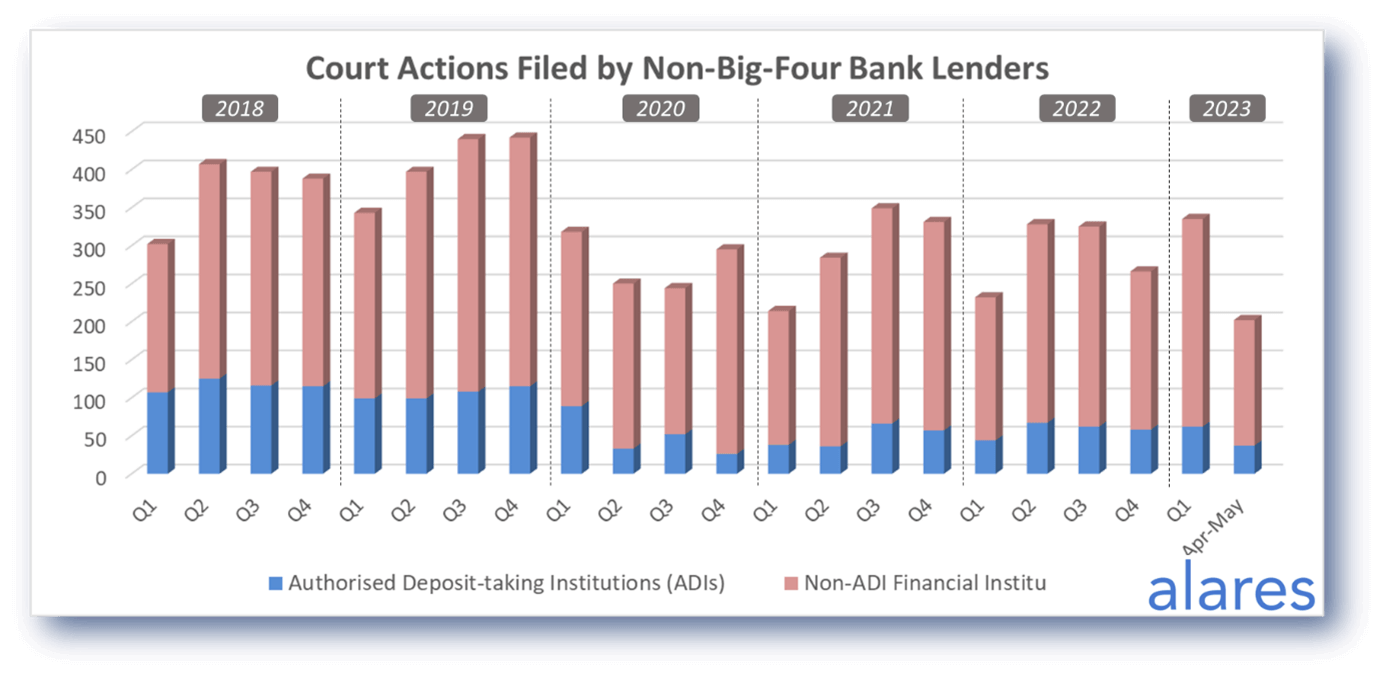

Similarly, the non-bank lenders have maintained a steady level of Court activity

As with the big banks, we have seen no major changes so far in 2023.

Alares provides key credit risk insights that are NOT captured in credit reports

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners