Written and provided by Alares.

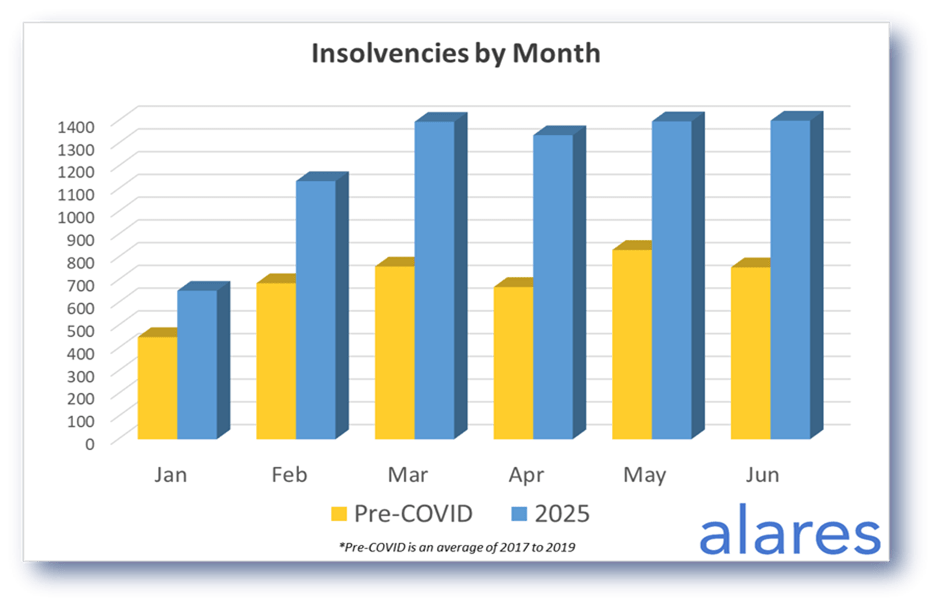

Insolvencies have remained at or near record monthly highs since March. In June, we saw more of the same with monthly numbers again nearly double pre-pandemic levels.

In terms of the insolvency catch-up, overall numbers suggest a remaining 1,500 additional insolvencies still to come. At the current rate, the insolvency catch up will be complete by the end of September – but what happens then? Stay tuned to find out.

Key highlights in Jun

- Insolvencies remain at all-time monthly highs.

- The ATO is keeping their foot on the throat while the big four banks continue to ease off.

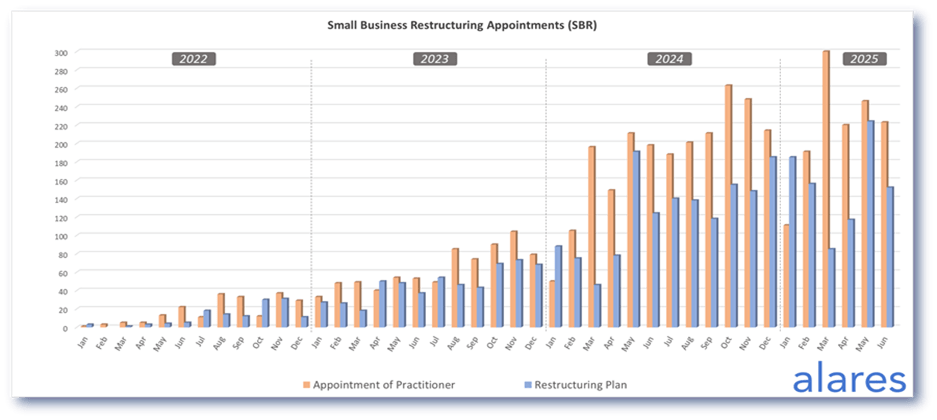

Small business restructuring (SBR) appointments appear to have plateaued, for now.

Insolvencies in June remained at all-time monthly highs

Monthly numbers were again almost double pre-pandemic levels, which maintains the trend we have seen since March.

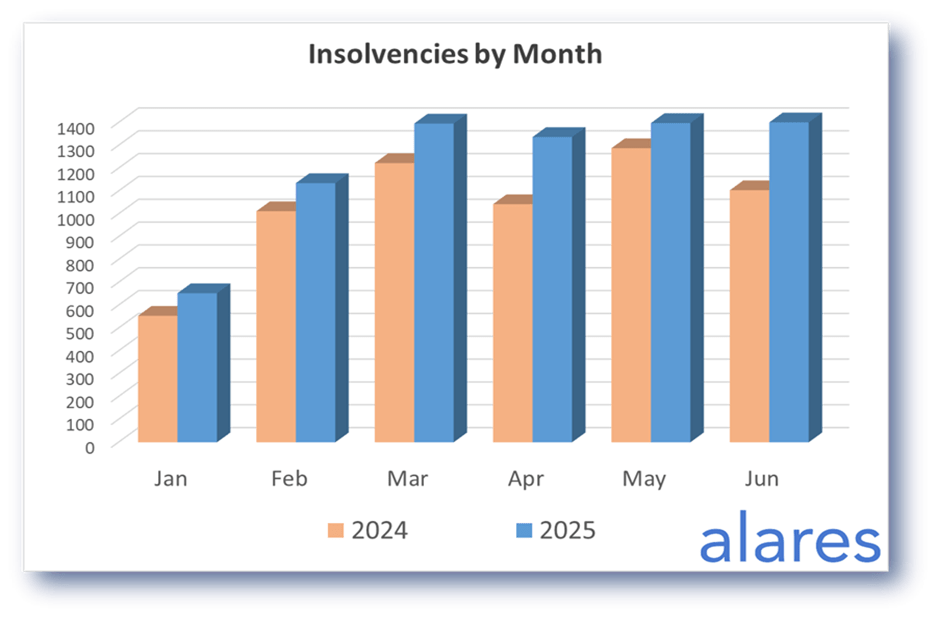

2025 numbers continue to track above the previous highs from 2024

Monthly insolvencies numbers in 2025 continue to track above 2024 numbers, which themselves were all-time highs at the time.

Small business restructuring (SBR) appointments have plateaued since the March peak

Anecdotal feedback suggests the ATO may be applying more scrutiny to recent SBR applications, potentially removing SBR as an option for some small businesses.

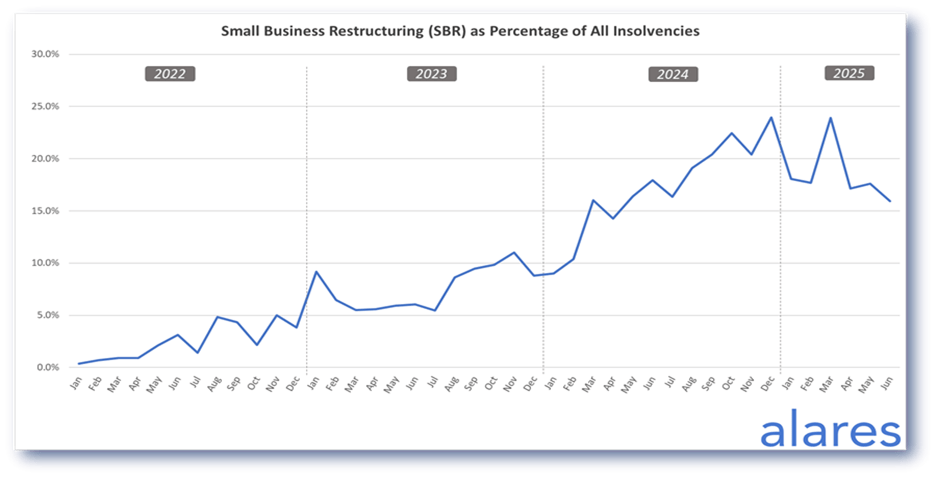

SBRs have momentarily peaked as a percentage of new insolvency appointments

As a percentage of all new appointments, SBRs have recently dropped from almost 25% to just over 15%. Again, this suggests increased rigor in the SBR process, with a higher percentage of insolvencies tending towards voluntary administration and liquidation.

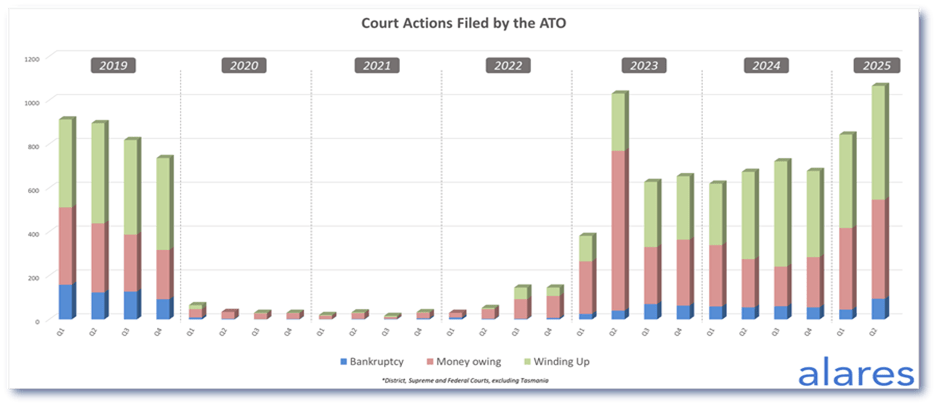

The ATO continues to apply pressure to collect outstanding tax debts

ATO Court recoveries continue to increase across the board against companies, directors and individuals via Winding up petitions, money owing claims and bankruptcy sequestrations.

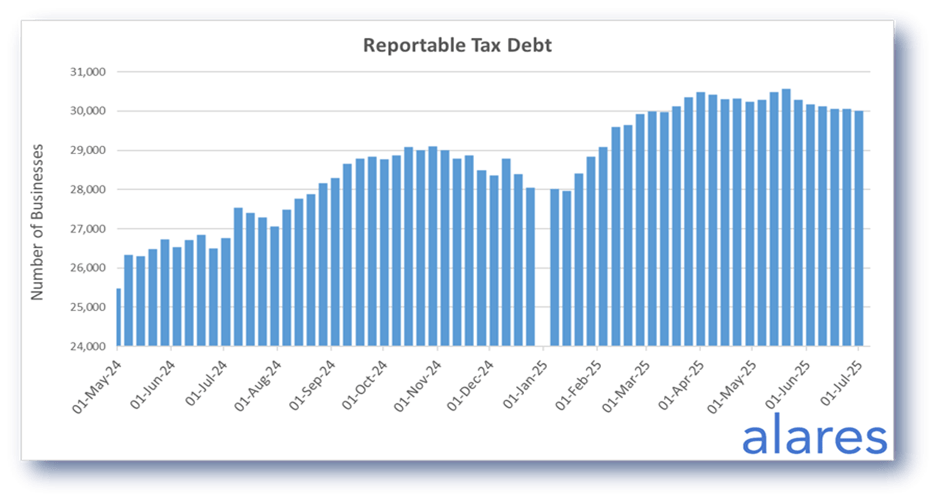

Similarly, the ATO’s disclosure of business tax debts continues at pace

The total number of businesses subject to tax debt reporting has remained almost unchanged since March despite the record number of insolvencies in that time, with hundreds of new businesses added to the ATO’s list each week.

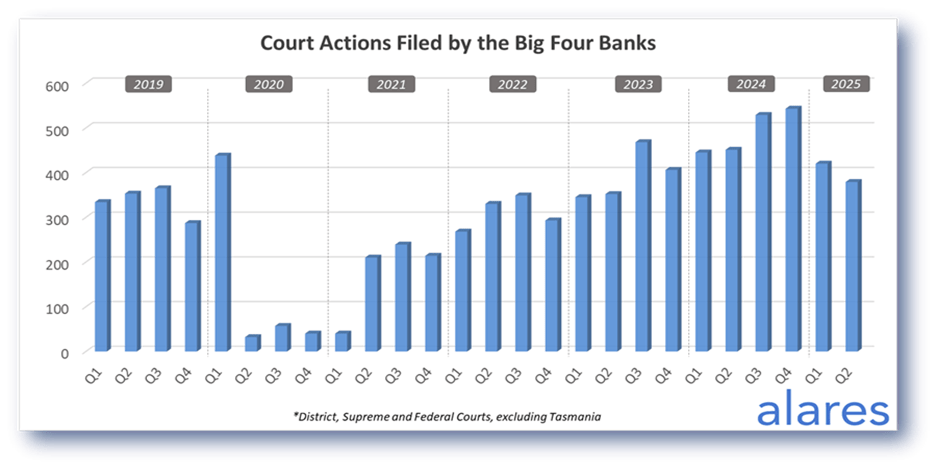

In good news for borrowers, Court recoveries from the big four banks continue to decline

We have seen an ongoing drop throughout 2025 after a prolonged ramp-up over the past four years.

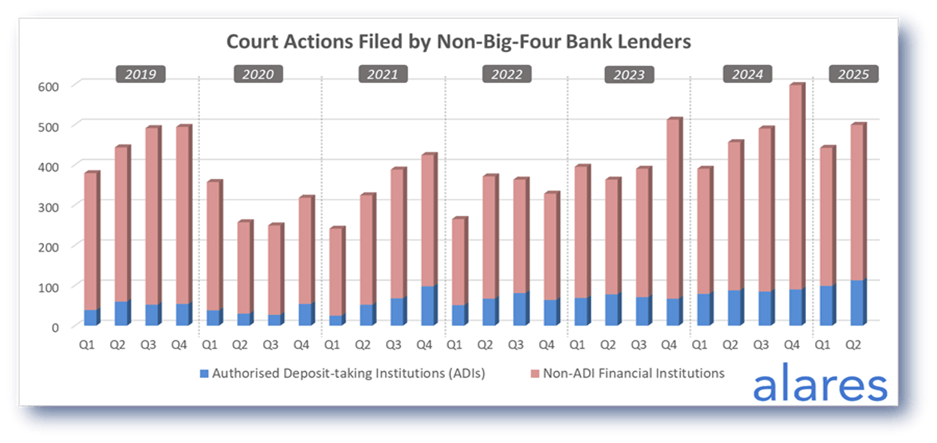

However, the reduction from the big-four has in-part been offset by an increase in Court activity from other lenders

This could be indicative of the big-four banks focusing on mortgages and blue-chip business lending, while other “higher risk” borrowers are increasingly pushed to look elsewhere.

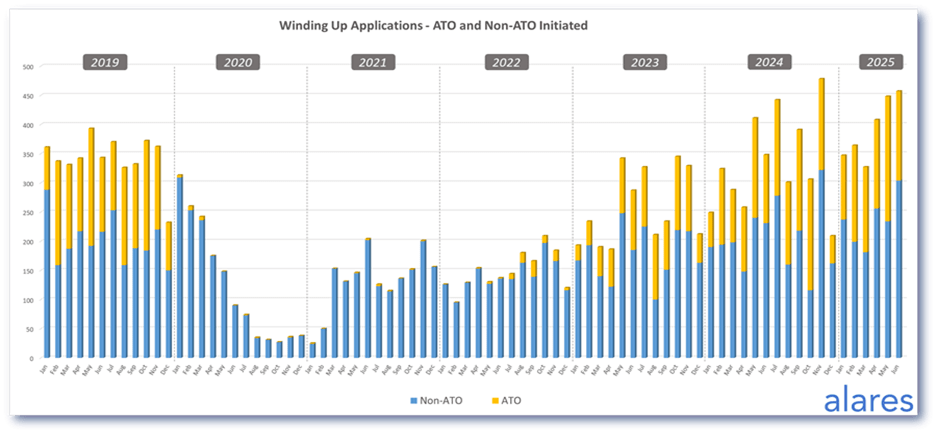

Meanwhile, winding up applications continue to rise

In addition to the ATO remaining active, non-ATO initiated winding up applications are also hovering near record monthly highs.

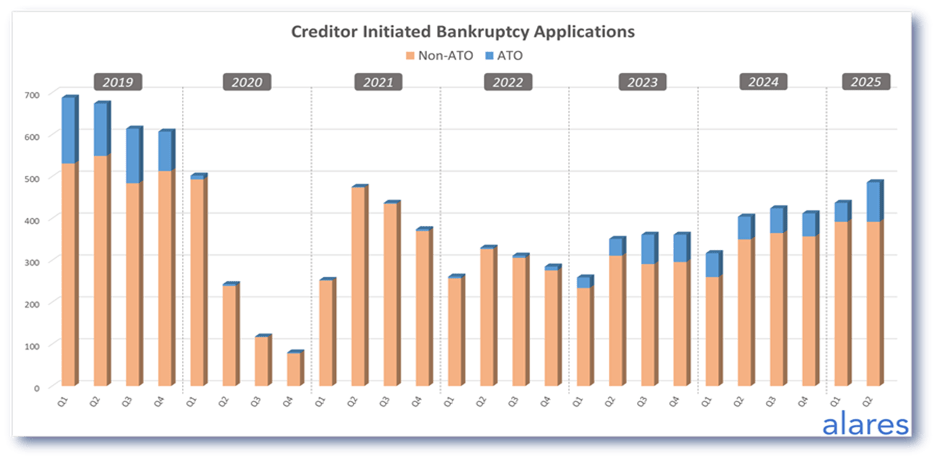

Similarly, creditor-initiated bankruptcy sequestrations continue to steadily increase

Overall numbers remain low compared to historic highs, however bankruptcies have continued to increase since the start of 2024.

Alares provides critical due diligence data that is NOT captured by other providers.

For better insights into financial and reputational risks impacting your customers and suppliers, please get in touch

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Follow FTMA Australia for Industry News and Updates

Our Principal Partners