Written and provided by Alares.

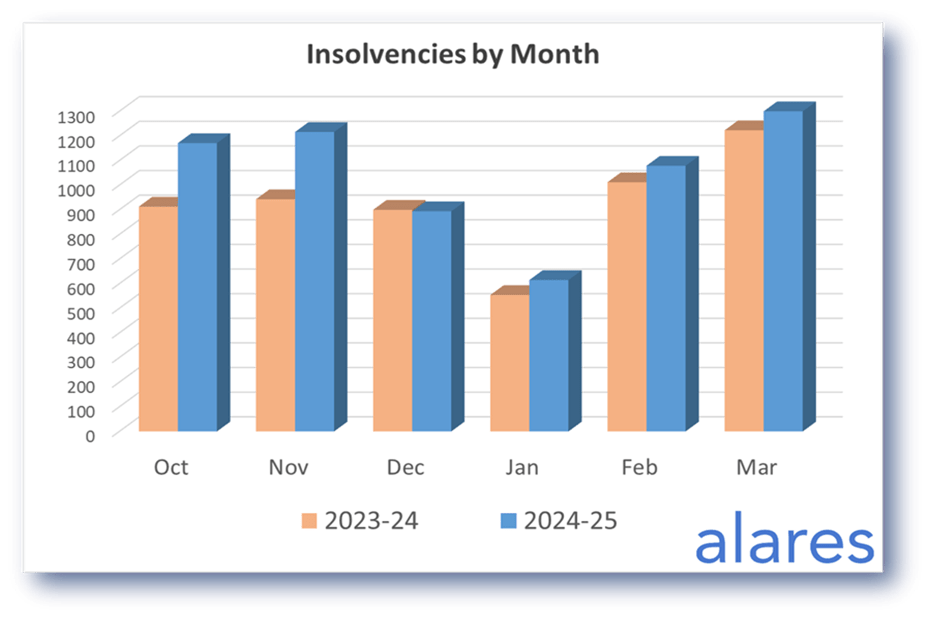

Insolvencies in March again hit an all-time monthly high, eclipsing the prior record from May last year. Small businesses were particularly hard hit in March, with small business restructuring (SBR) appointments again surging.

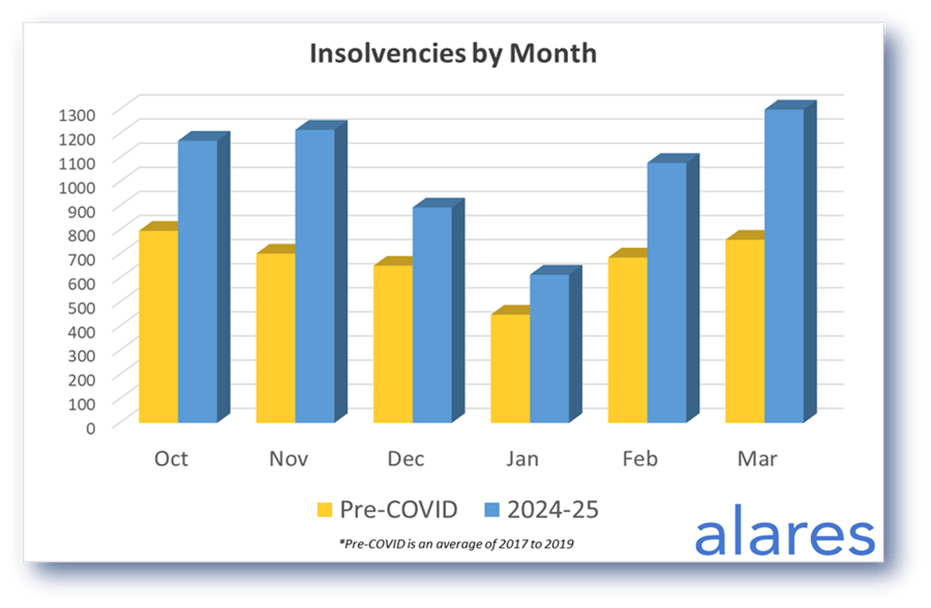

In our January update we noted there were an additional ~4,500 insolvencies still to be caught up from the COVID lull. So far in 2025, we have seen an additional ~1,100 insolvencies above typical levels, indicating another ~3,400 additional insolvencies still to come in the “catch-up”. Stay tuned to see how this plays out for the remainder of 2025.

Key highlights in March

- Insolvencies hit a new monthly high led by another surge in SBRs.

- The ATO continues to apply increasing pressure with all tools at their disposal.

- In some positive news, the major banks appear to have eased off on their Court recoveries after a prolonged ramp-up.

Insolvencies in March hit another monthly high

March insolvencies saw a 70% increase above historical levels.

2025 continues to track slightly above the prior record highs from 2024

We are yet to see a return to “normal” insolvency levels with the insolvency catch-up still unfolding.

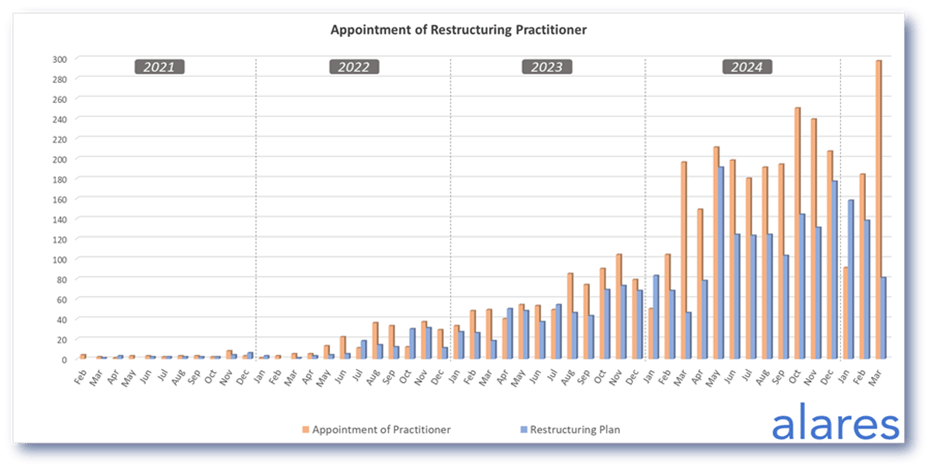

Small business restructuring (SBR) appointments spiked again in March

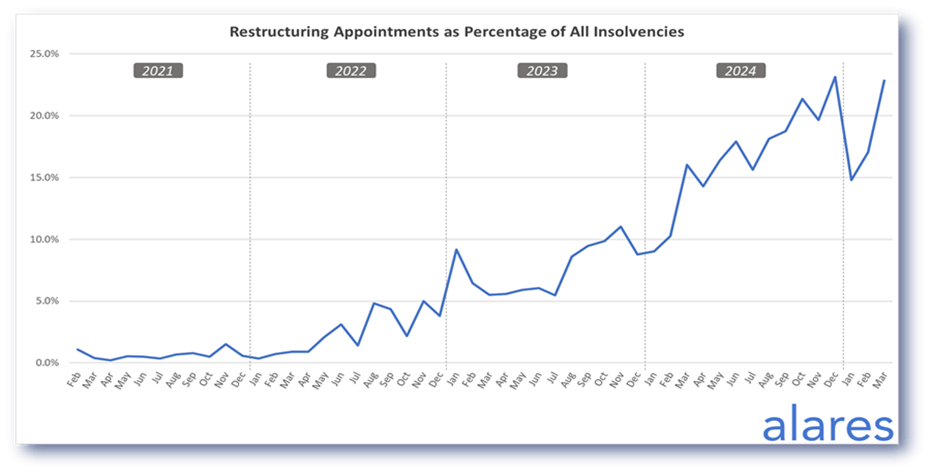

Similar to last year, March again saw a significant increase in new SBR appointments, presumably as tax reporting deadlines quickly approach.

SBRs are again approaching 25% of all new insolvency appointments

This indicates that small businesses (less than $1M in total outstanding debts) are increasingly feeling the pinch.

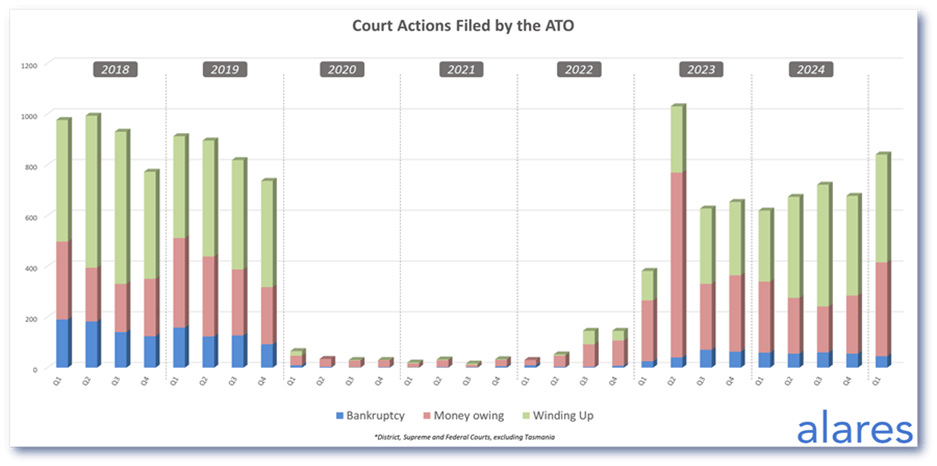

The ATO remains the dominant driver, with no current signs of reprieve

ATO initiated Court recoveries continue to increase, up nearly 40% on a year-on-year basis.

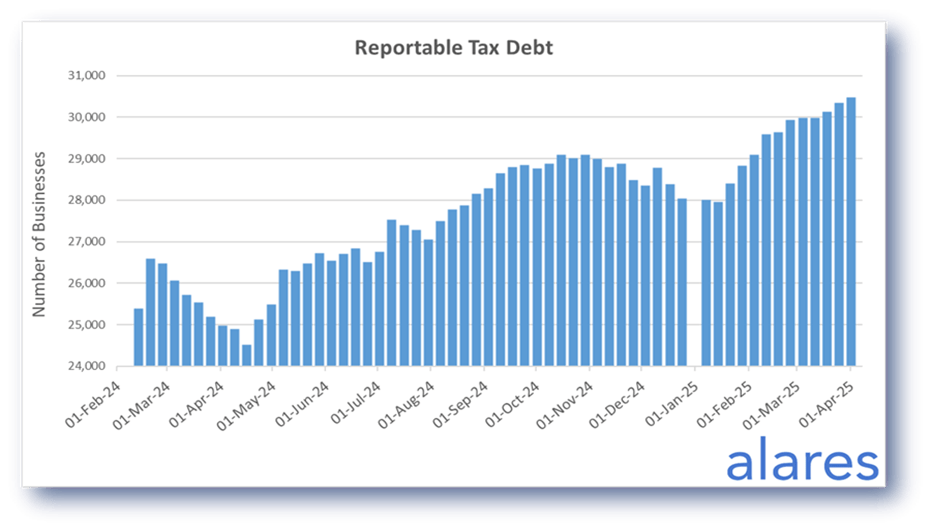

Similarly, the ATO’s disclosure of business tax debts continues to increase

More than 30,000 businesses are now subject to disclosure of tax debt reporting, with the number currently continuing to grow week by week.

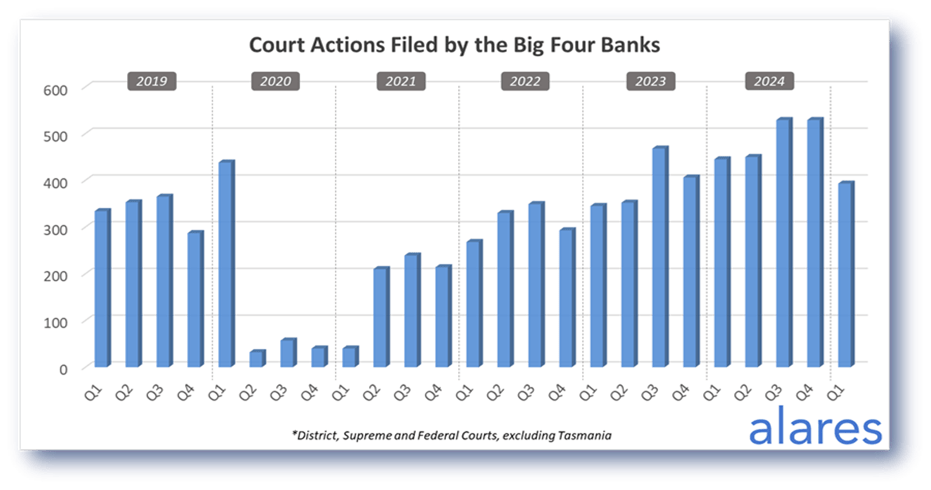

The big four banks offer some positive news with a year-on-year decline in Court recoveries

This represents the first year-on-year decline in many years, although overall Court recoveries still remain historically high.

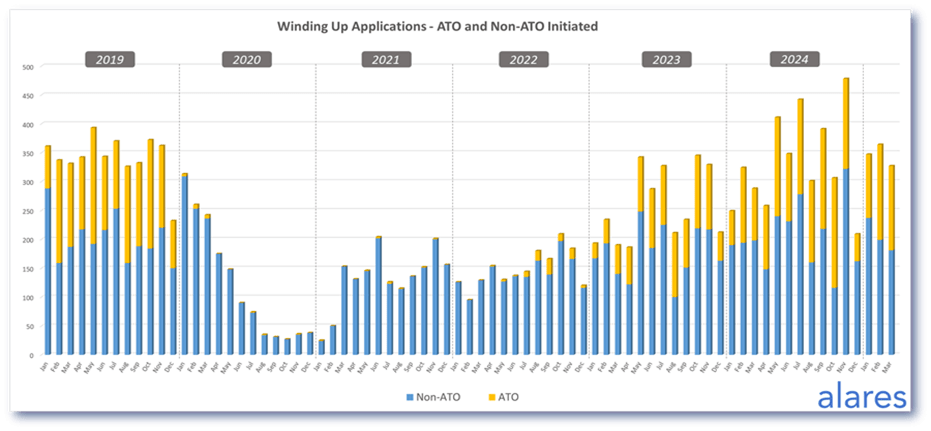

Winding up applications continue to show a slight year-on-year increase

In both 2023 and 2024, winding up applications peaked in May. Time will tell if we see a similar increase again in 2025.

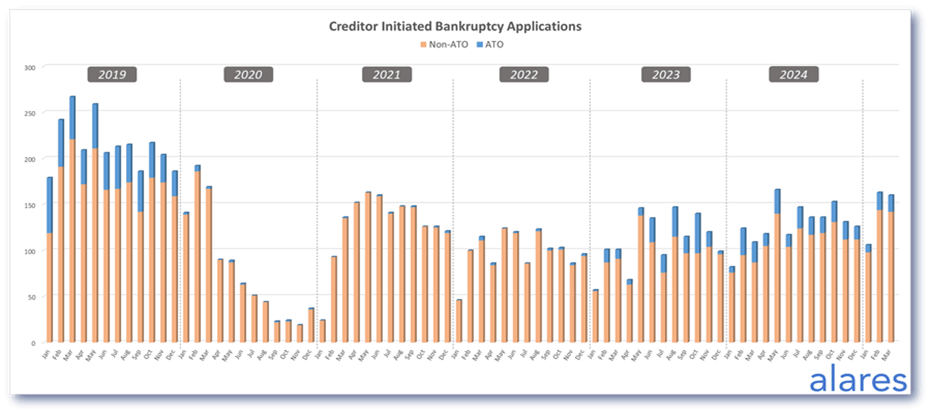

Creditor-initiated bankruptcy applications continue to hover around multi-year highs

However, overall numbers remain low on a historical basis.

Alares provides critical due diligence data that is NOT captured by other providers.

For better insights into financial and reputational risks impacting your customers and suppliers, please get in touch

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Follow FTMA Australia for Industry News and Updates

Our Principal Partners