Written and provided by Alares.

Insolvencies remained historically high in February, more than 50% above pre-COVID levels, and higher again than February last year. Is this now the new normal, or will insolvencies trend back to historical levels once the “catch up” has played out?

Key highlights in Feb

- Insolvencies are still 50% above historical levels.

- The ATO remains the key driver as Court recoveries and disclosure of business tax debts continue to increase.

- Most major risk factors remain higher on a year-on-year basis.

Insolvencies remain well above historical levels

2025 continues where 2024 left off, with insolvencies still significantly higher than pre-pandemic.

February insolvencies remained slightly up on last year

In 2024 we saw record high insolvencies. So far in 2025 we have seen a slight increase again on 2024 numbers. This is not entirely unexpected as the insolvency “catch up” continues to shake out, however the questions remain if and when we will see a return to normal?

Small business restructuring (SBR) bounced back from the January low, in-line with insolvencies more generally

Last year in March we saw the rst major uptick in SBR appointments. Next month’s numbers will be a key point of comparison to see where SBRs may trend moving forward.

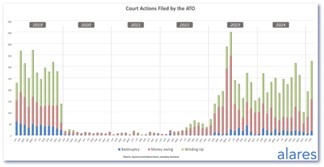

The ATO remains the dominant driver of insolvencies with a continued year-on-year increase in Court recoveries

So far the ATO is showing no signs of reprieve as outstanding debt collection activities continue in full swing.

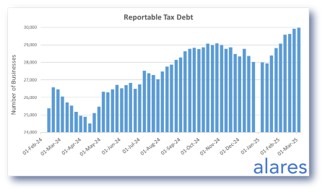

Similarly, the ATO’s disclosure of business tax debts continues to increase

Approximately 30,000 businesses are now subject to outstanding tax debt reporting – more than $100,000 owing for more than 90days with no meaningful engagement with the ATO.

Winding up applications also continue to trend up on a year-on-year basis

Both ATO initiated and non-ATO initiated winding up applications continue to increase.

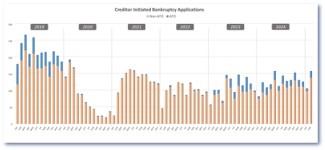

Similarly, creditor-initiated bankruptcy applications have continued to increase year-on-year

Overall numbers remain low on a historical basis, but are slowly trending back upwards after a prolonged drop.

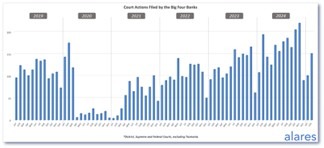

The big four banks were the only major risk indicator that showed a year-on-year decline in February

Big four bank Court recoveries remain historically high, and we will see in the coming months if the drop in February was a one-off or the beginning of a broader trend for the major lenders.

Alares provides critical due diligence data that is NOT captured by other providers.

For better insights into financial and reputational risks impacting your customers and suppliers, please get in touch

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Follow FTMA Australia for Industry News and Updates

Our Principal Partners