Written and provided by Alares.

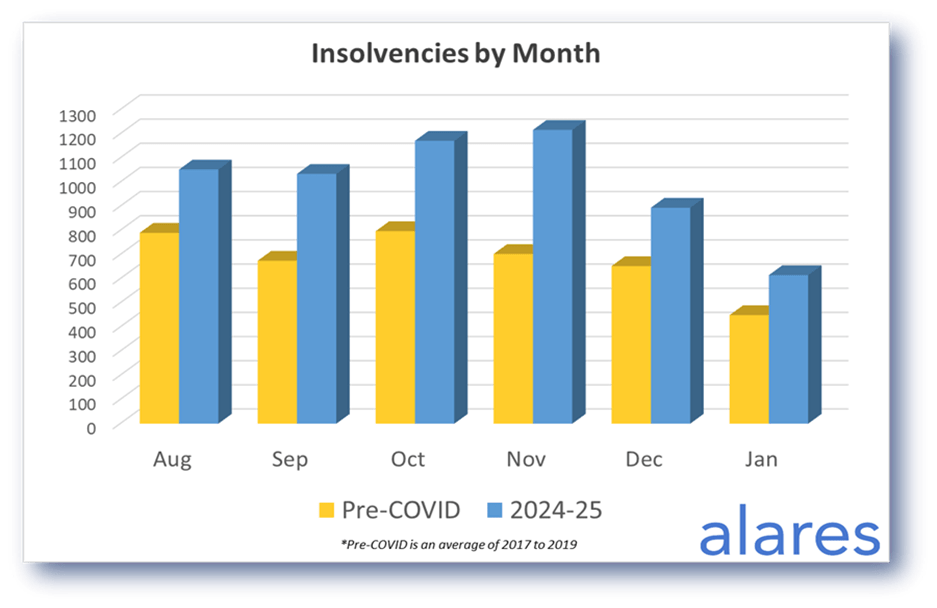

January is historically a low month for insolvencies and we saw this again last month, however numbers were still ~40% up on pre-COVID levels, and slightly up on last year. Will this set the tone for the rest of 2025?

Key highlights in January

- Insolvencies still 40% higher than historical levels.

- The ATO increased tax debt reporting after a slow-down in November and December.

- Creditor-initiated winding up applications continue to ramp up.

Insolvencies remain well above historical levels

2025 has started where 2024 left off, around 40% higher than pre-pandemic.

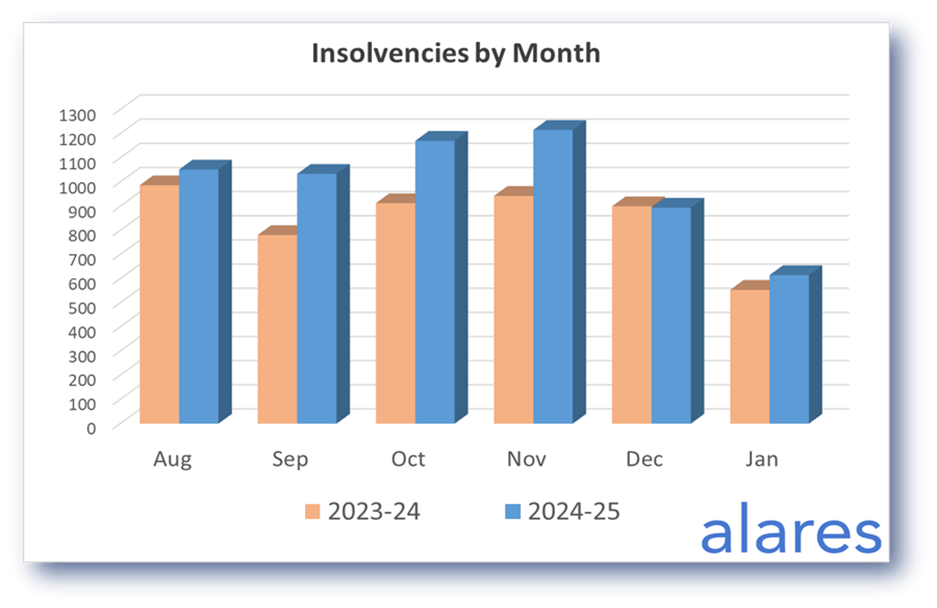

January insolvencies were also slightly up on last year

In 2024 we saw record high insolvencies. In January 2025 we saw a slight increase again over 2024 numbers as the insolvency catch-up continues to play out.

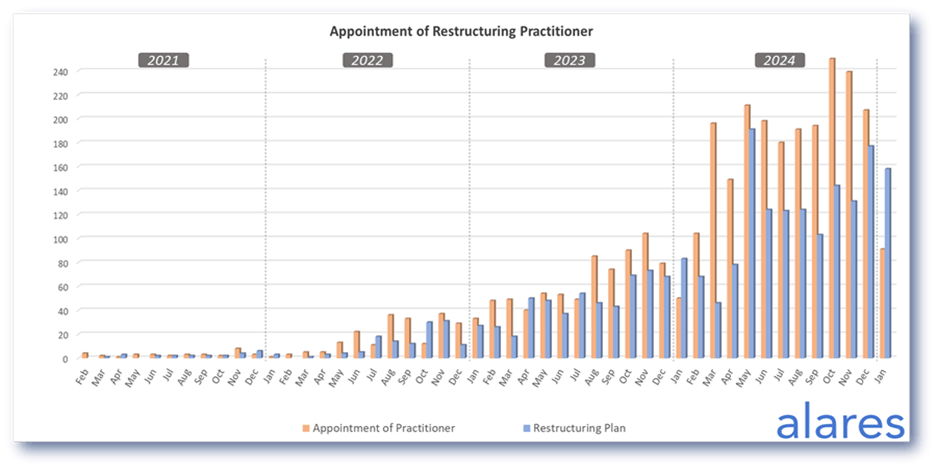

SBRs also saw the typical January drop, however year-on-year numbers were significantly higher than 2024

Next month’s numbers will show even greater insight into how SBR numbers may track in 2025 after the 2024 surge.

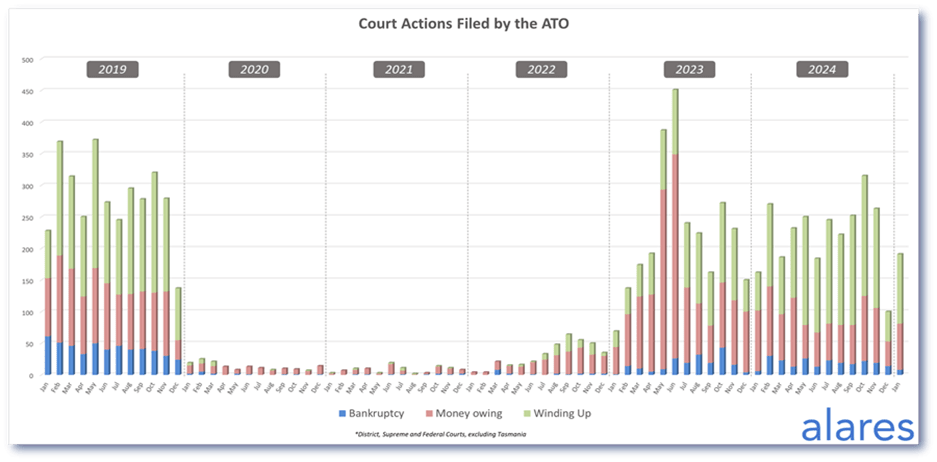

The ATO was back in full-swing in January

ATO Court recoveries in January showed another year-on-year increase as the ATO’s focus on outstanding debt collection continues.

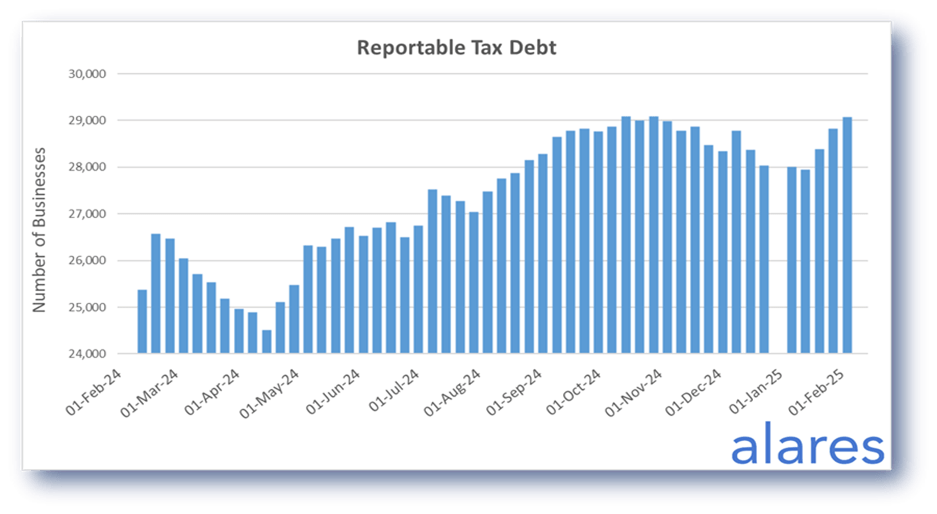

ATO disclosure of reportable tax debts increased significantly in January

After a steady decline in the number of businesses subject to ATO reporting in November and December, we saw a significant increase in January.

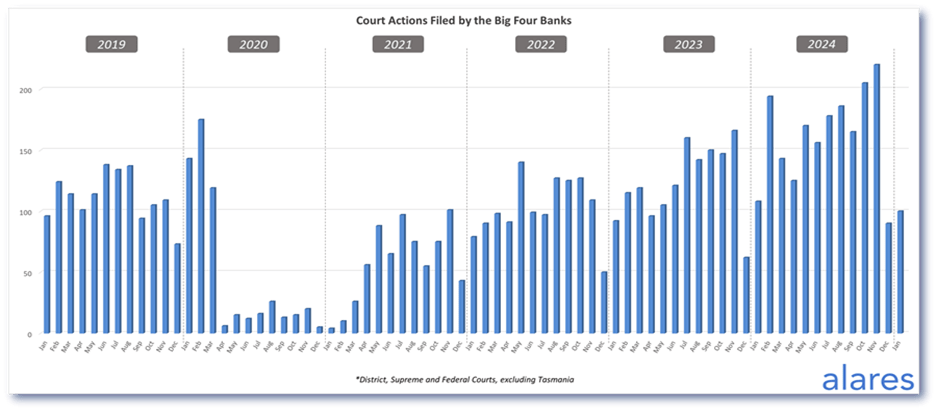

The big four banks had a quiet time in December and January in-line with the historical trend

In 2024 we saw a significant ramp-up in Court recoveries from the major lenders. Next month’s numbers will likely show whether this trend will continue in 2025.

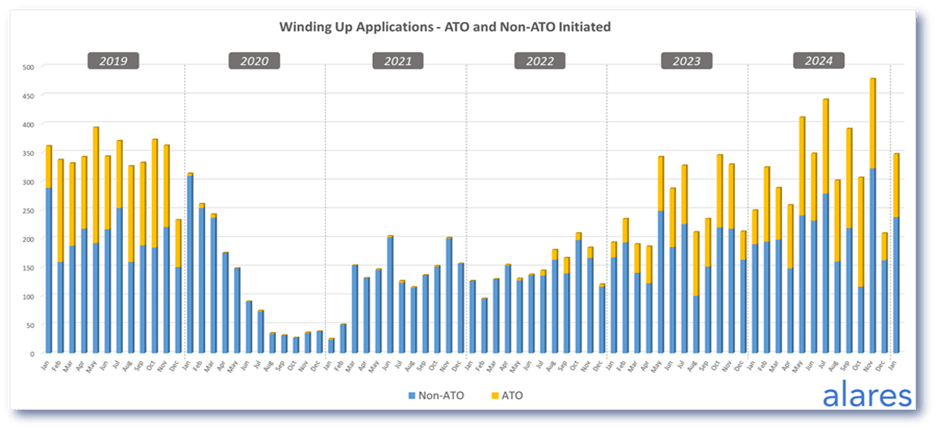

January saw a significant year-on-year increase in winding up applications

Winding ups often foreshadow future insolvencies. 2024 saw a sharp increase in winding ups, and so far this trend appears to be continuing.

Alares provides a full suite of reports and alerts to help manage your financial and reputational risk.

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Follow FTMA Australia for Industry News and Updates

Our Principal Partners