This piece was written and provided by Alares.

Insolvencies remain at historical highs amid ongoing pressure from the ATO and major lenders.

Key highlights in September

- Insolvencies more than 50% above historical levels.

- The ATO remains the dominant player, both in terms of outstanding tax debt reporting and direct Court action.

- Court recoveries from the big four banks continue to rise.

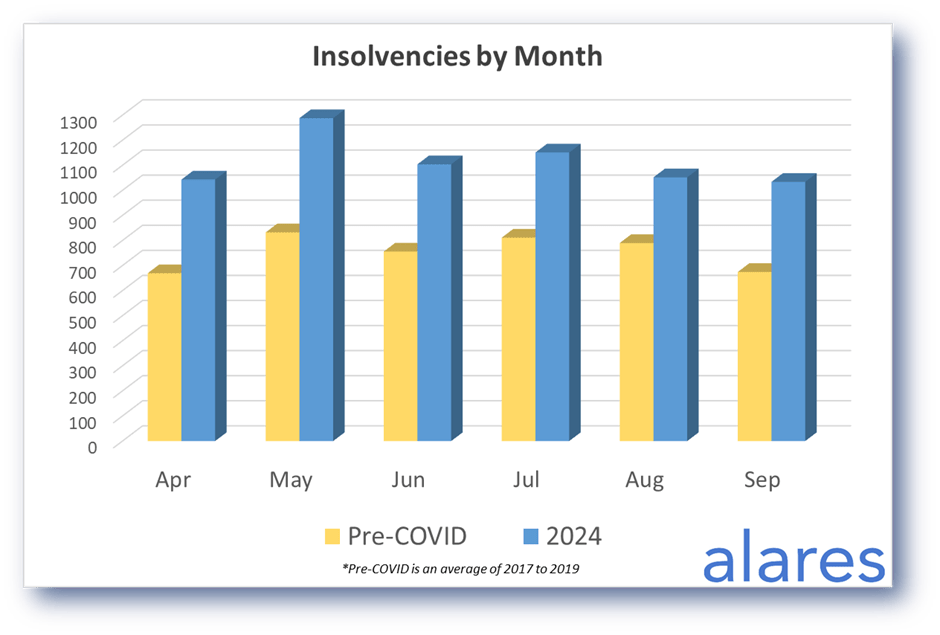

Insolvencies are still well above historical levels

Insolvencies in September were back over 50% above historical levels. This might suggest the insolvency catch up is still in full swing.

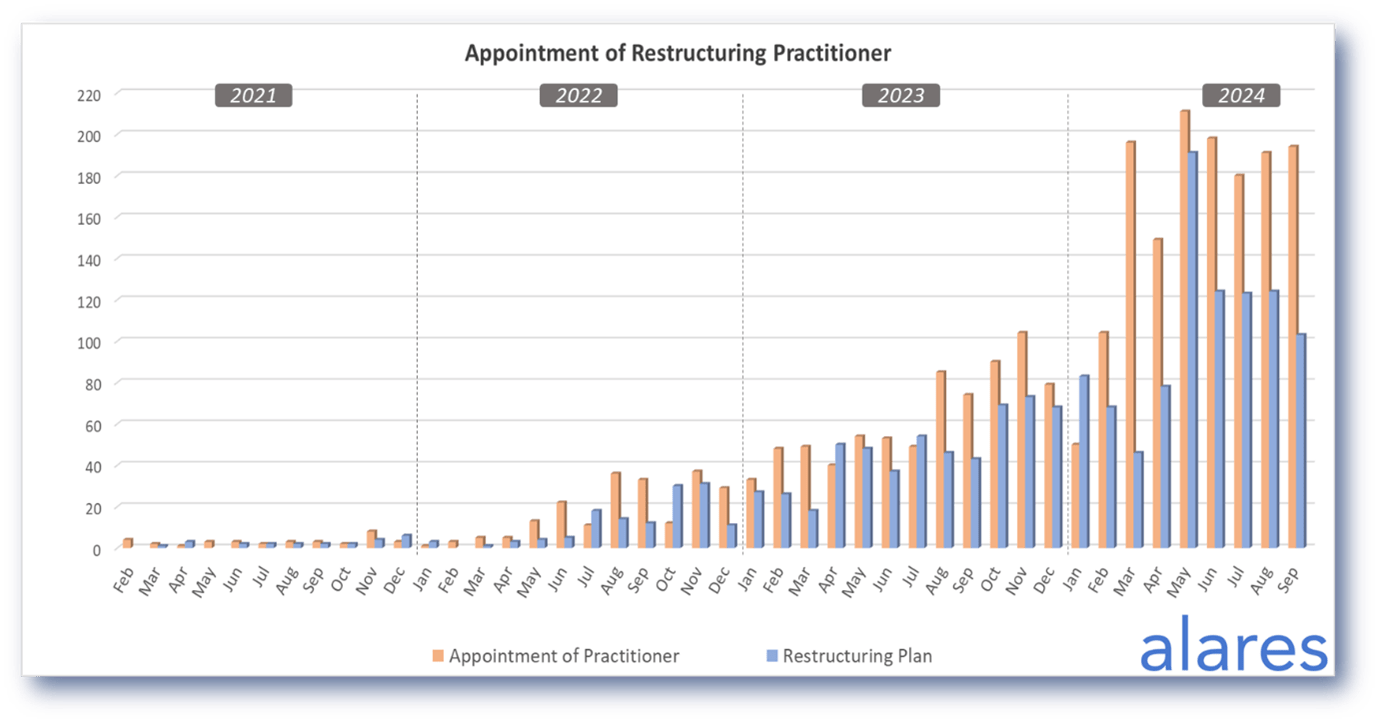

Small business restructuring appointments remain high, continuing the trend for 2024

Small businesses continue to look to the SBR process to restructure their debts, in particular tax debts.

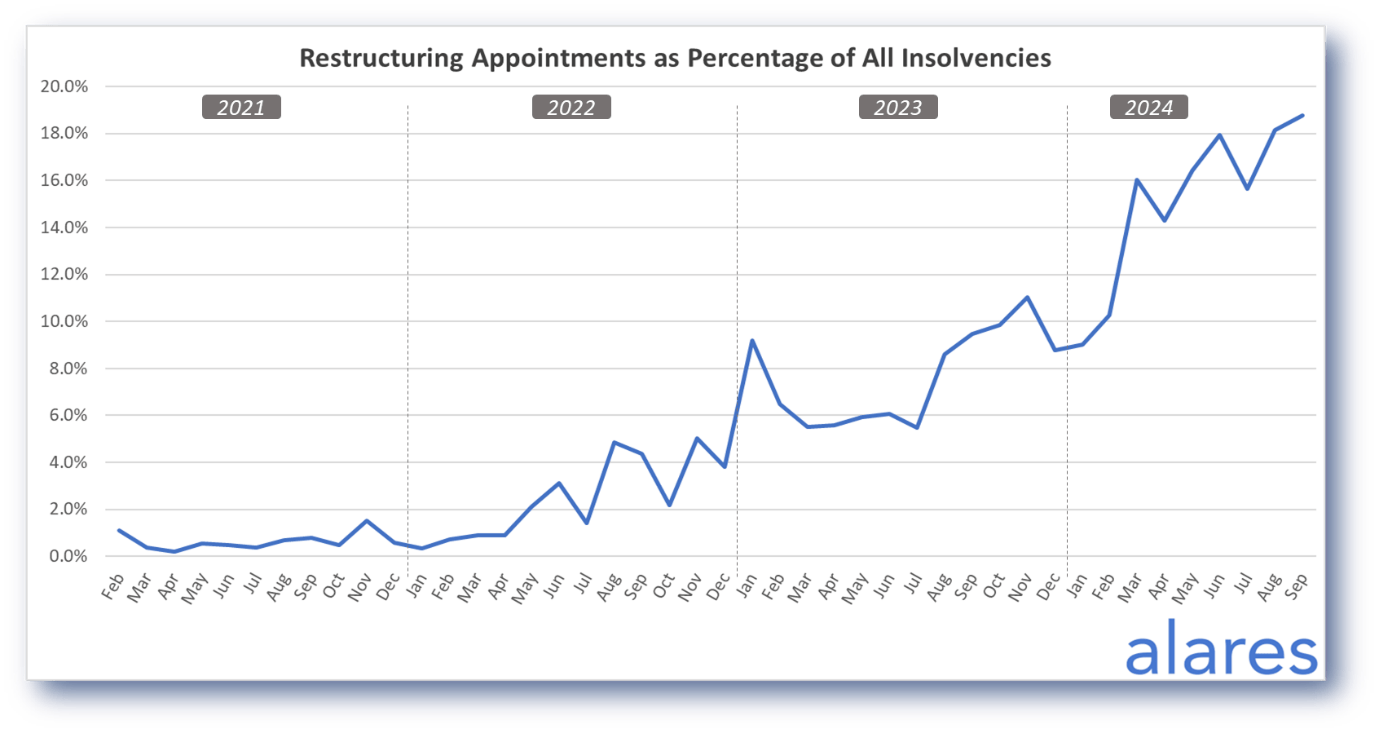

Small business restructuring accounts for an increasing percentage of all insolvency appointments

SBRs continue trending up towards 20% of all new insolvency appointments.

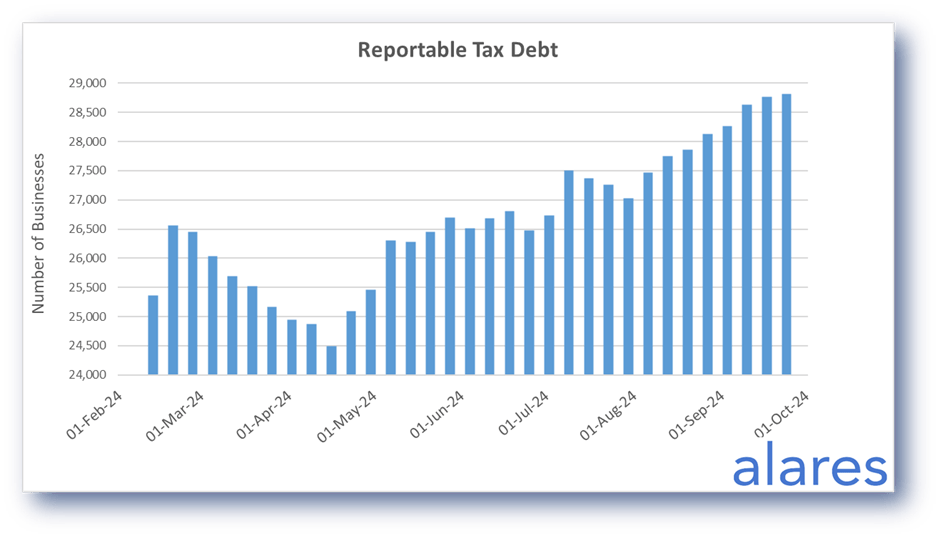

The number of businesses reported by the ATO as having reportable outstanding tax debts continues to rise

The increase in SBRs is perhaps unsurprising given the increasing number of businesses reported by the ATO (more than $100k outstanding for more than 90 days without effective engagement).

After a drop in March and April, the number of businesses reported by the ATO has grown steadily since May, now approaching 29,000 in total.

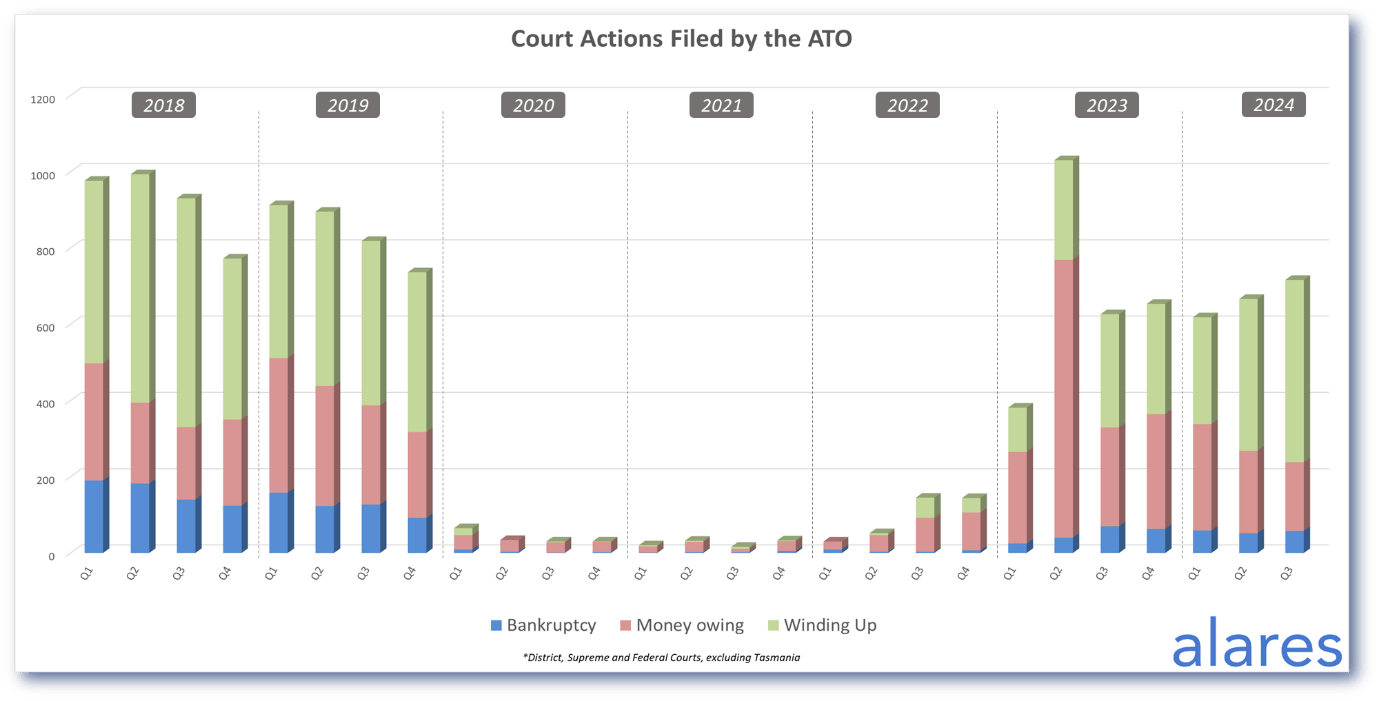

In addition to tax debt reporting, the ATO remains active in the Courts, in particular with winding up applications

September saw the highest monthly number of ATO-initiated winding up applications since Oct 2019.

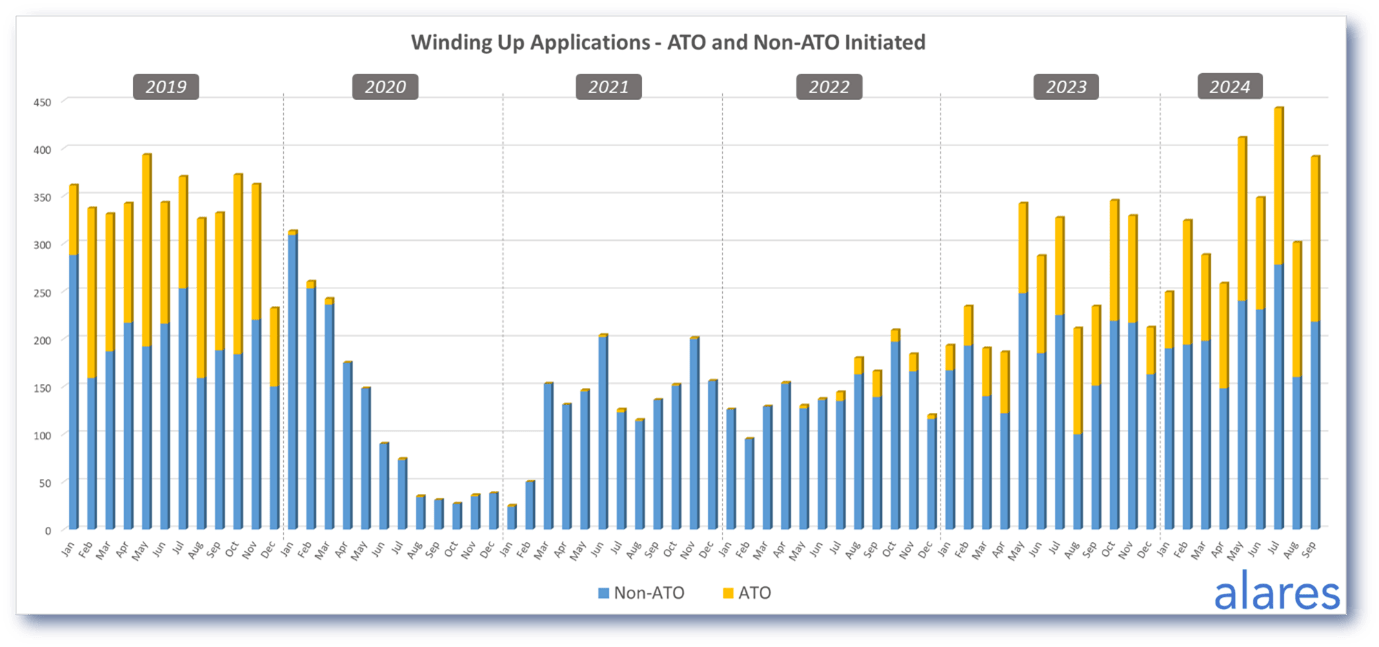

Winding up applications remain high across the board as creditors seek to enforce their rights

Both ATO-initiated and non ATO-initiated winding up applications in September were above historical levels.

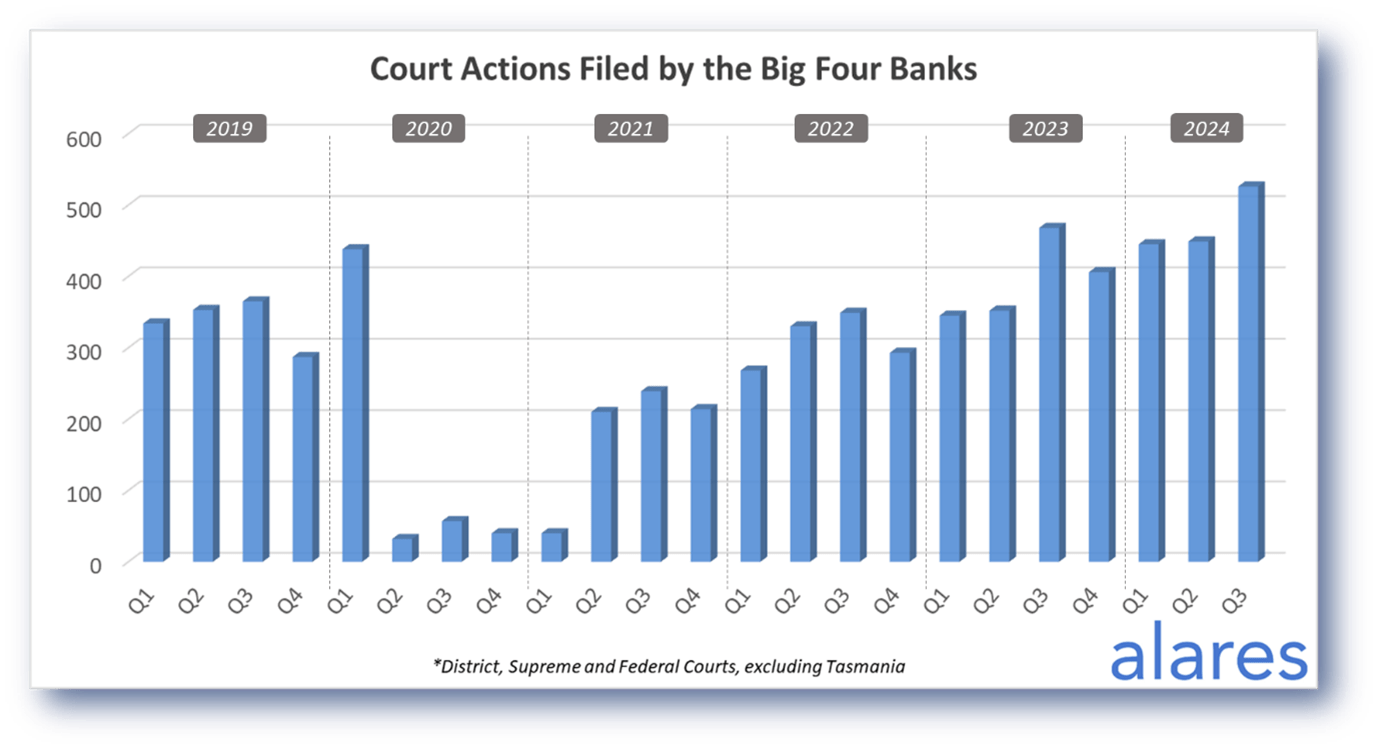

The big four banks also continue to ramp up their Court recoveries

Court actions filed by the big four banks have remained on an upward trajectory throughout 2024 and sit well above historical levels.

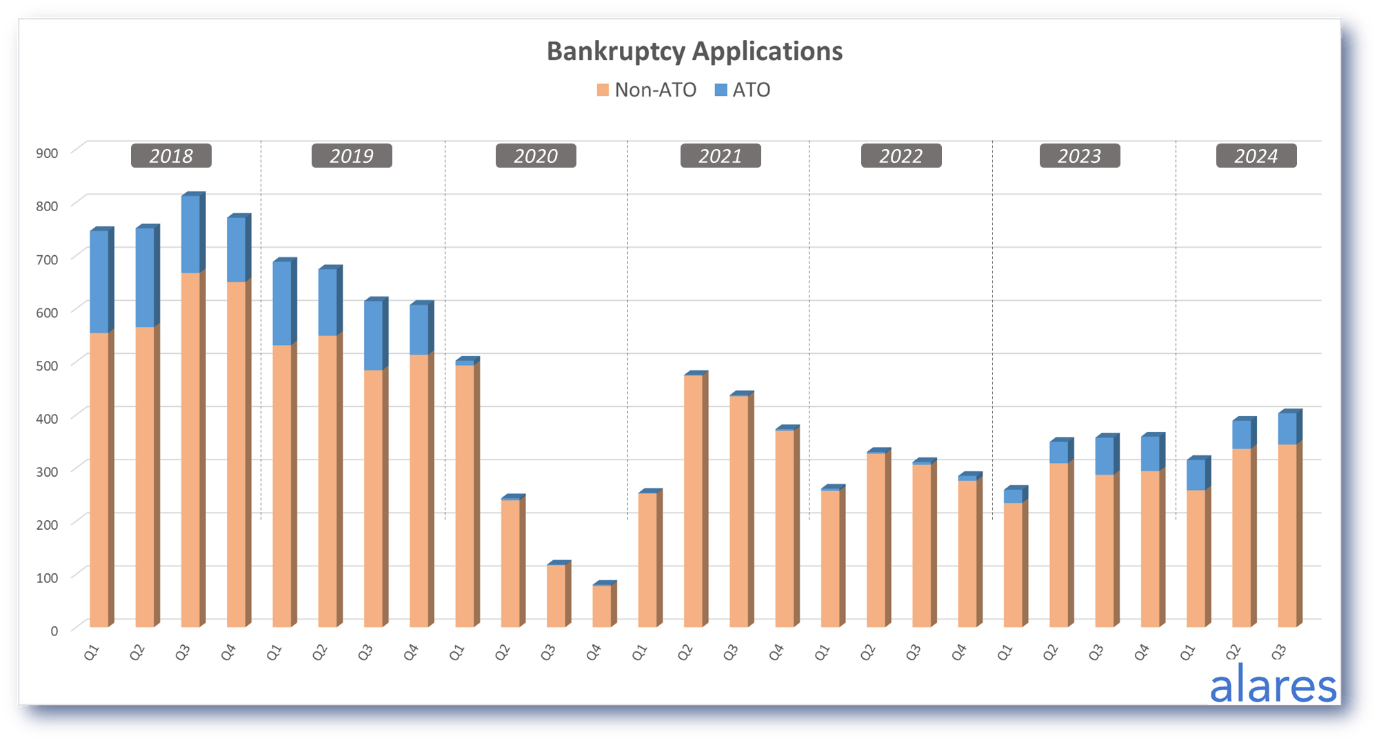

Creditor-initiated bankruptcy applications are also showing small signs of increase

Bankruptcy sequestrations were on the decline for many years, however recent data suggests bankruptcies may be slightly on the rise.

Alares provides a full suite of reports and alerts to help manage your financial and reputational risk

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners