This piece was written and provided by Alares.

Insolvencies continued to increase in March, again peaking at the highest monthly level seen in many years. Small business restructuring (SBR) appointments spiked in March, driven in large part by the ATO’s debt recovery efforts.

Key highlights in March

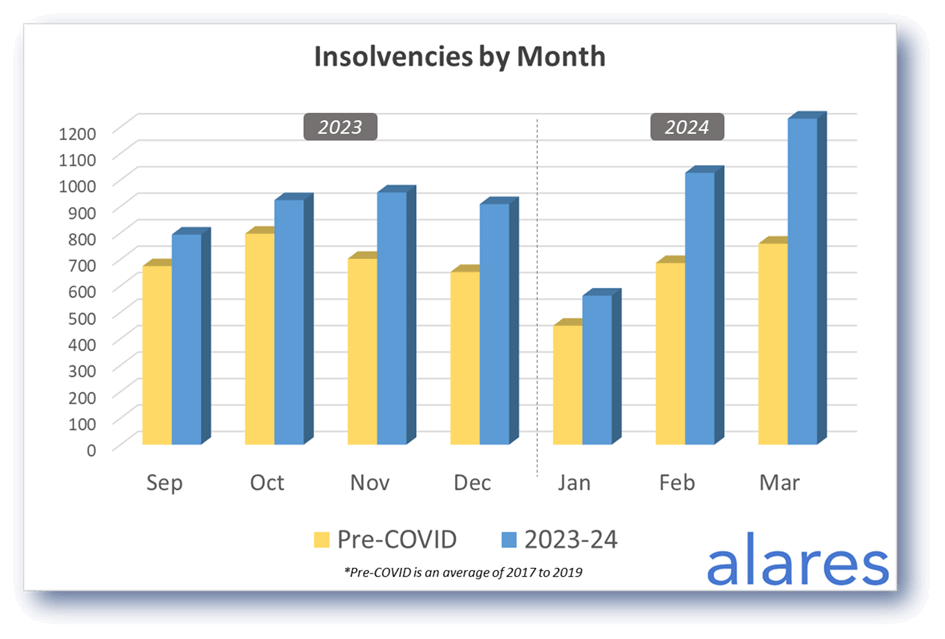

- Insolvencies more than 50% above pre-COVID levels.

- Significant spike in small business restructuring appointments.

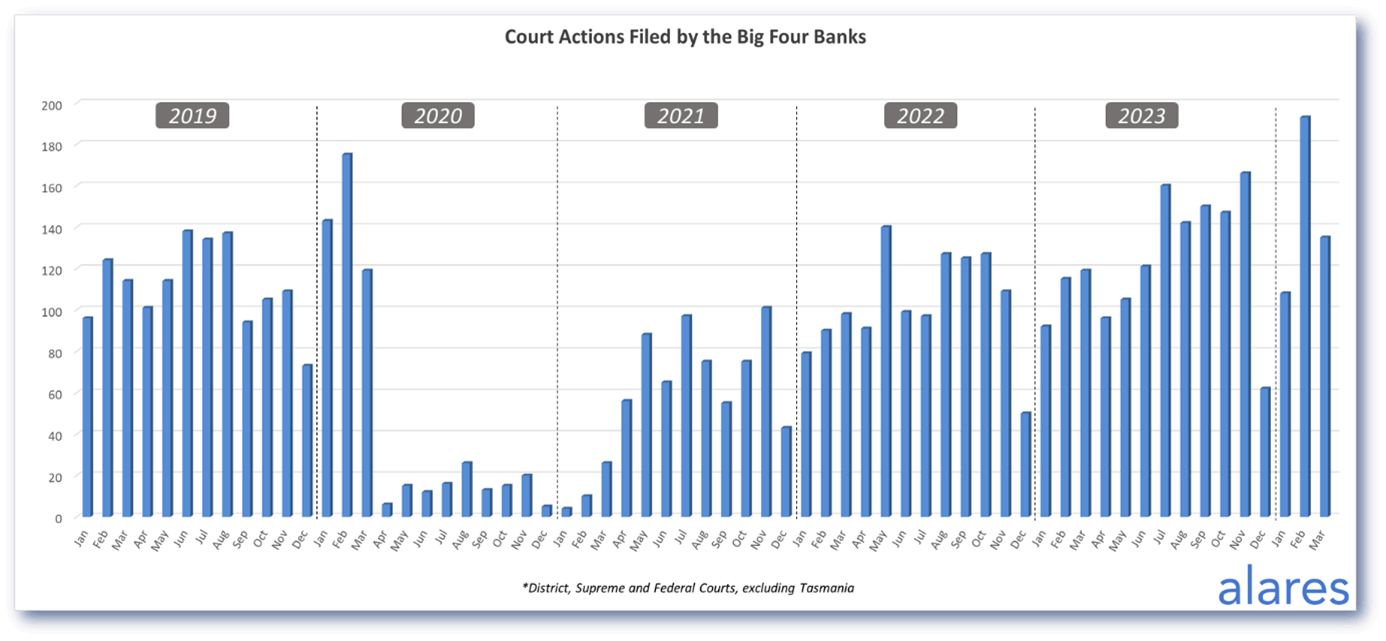

- The big four banks remain vigilant in their Court recoveries.

Insolvencies in March peaked at more than 50% above pre-COVID levels

March marked the highest number of monthly insolvencies in many years.

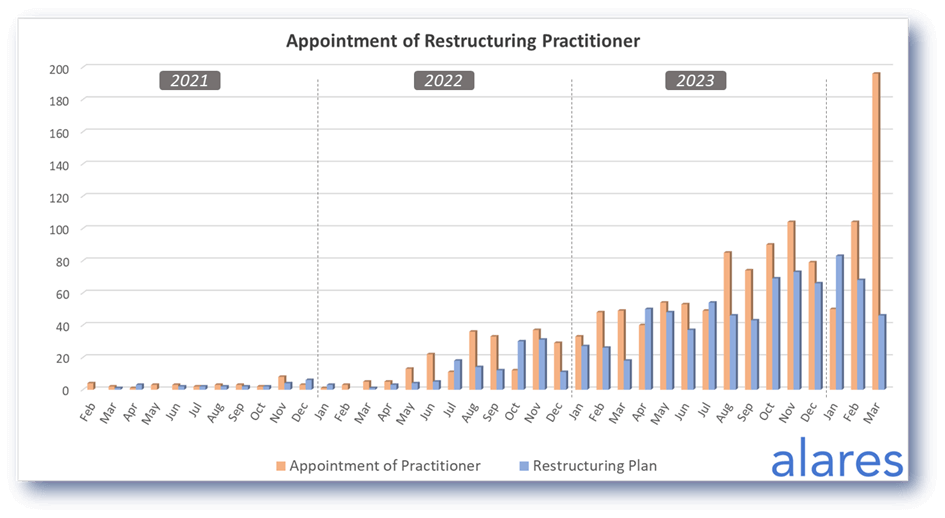

Small business restructuring appointments spiked in March, amid mounting pressure from the ATO

As the ATO continues to disclose overdue tax debts, as well as issuing director’s penalty notices and warning letters, more small business owners are turning to the SBR process for relief.

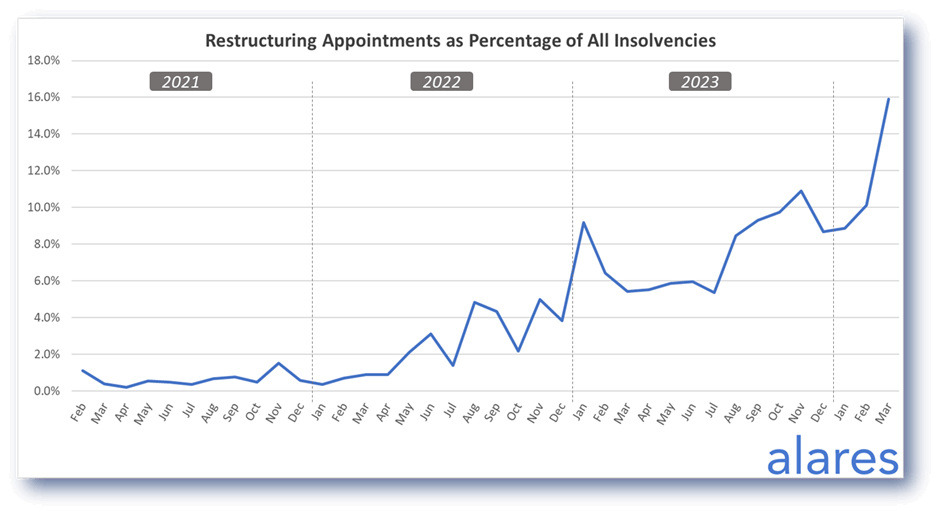

SBRs continue to account for a growing percentage of all insolvencies

SBRs in March accounted for ~16% of all insolvency appointments.

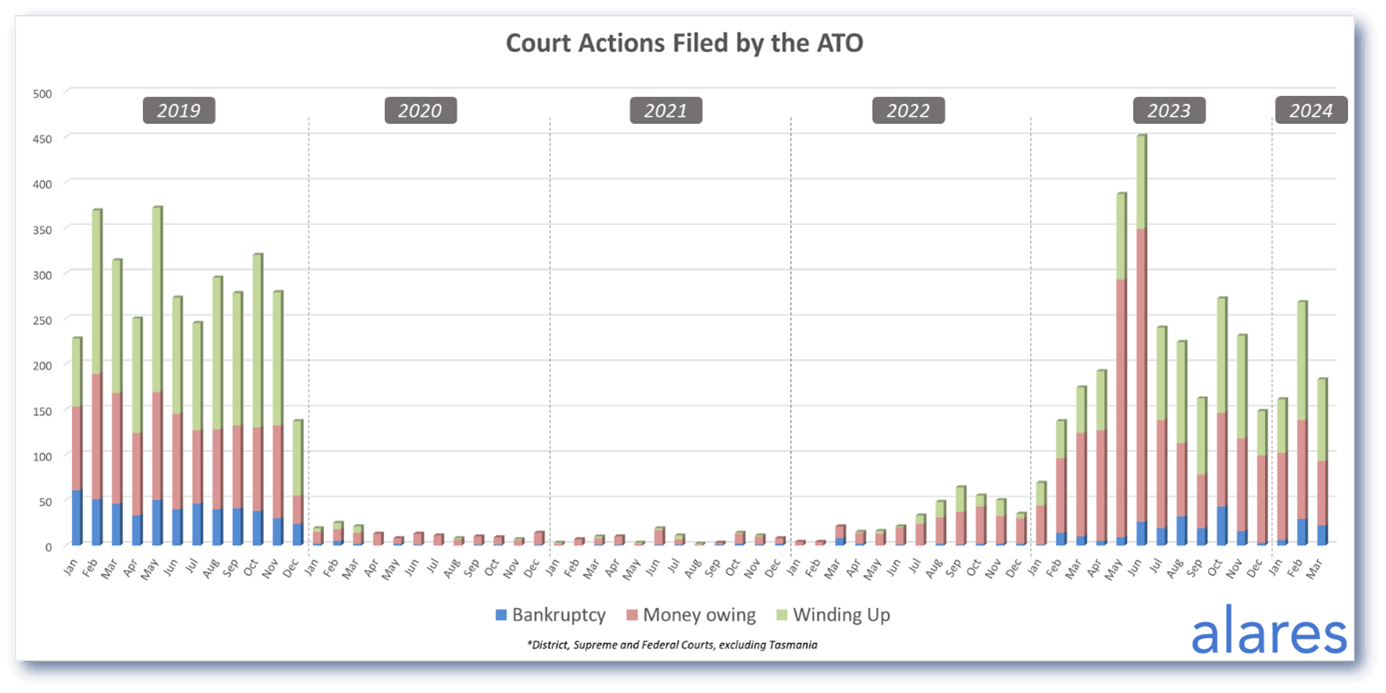

The ATO remains active in Court recoveries

In addition to director’s penalty notices and disclosing business tax debts, the ATO remains active in Court recoveries.

Similarly, the big four banks remain vigilant with Court recoveries

Court actions filed by the big four banks in March remained above historical monthly levels.

Alares provides critical credit risk data that is NOT captured by other providers

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners