This piece was written and provided by Alares.

Insolvencies increased substantially in February, peaking at the highest monthly level seen in many years. This coincides with a sharp uptick in Court recoveries from the big four banks and the ATO. Is February a one-off or will this trend continue throughout 2024? Stay tuned for next month’s update to see how these trends develop.

Key highlights in February

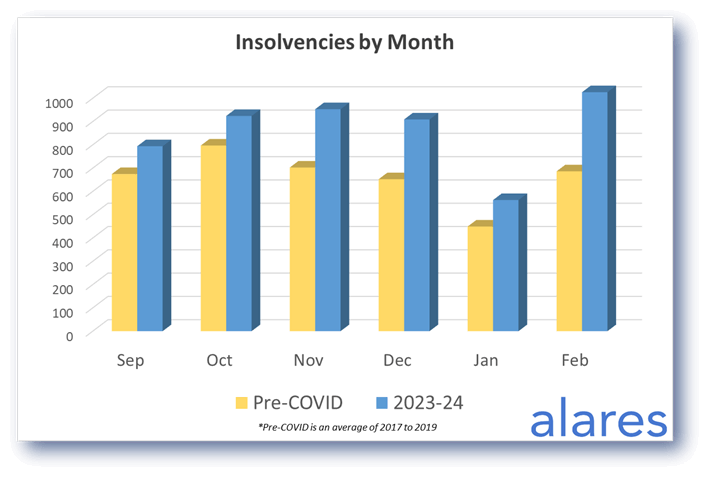

- Insolvencies well above historical levels.

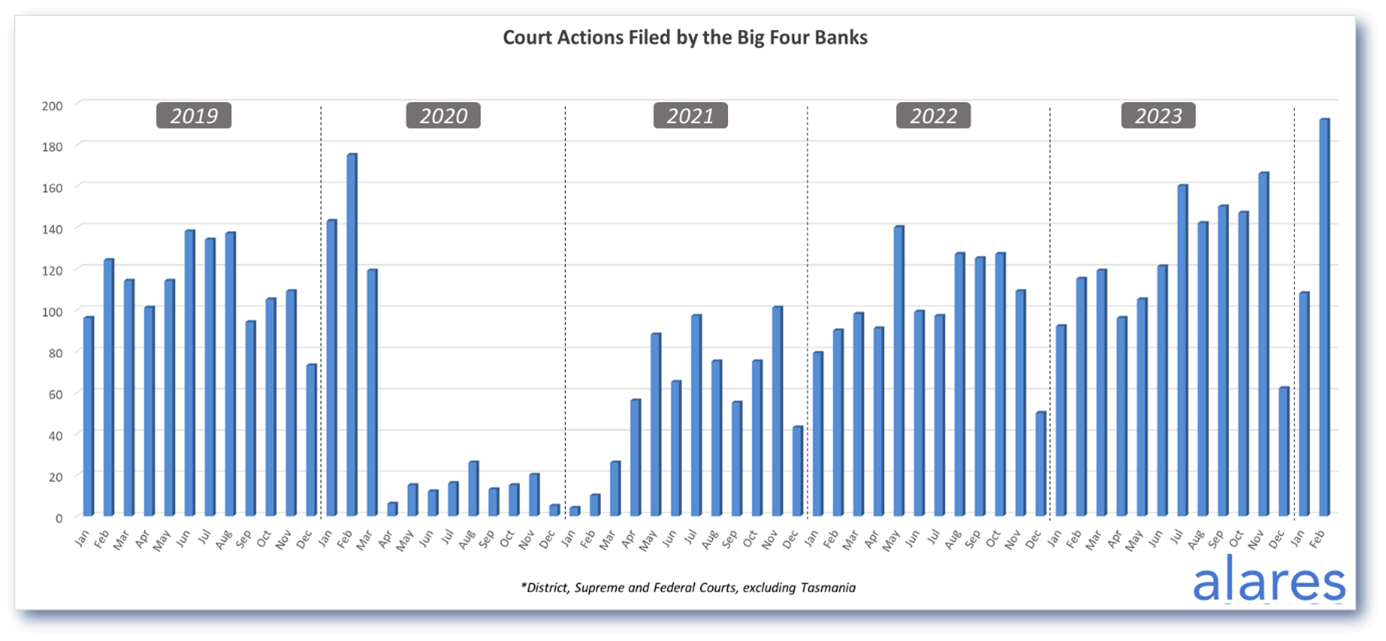

- Significant increase in Court recoveries from the big four banks.

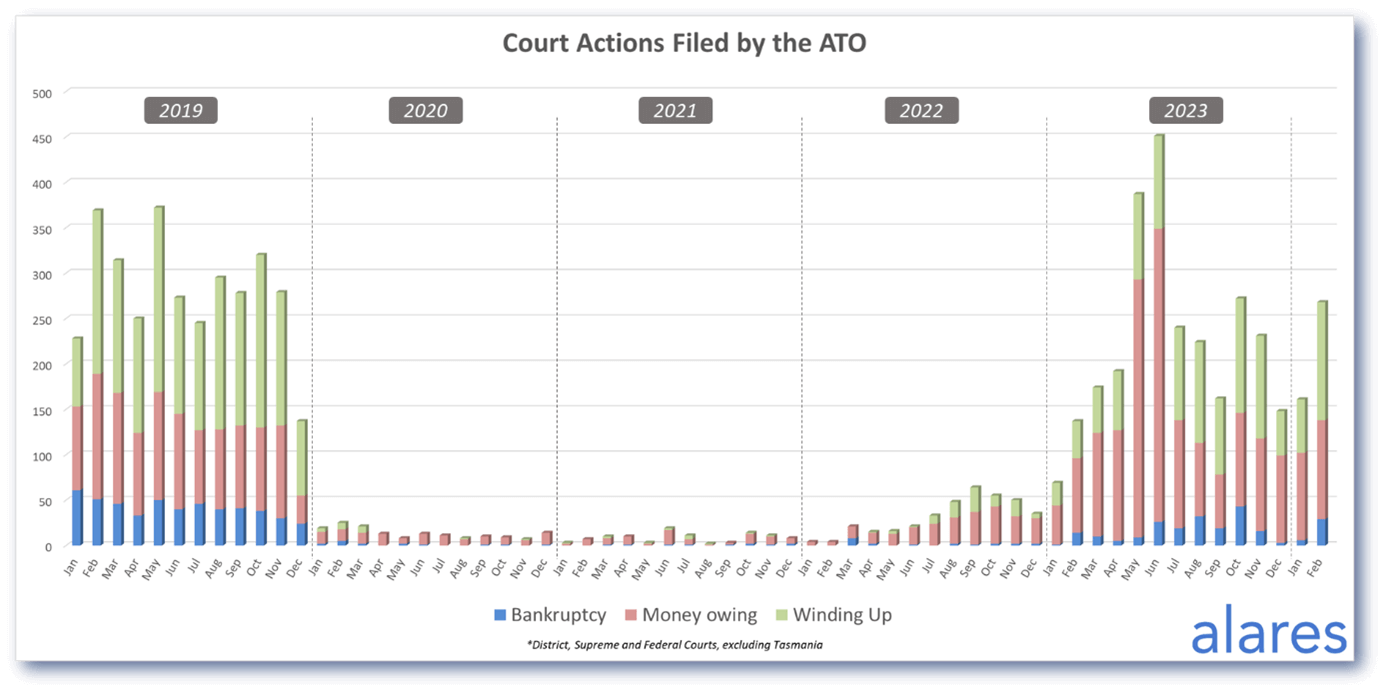

- Winding up applications approaching historical levels.

Substantial increase in insolvencies in February

Total insolvencies in February were almost 50% higher than pre-COVID numbers. This marks the highest monthly percentage increase we have seen to date.

Significant increase in Court recoveries from the big four banks

The big four banks have significantly increased their recovery activity after the typical pause in December and January. Was February a ‘catch up’ month or will this increased activity continue in the coming months?

Similarly, ATO Court activity increased after the typical slowdown in December / January

ATO Court activity returned to the levels we saw in the second half of 2023, with total monthly numbers approaching pre-COVID levels.

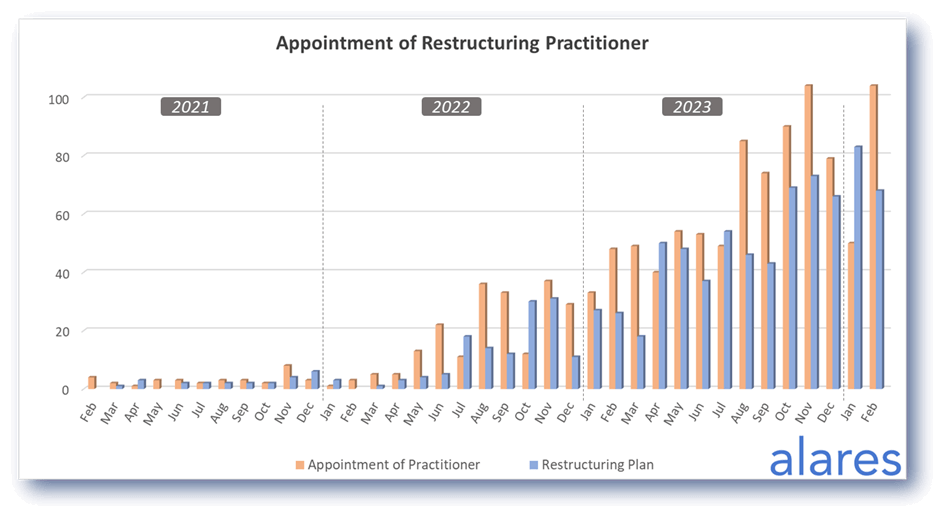

Small business restructuring remains a key pathway for dealing with outstanding tax debts

The SBR process remains a key option for small business to navigate challenging economic conditions.

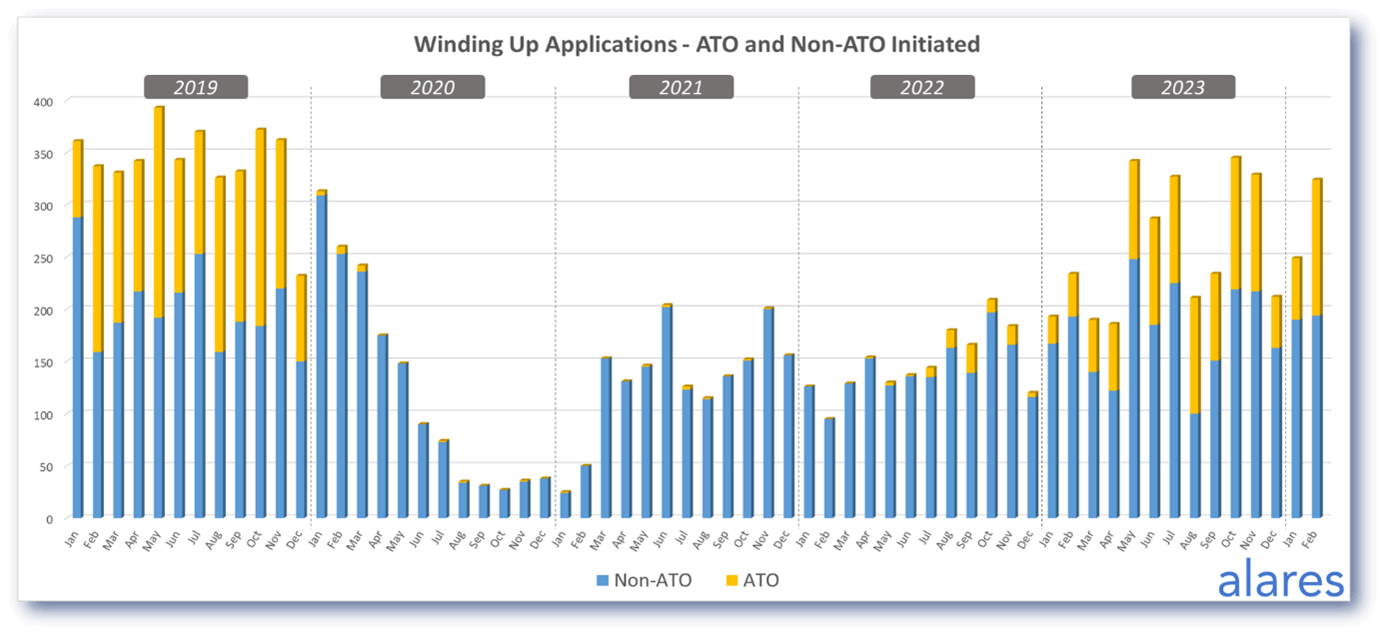

Winding up applications continue to approach historical levels

Both ATO-initiated and non ATO-initiated Winding Up applications continue to trend back towards historical levels.

Alares provides critical credit risk data that is NOT captured by other providers

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners