This piece was written and provided by Alares.

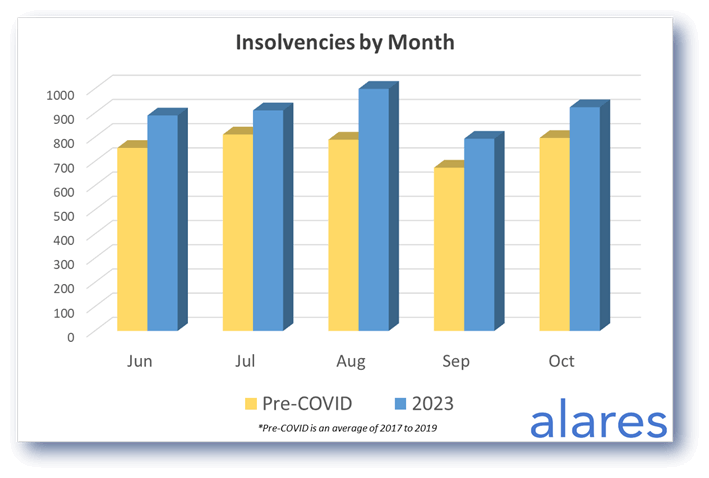

Insolvencies in October remained ~15% above pre-COVID levels following the consistent trend throughout 2023.

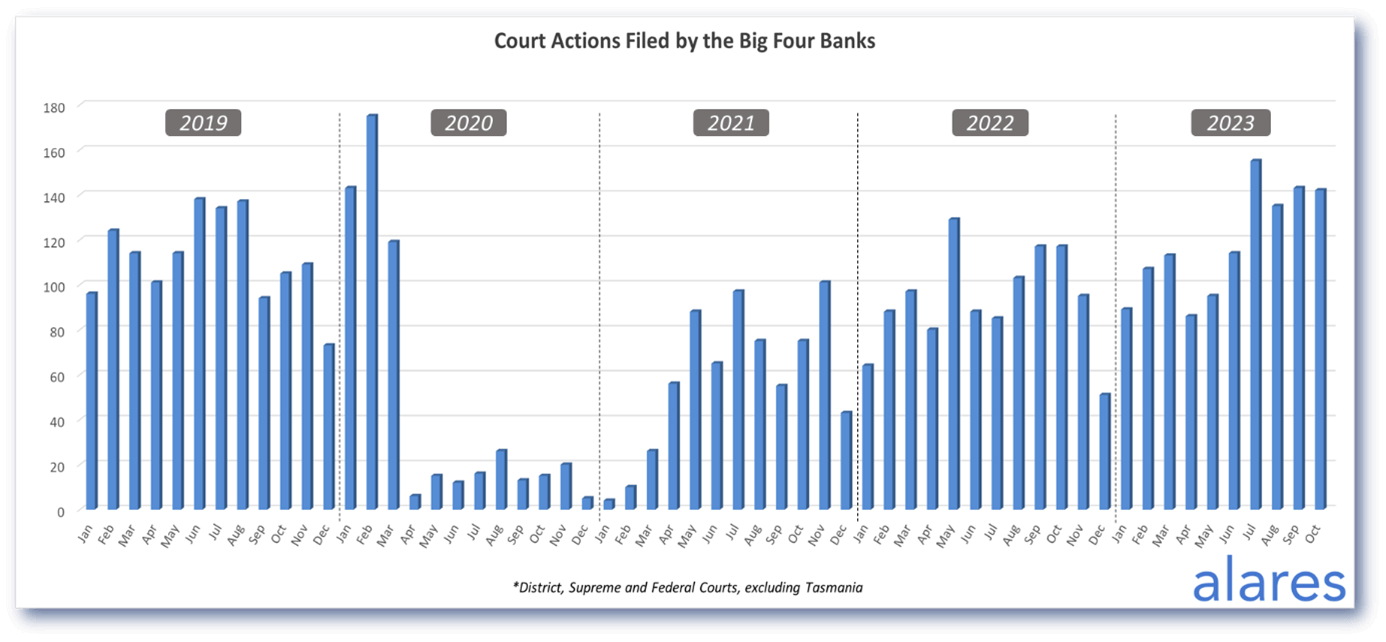

Court recoveries from the big four banks and small business restructuring appointments remain high, while the ATO also increased its Court activity significantly from September.

Key highlights in October

- Court activity from the big four banks remains high, in line with the past few months.

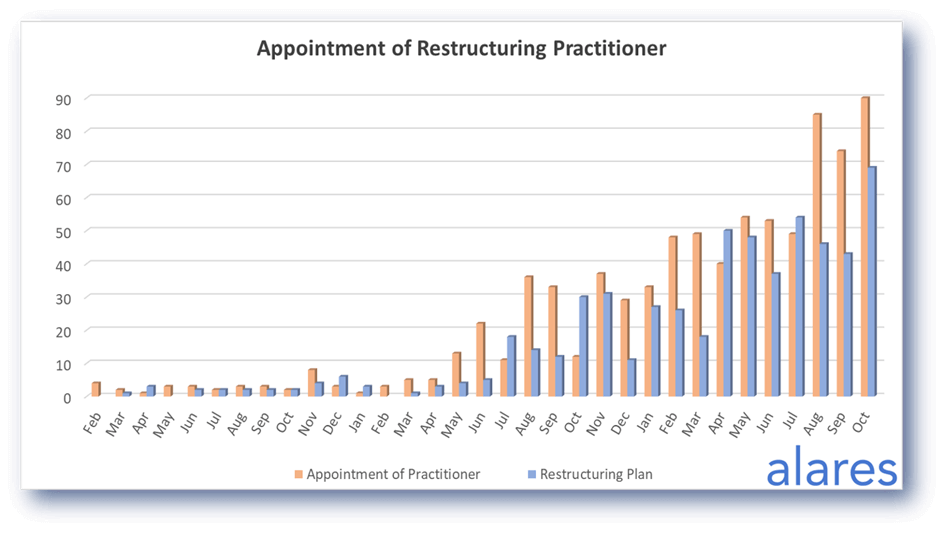

- Small business restructuring appointments continue to increase.

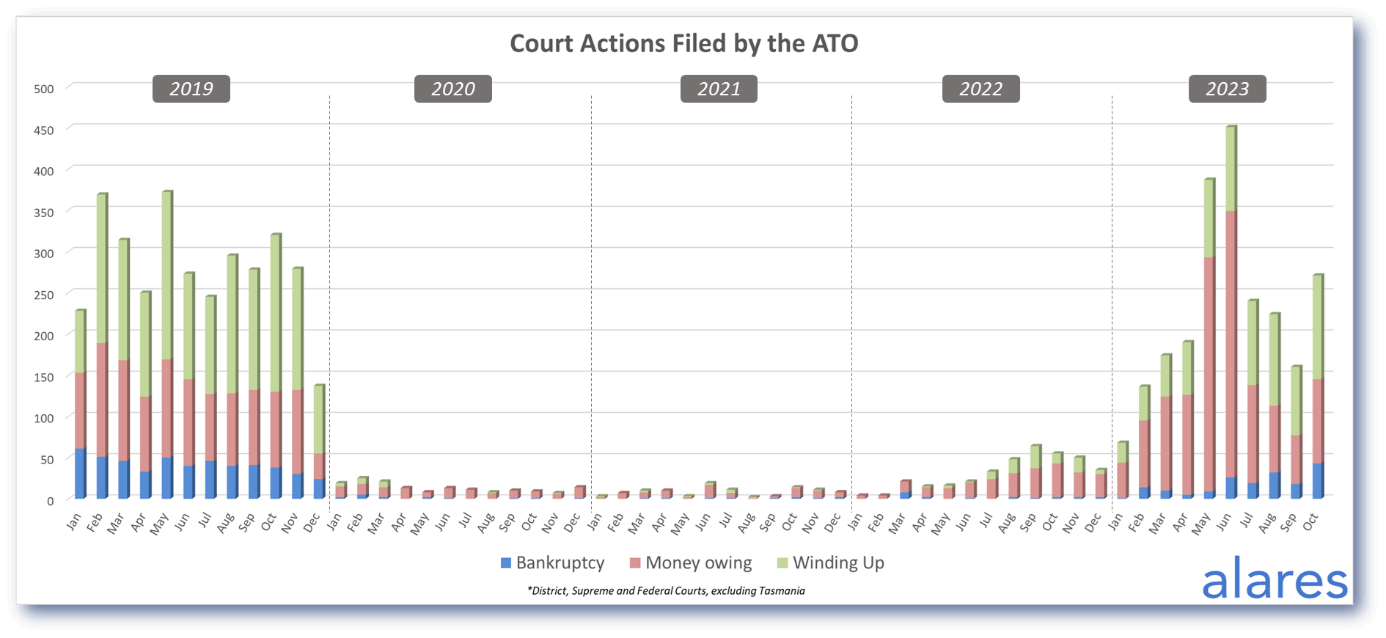

- ATO Court activity increased in October after a brief slowdown.

Insolvencies in October remained above pre-COVID levels

This continues the trend we have seen throughout 2023.

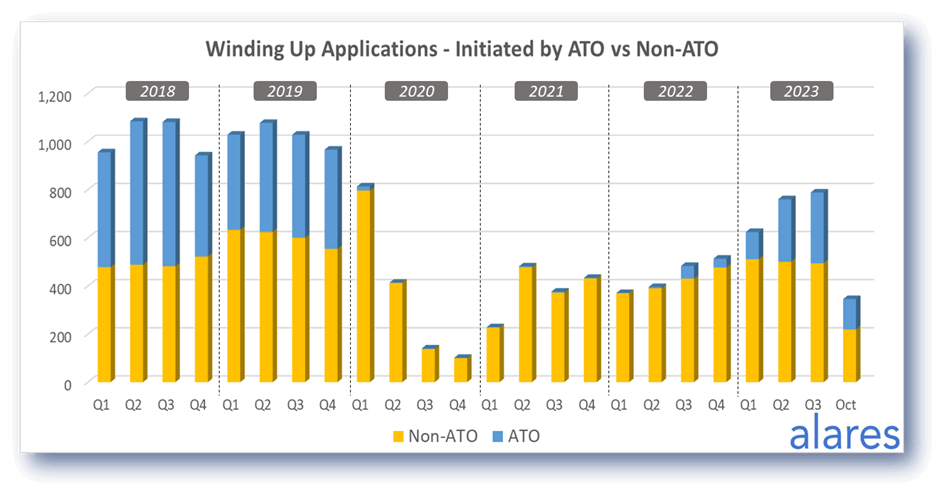

ATO Court activity increased in October after a brief slowdown.

Overall ATO Court activity is back in-line with pre-COVID levels, while Winding Up applications and bankruptcy petitions were both at the highest monthly level since 2019.

Small business restructuring appointments continue to increase

The number of appointments in October continued to increase after the spike in August and September. In previous months, the increase in restructuring appointments coincided with a drop in ATO Court activity – October saw an increase in both restructuring and ATO activity. How will this impact insolvencies for the remainder of the year? Stay tuned to find out.

The big four banks have significantly increased their Court recoveries in recent months

With higher interest rates impacting the serviceability of debt, the big banks continue to ramp up their Court activity.

Winding up applications continue their steady upwards trajectory

Winding up applications have been trending upwards since the beginning of 2022 and are starting to approach historical levels.

Alares provides critical credit risk data that is NOT captured by other providers

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners