This piece was written and provided by FTMA Supporting Partner, Programmed Timber.

As another financial year comes to an end, business owners and those managers charged with financial responsibility will be reflecting heavily on the year just finishing results and assessing the year ahead’s prospects.

It would be easy to have a whinge about how we arrived at this situation and who is responsible but I’m sure we’ve already done that in our minds and variously shared our opinions with others. As the old saying, paraphrased, goes ‘life’s not fair – it is not about what happens to you but what you do about it’.

The current situation looks like continuing for some time yet with a national housing shortage and for various reasons a very subdued response in building activity. It is not unreasonable to expect a resurgence in building activity though it won’t be instantaneous but possibly ramp up quickly when it does occur.

For some the present focus is simply surviving until that recovery happens. For anyone who is in a better current situation, do they believe the future is the same but more? Experience says that all your growth opportunities occur in the quiet market. What you do now will determine how you will be able to network any market improvement or at least survive in the interim. Those who make the better decisions now can not only survive but surpass those who have not progressed their approach.

Either way the facts of the matter need to be recognised. The minimum national wage increases 3.75% from 1 July. The greater majority of workers in this industry are paid above the minimum and there is no obligation to make the same adjustment, however to retain employees it is going to be difficult to not pass at least the majority in full. Additionally the superannuation guarantee increases 0.5% at the same time. Effectively it could be reasonable to assume a company’s wage bill is increasing 4.25%

Other cost increases are coming through thick and fast. Insurance is up, electricity is up, interest is up and along with the mirriad of other costs businesses have to contend with. Every business will be trying to negotiate for lesser increases but an overall increase will be for sure. Unfortunately with building activity subdued, there is little chance of recovering these real cost increases from the market. In fact there is pressure for price decreases so those downstream can retain some margin after enduring their own cost increases.

This is the most interesting point where downstream customers in the supply chain are largely seeking relief from their suppliers as the major offset to other increases. Those that have to decrease their price to retain business but have unavoidable increased cost suffer – badly. Those that can withstand this increased cost pressure at the front whilst still being able to offer their customers no increase, little increase or even decrease win the battle if they can survive.

The clear threat is that when pressure is applied upstream for cost reduction and the supplier has run out of margin, that supplier may be no more.

Simply, if you are manufacturing something, it is going to cost more unless there is greater plant productivity.

This is where that major economic factor comes hugely into play – productivity. Productivity improvement is the absolute key to being able to entertain input cost increases and offer customer price stability. The question is how to improve productivity. Productivity is the networking of inputs to achieve better output by ratio. Higher inputs must achieve greater by percentage outputs, same inputs must achieve greater output or less inputs to have a lesser percentage output reduction.

Market demand will determine which productivity route to follow. Overproduction in a subdued market will quickly force discounting to move output. Underproduction in a strong market diminishes returns on investment. Stable markets are – well boring, but the opportunity for continuous productivity improvements enables greater competitiveness/profitability.

The measurement of productivity is very often unfortunately overlooked as it is knowledge and facts that form the basis of strong decision making. Timber suppliers to the frame & truss industry rely heavily on the relativity of the volumetric measure of cubic metres (M3) as a basis for their Key Performance Indicators (KPI’s).

At Programmed Timber we measure many aspects of our business against M3 production. As an example, our salary and wage cost is measured against our M3 operational output and represented as a $/M3 figure. If we are able to keep our wages $/M3 constant even after a wage increase we know that expense is not going to affect our pressure to increase rates downstream.

The same goes for many other expenses and the grouping of manageable or variable costs to determine a production cost efficiency ($/M3). Fixed costs – those that don’t vary to the production volume, like capital serving, rent/property costs etc are also able to be measured the same way to see how the production volume variation is affecting finished goods overall ‘cost on floor’ on a $/M3 rate. Understanding the sales $/M3 allows for a simple alignment of costs to income as a straightforward KPI.

In a difficult market what are the options for productivity improvement? Unfortunately there are a couple of ‘strong market’ levers that are more difficult to pull in a ‘soft market’. The first one is capital expenditure and the other is increasing skilled labour with higher cost.

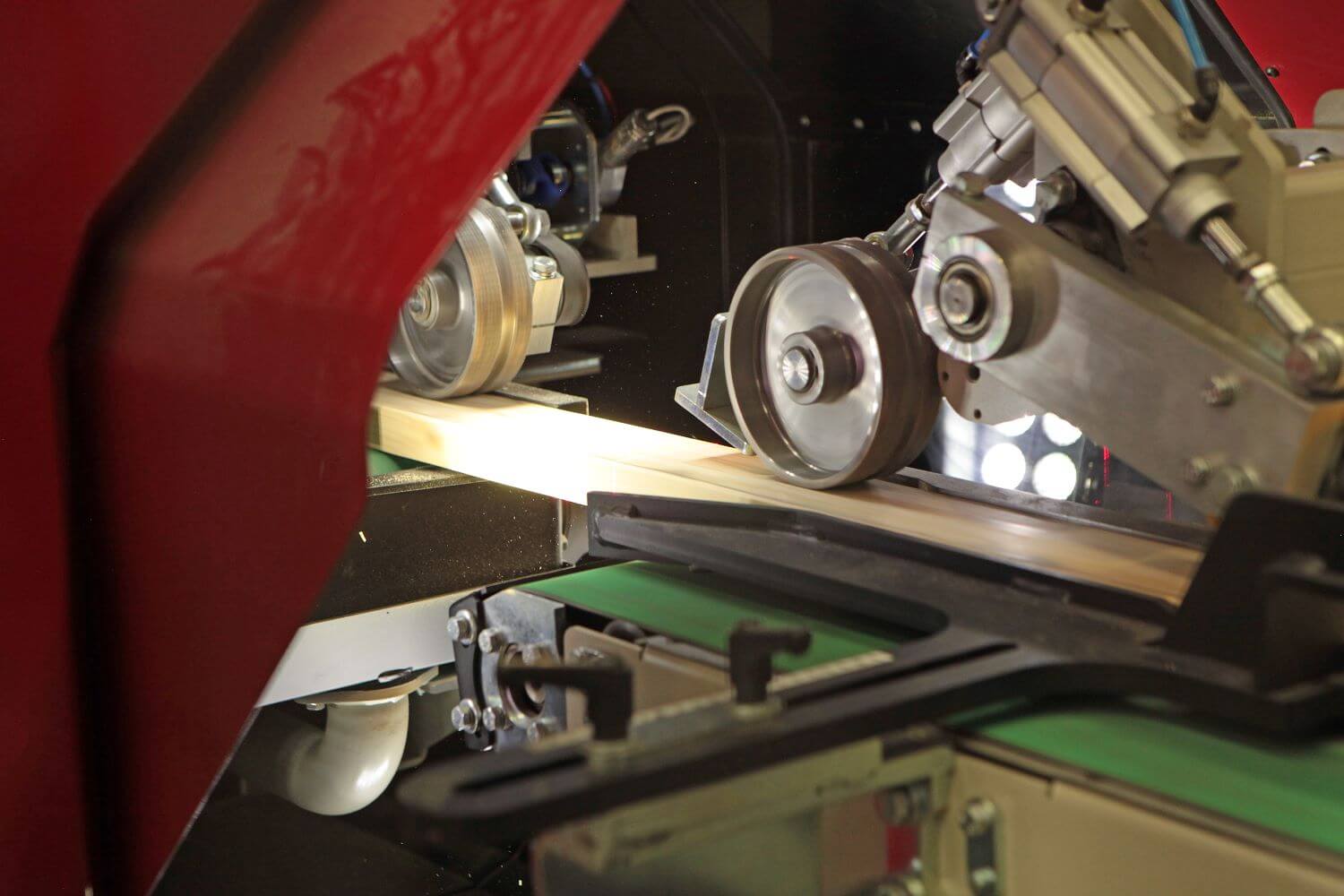

A most effective and immediate lever to reduce unit cost regardless of volume is through materials and processing intensity. The most effective way to reduce a manufacturing cost is to not manufacture it. It is an absolute truism that the further upstream manufacture occurs, the lower the unit cost. Economy of Scale and Economy of Commonality. A car producer that makes 1,000 cars per day would be dramatically more productive than 1,000 plants making one car per day. Programmed Timber can make over 300,000 Junction Blocks or 60,000 Truss Webs or 200,000 Trimmers per shift.

Productivity is best served when utilising the highest efficiency opportunities up and down the supply chain. Not making items that can be mass produced upstream allows immediate productivity gain and enables focus for the specialised individual item manufacture.

The success of Programmed Timber is through making their customers more productive.

For more email: contact@ptimbers.com.au

Our Principal Partners