Written and provided by Alares.

Insolvencies in May hit another all-time monthly high as the ATO continues to turn the screws on businesses and directors who fail to lodge and pay.

In terms of the insolvency catch-up, overall numbers suggest a remaining 2,150 additional insolvencies above typical levels still to come through the second half of 2025. The questions . At the current monthly run rate, the insolvency catch up will continue to play out through the remainder of 2025.

Key highlights in May

- Insolvencies were again at all-time monthly highs.

- The ATO significantly ramped up their Court recoveries against both companies and directors.

- Winding up and bankruptcy petitions continue to rise.

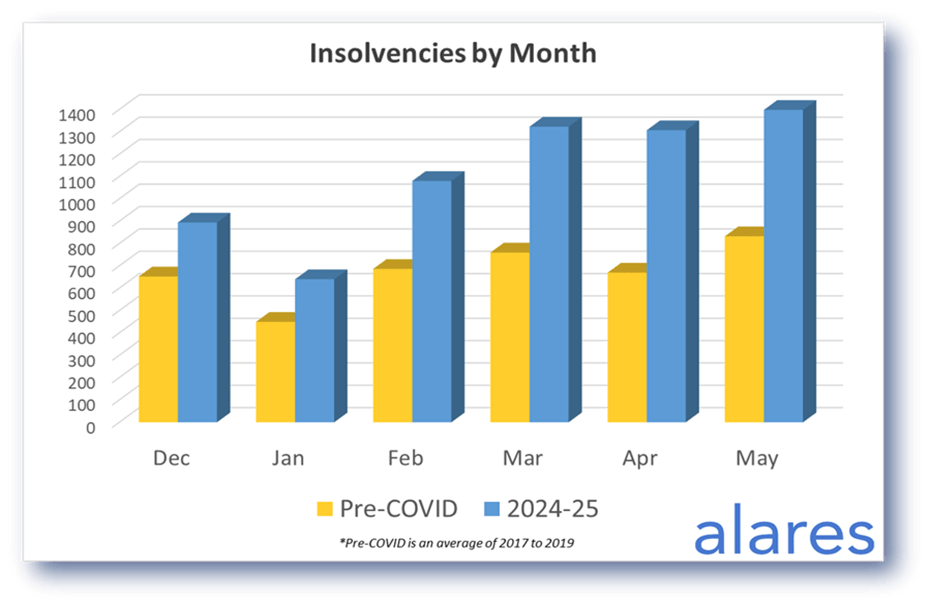

Insolvencies in May hit another all-time monthly high

Monthly insolvencies were 70% above pre-pandemic levels for May, which has historically been the highest month of the year for insolvencies.

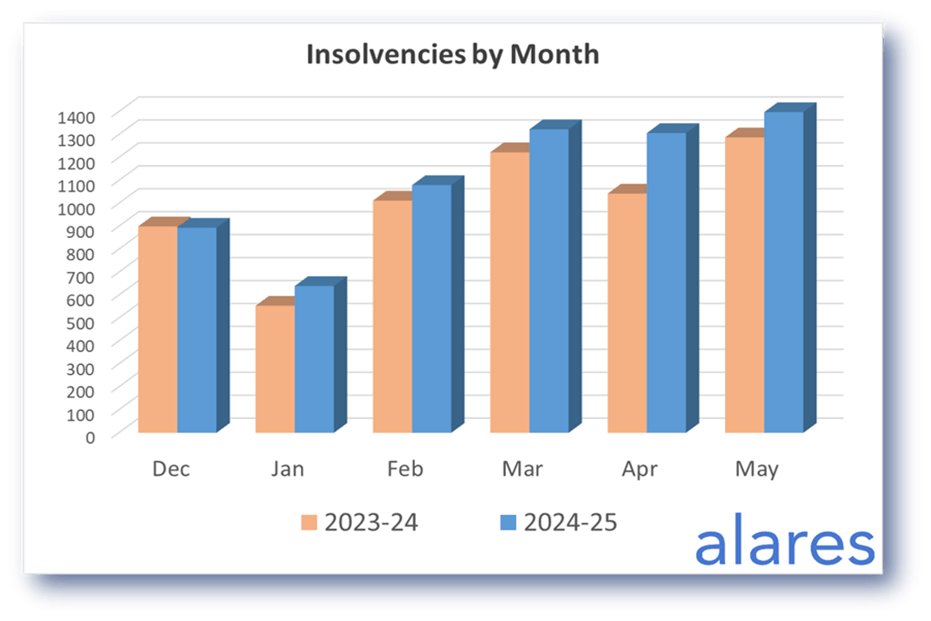

2025 numbers continue to track above the previous highs in 2024

Monthly insolvencies numbers in 2025 continue to track above 2024 numbers, which themselves were previous all-time highs

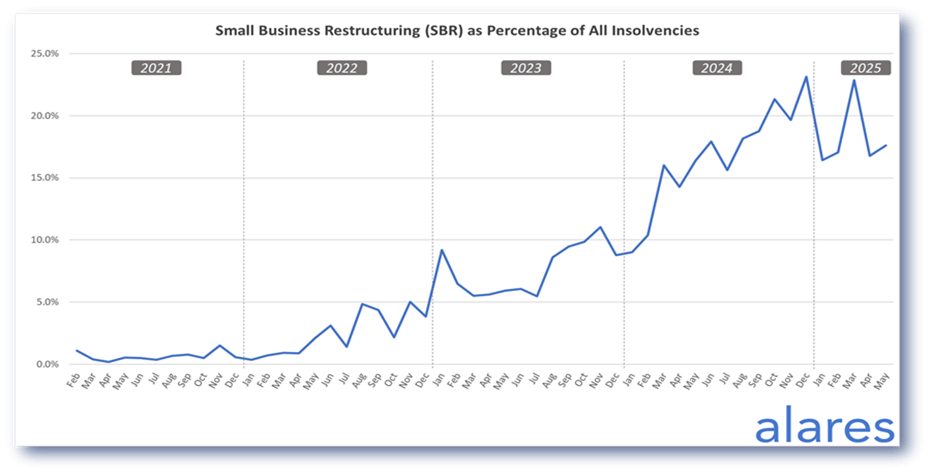

Small business restructuring (SBR) appointments have remained steady

Overall SBR numbers were up slightly from April, but still short of the Match peak.

SBRs appear to have peaked as a percentage of new insolvencies

SBRs as a percentage of all insolvencies increased steadily from the start of 2022 to the end of 2024. However, this trend now appears to have plateaued in 2025, other than the spike in March.

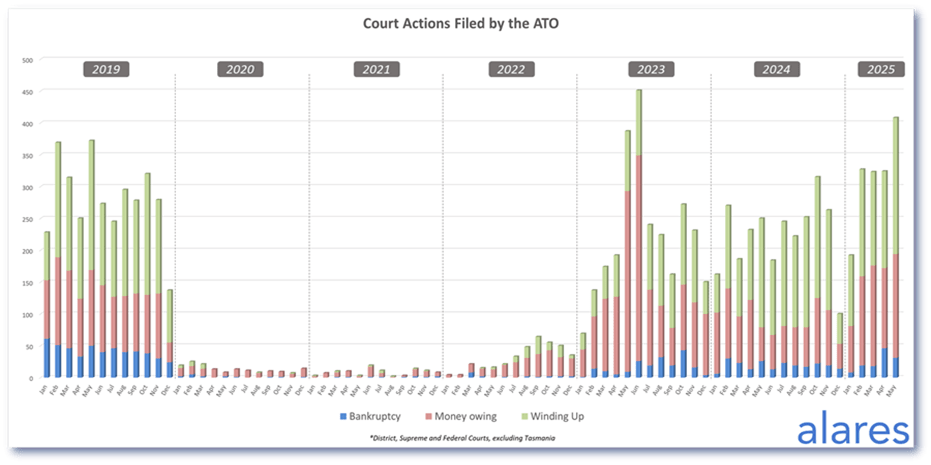

The ATO showed another significant increase in Court recoveries in May

Winding up petitions against companies (green bar below) and money owing claims, predominantly against company directors (red bar below) both increased significantly in May.

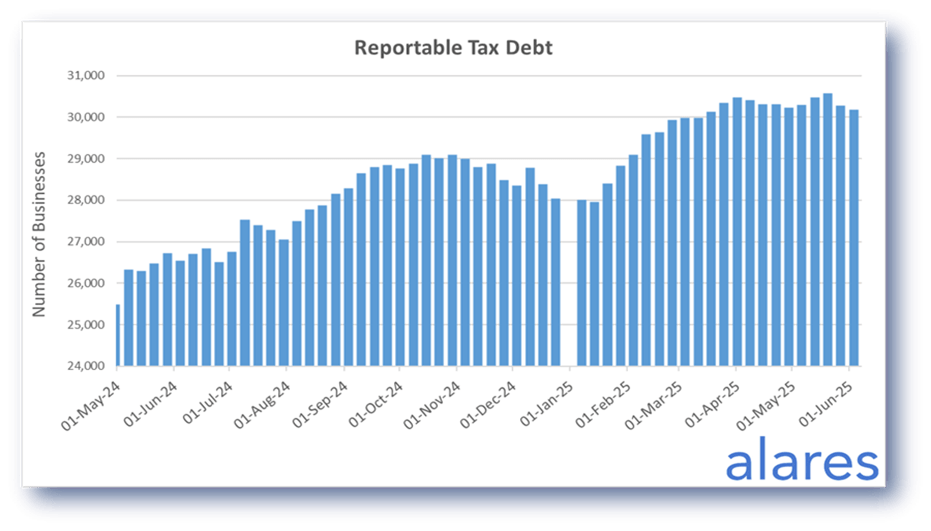

Similarly, the ATO’s disclosure of business tax debts continues at pace

More than 30,000 businesses (companies, trusts, partnerships, sole traders) remain subject to tax debt reporting (more than $100k outstanding for more than 90days without adequate engagement with the ATO).

Companies subject to ATO reporting continue to have a very high failure rate (greater than 30%) which remains the key driver of high insolvency numbers.

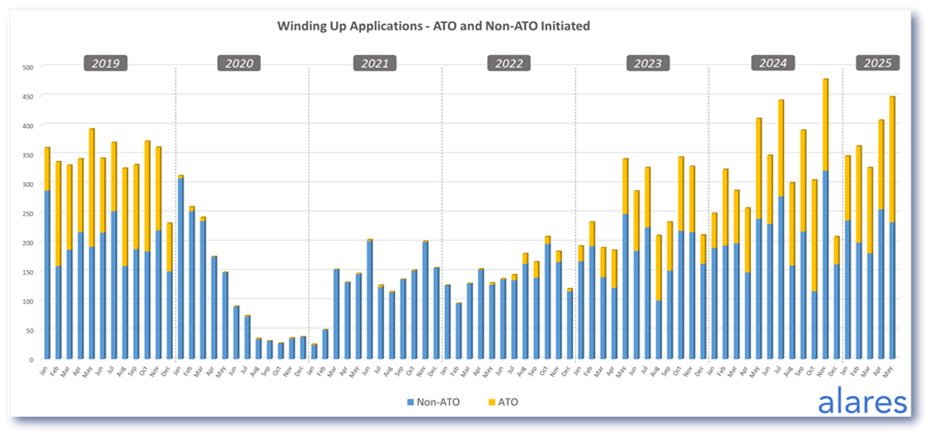

Winding up applications also continue to rise, a further indication that more insolvencies may be on the horizon

Winding up applications in May showed another year-on-year increase and remain above historical levels.

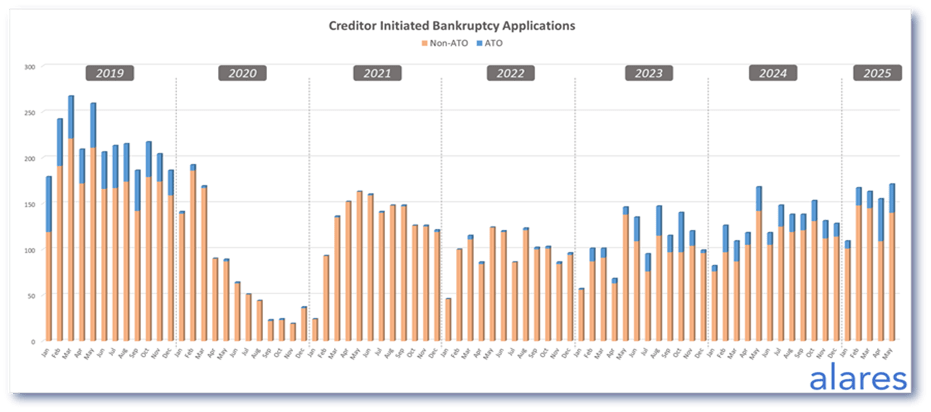

Similarly, creditor-initiated bankruptcy applications continue to creep upwards

Current numbers remain near multi-year highs, showing that individuals are also increasingly feeling the pressure, along with businesses.

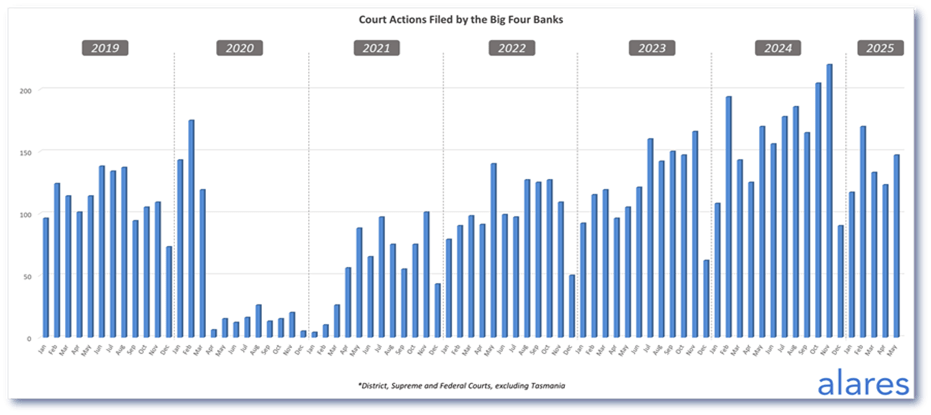

Meanwhile, Court recoveries from the big four banks continue to slow down

Overall numbers remain historically high, however year-on-year numbers have now dropped for the past four months, providing some positive news.

Alares provides critical due diligence data that is NOT captured by other providers.

For better insights into financial and reputational risks impacting your customers and suppliers, please get in touch

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Follow FTMA Australia for Industry News and Updates

Our Principal Partners