This piece was written and provided by Alares.

Most of the key business risk factors remain high as the ATO and major lenders remain vigilant in their recoveries.

Key highlights in August

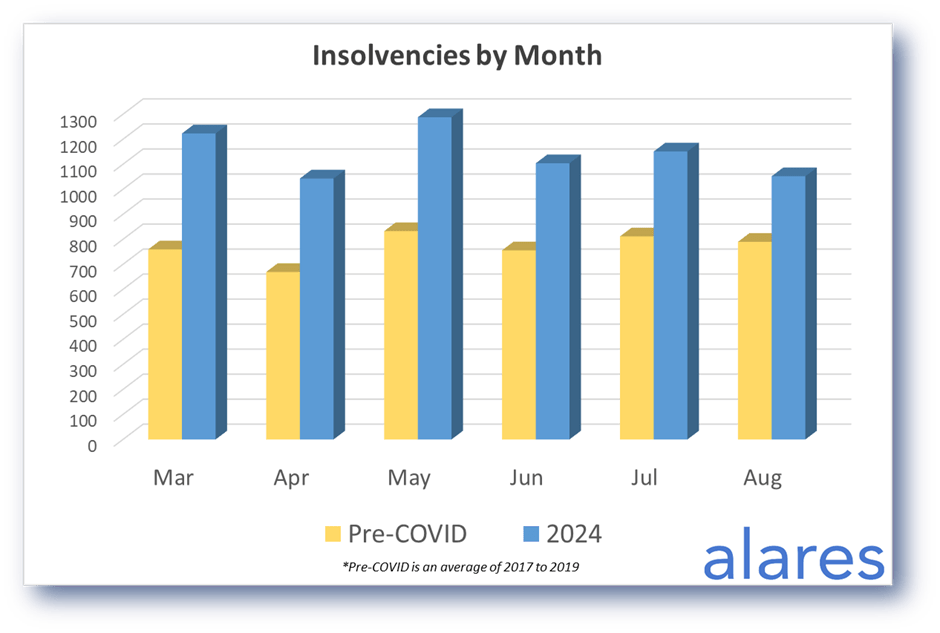

• Insolvencies are still well above historical levels.

• Court recoveries from the big four banks continue to rise.

• Small business restructuring increasingly becoming the go-to for small businesses facing headwinds.

Insolvencies are still well above historical levels

Insolvencies in August were ~33% above historical levels. This is a slight drop from recent months that saw numbers more than 50% above historical.

Is this is sign that the insolvency “catch up” is starting to slow down, or will the catch up continue in the months ahead? Stay tuned to see how this trend plays out for the remainder of 2024.

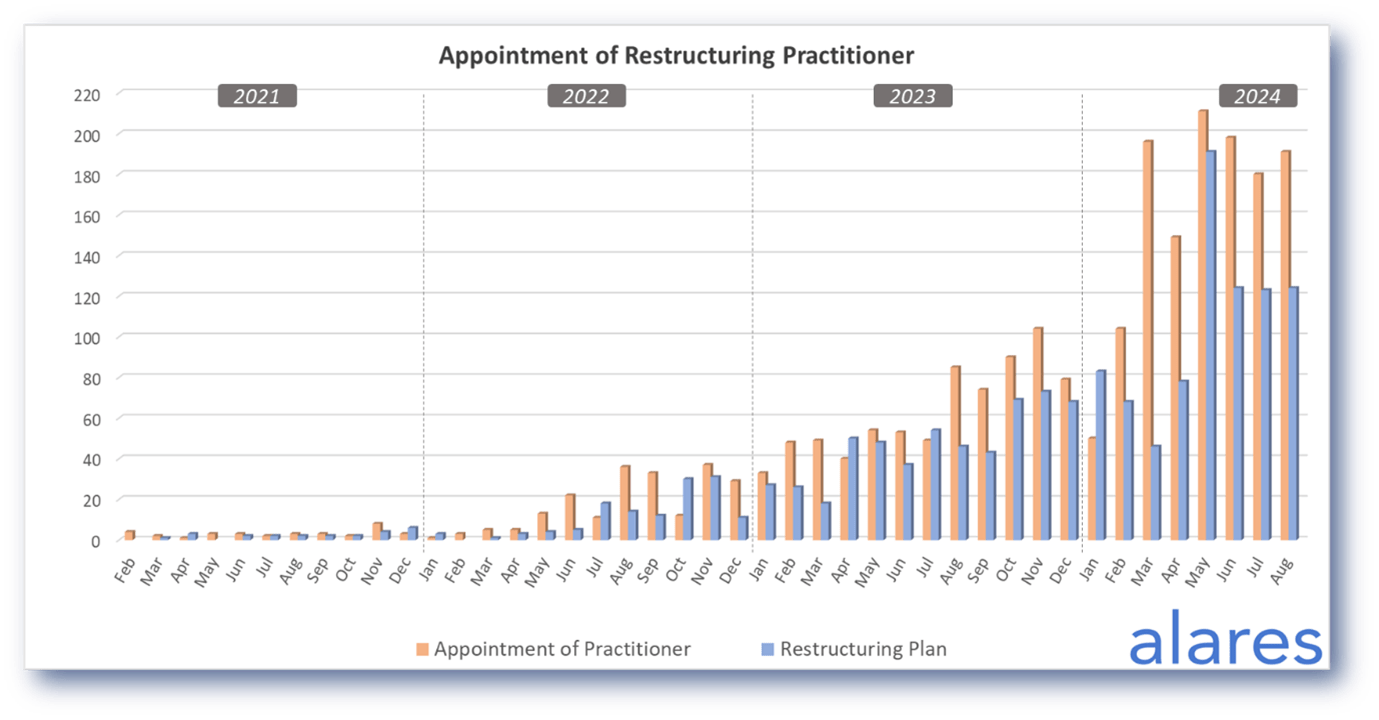

Small business restructuring appointments remain high, amid ongoing pressure from the ATO

SBR’s are now well established as a key option for small businesses grappling with tax obligations and other outstanding debts.

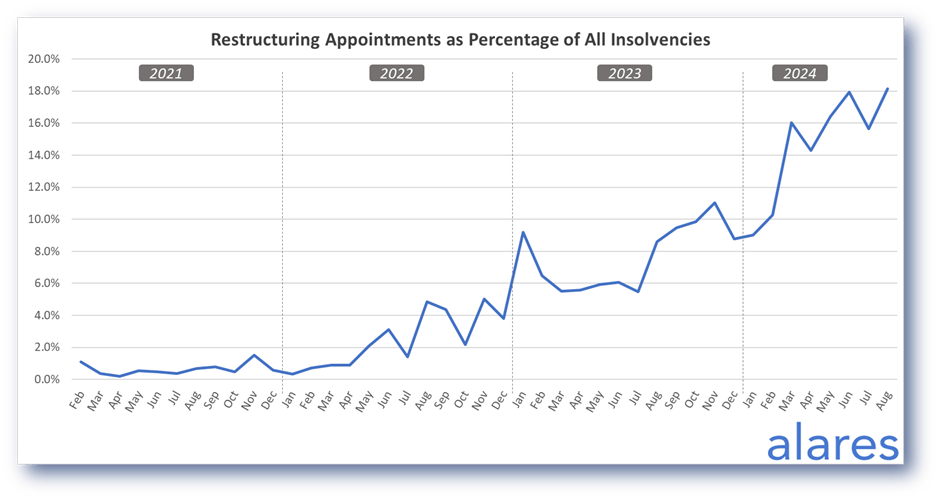

Small business restructuring accounts for an increasing percentage of all insolvency appointments

SBRs are trending towards 20% of all insolvency appointments, representing a significant increase from prior years.

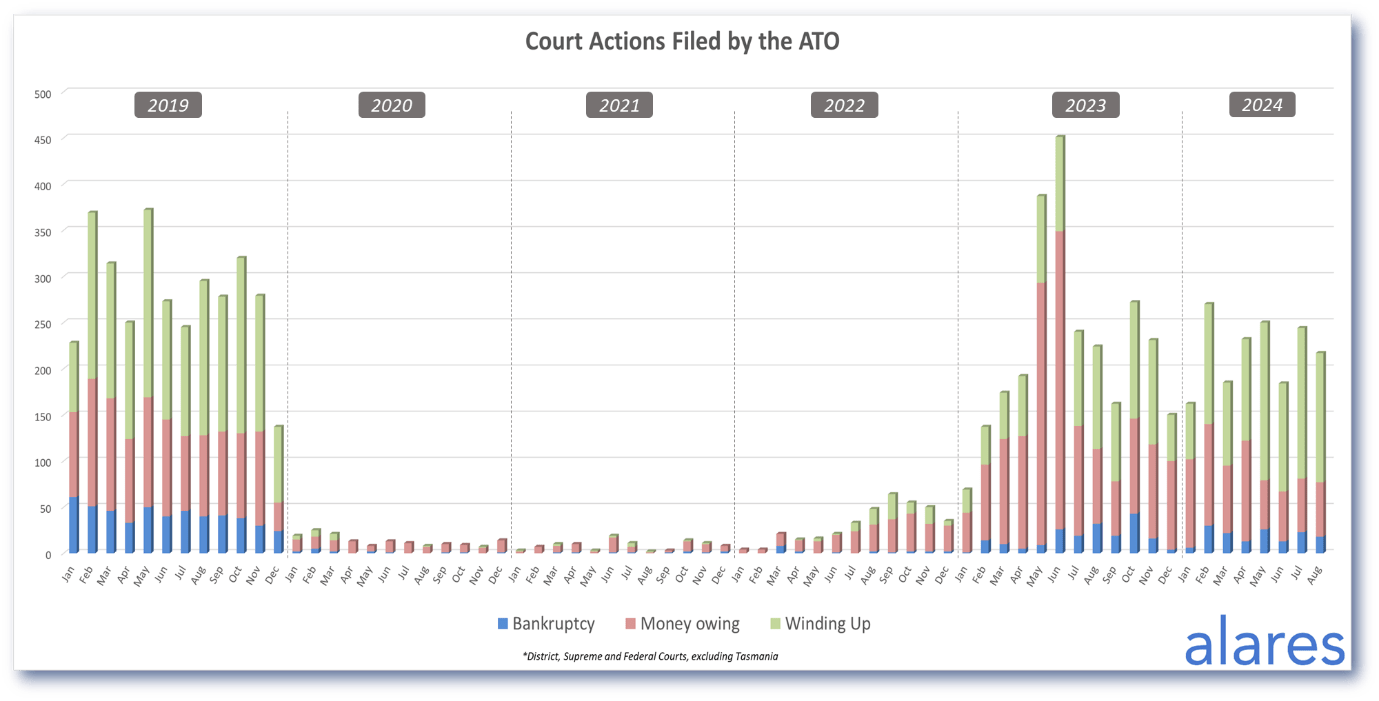

As before, the ATO remains the dominant driver of the insolvency catch up

The ATO continues to use all avenues at its disposal to recover outstanding tax obligations, including director’s penalty notices, overdue tax debt reporting, and direct Court recoveries.

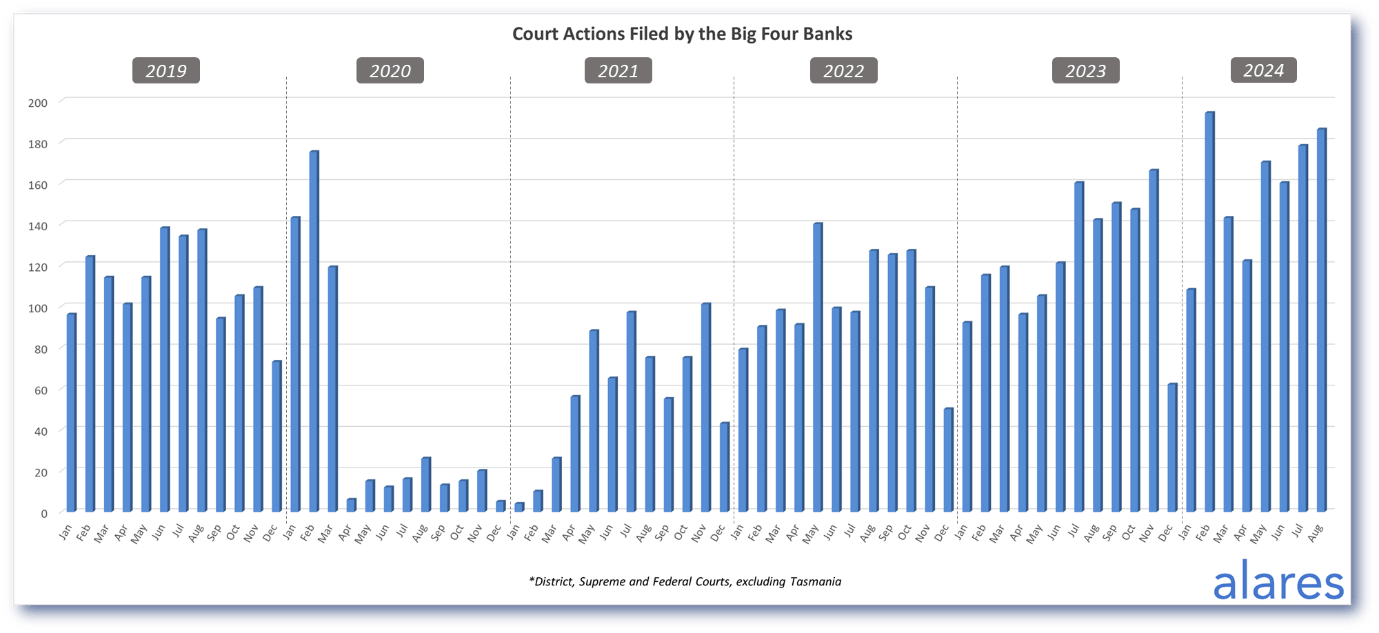

The big four banks continue to ramp up their Court recoveries

So far we are seeing no respite from the major lenders as their Court actions continue to rise well above historical levels.

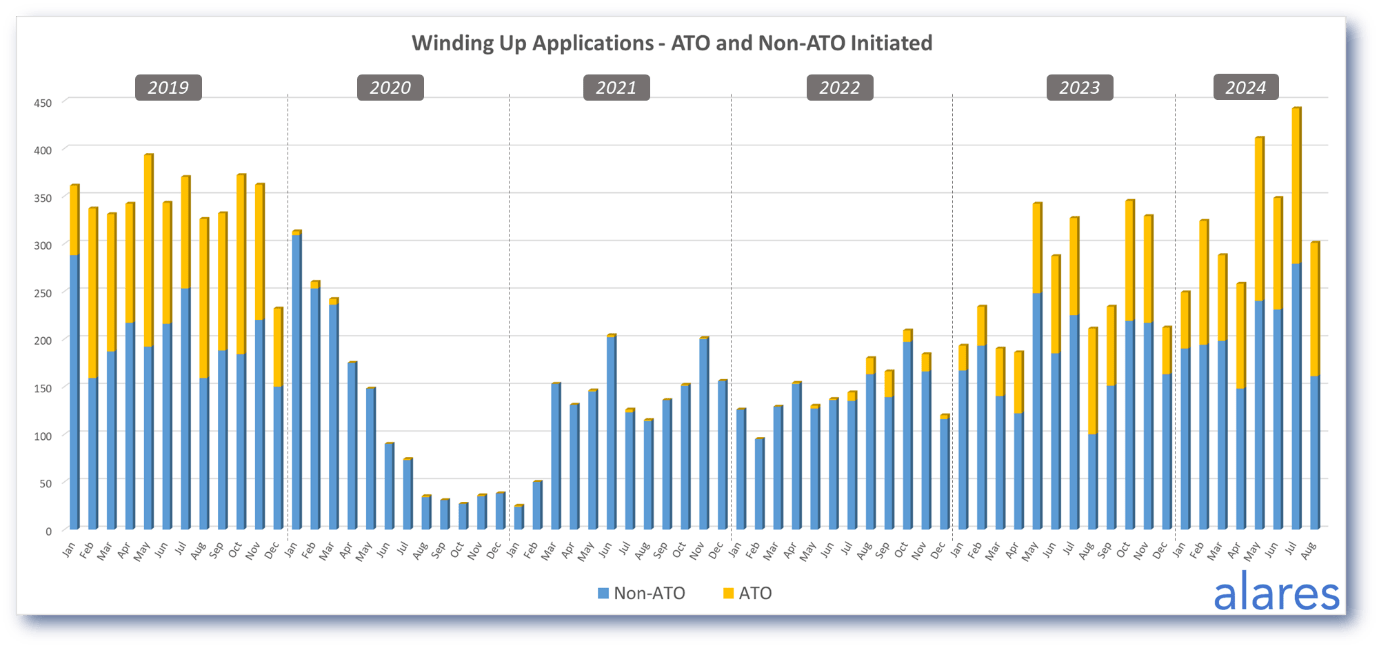

Winding up applications dropped from their peak in July, but remain in-line with historical levels

Overall numbers have varied significantly in past months – will we see another increase in September? Stay tuned to find out.

Alares provides critical credit risk data that is NOT captured by other providers

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners