This piece was written and provided by Alares.

The new financial year has started with a spike in winding up applications as both the ATO and major lenders clamp down on their recoveries.

Key highlights in July

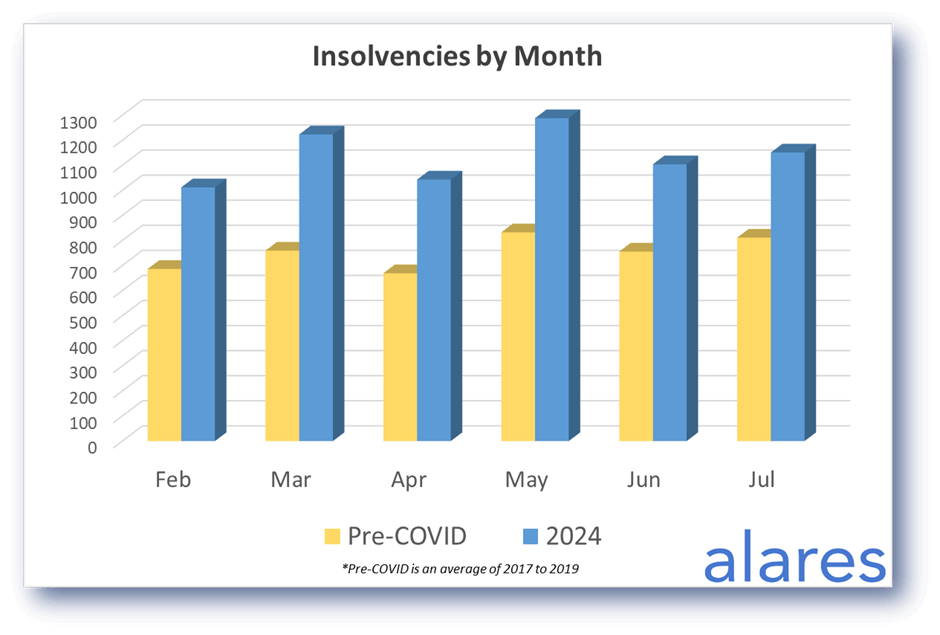

- Insolvencies still tracking well above historical levels.

- Court recoveries from the big four banks continue to rise.

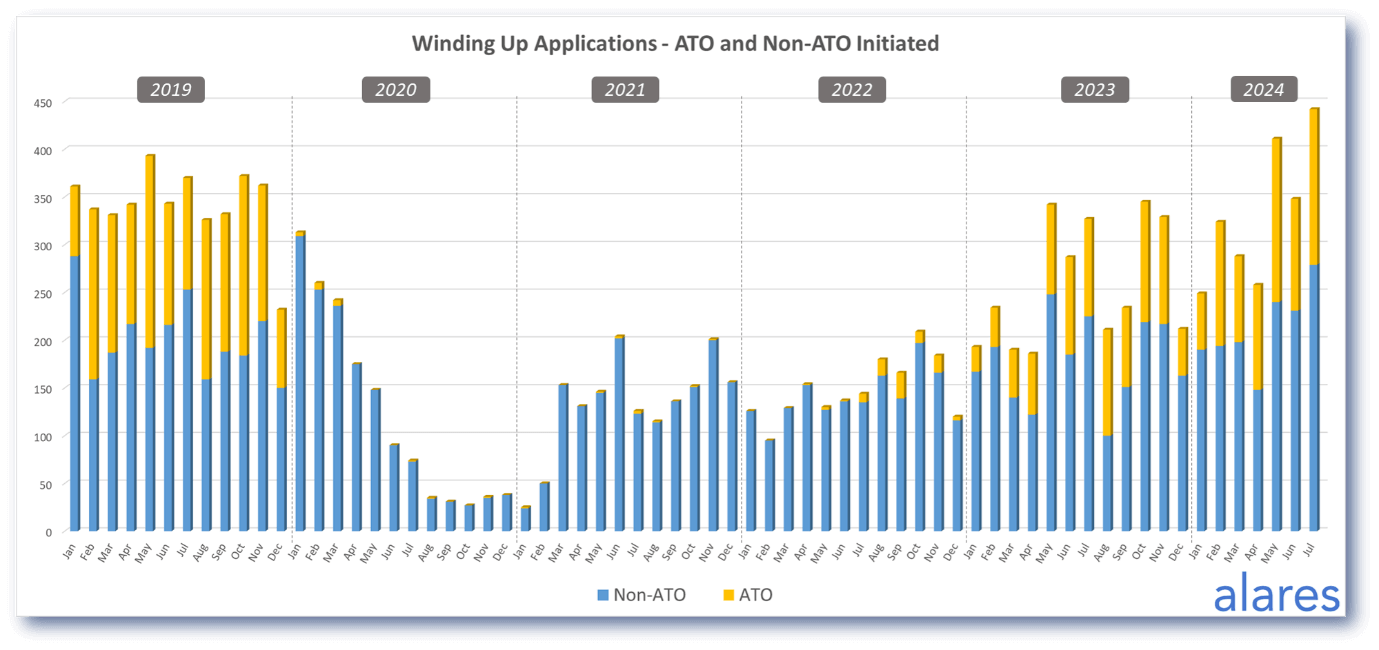

- Winding up applications now exceed pre-pandemic levels.

Insolvencies remain well above historical levels

The insolvency “catch up” continues as total numbers remain 40-50% higher than historical levels. Will this become the new normal, or will numbers start to revert back to pre-pandemic levels? Stay tuned to find out.

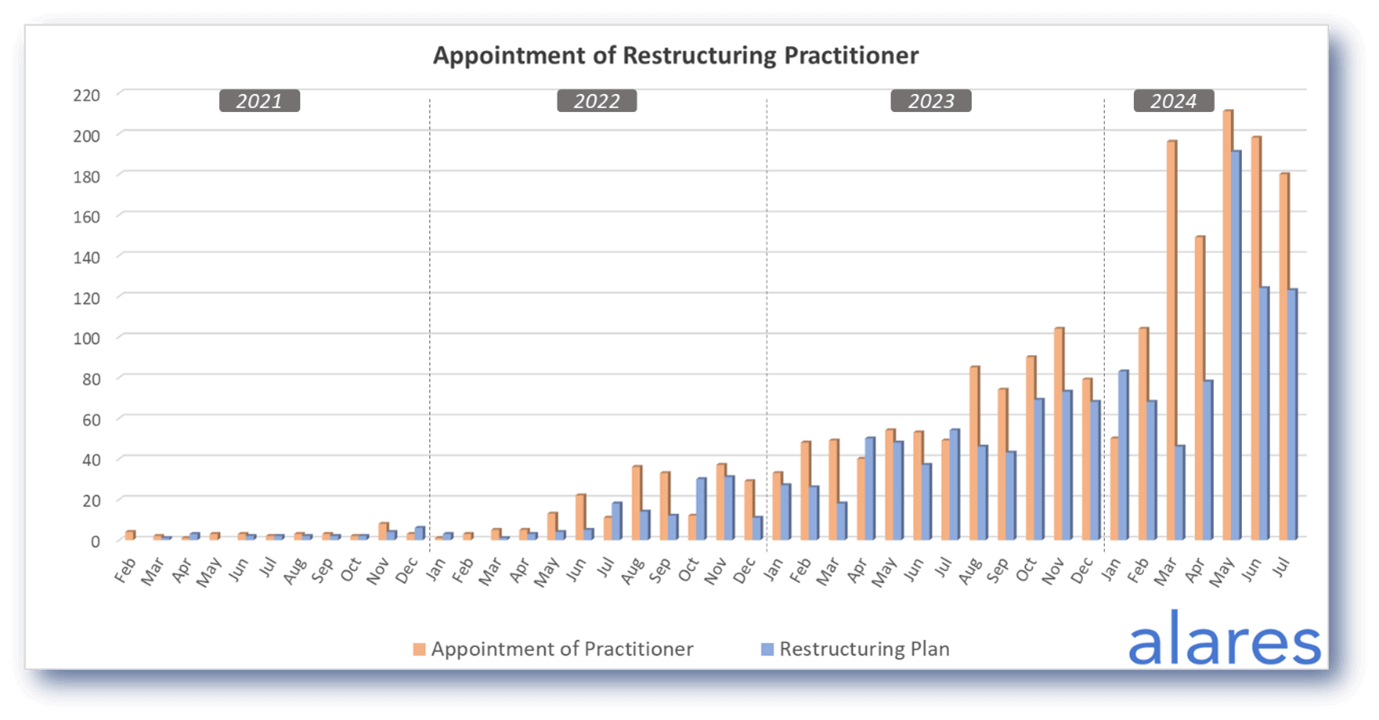

Small business restructuring appointments remain high, and continue to be driven by pressure from the ATO

SBR’s currently account for just under 20% of all insolvency appointments.

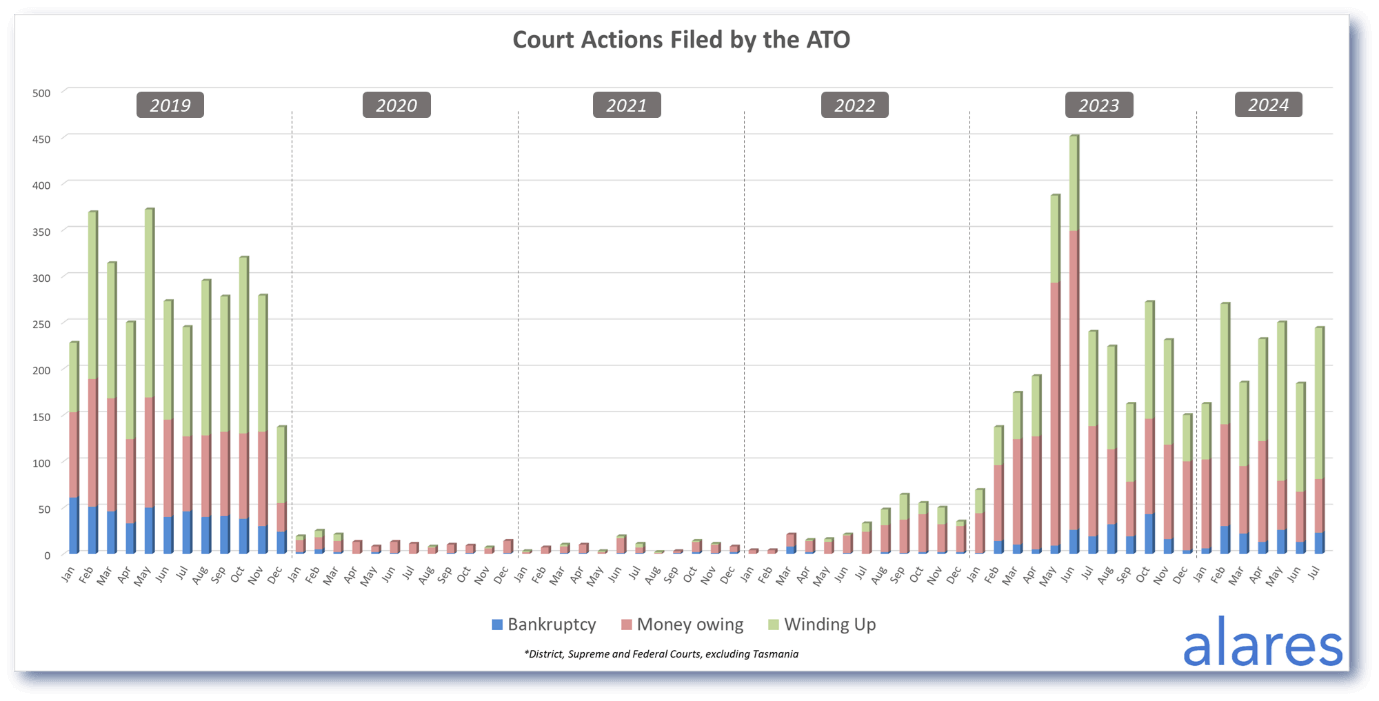

The ATO remains the dominant driver as the collection and enforcement of tax debt continues

The ATO is well and truly back to pre-pandemic “business as usual” in terms of collection and enforcement, both for legacy debts and new lodgements.

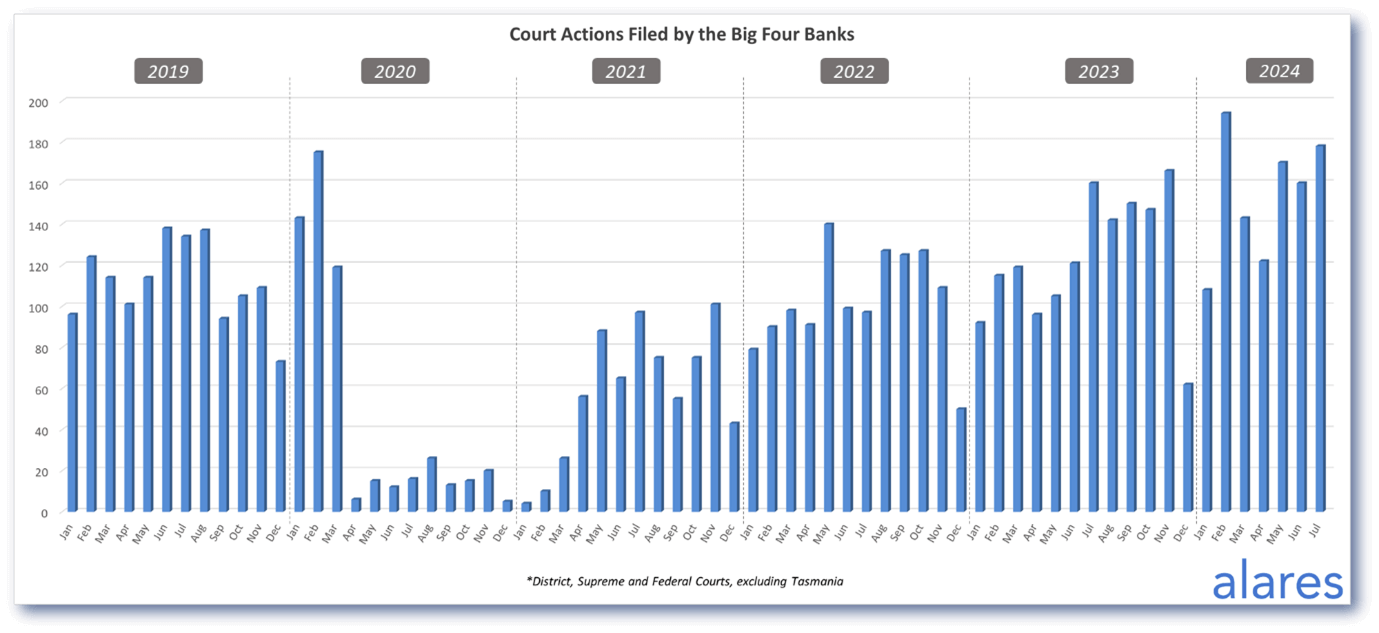

Court recoveries from the big four banks continue to increase

Recoveries from the major lenders have been above historical levels throughout 2024 and currently show no signs of slowly down.

Winding up applications peaked in July, rising above historical levels

July saw the highest number of winding ups in many years. How will this impact insolvencies in the coming months?

Alares provides critical credit risk data that is NOT captured by other providers

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners