This piece was written and provided by Alares.

As we start the new financial year, we take stock of the current insolvency and credit risk landscape, and see what may unfold for the second half of 2024.

Key highlights in June

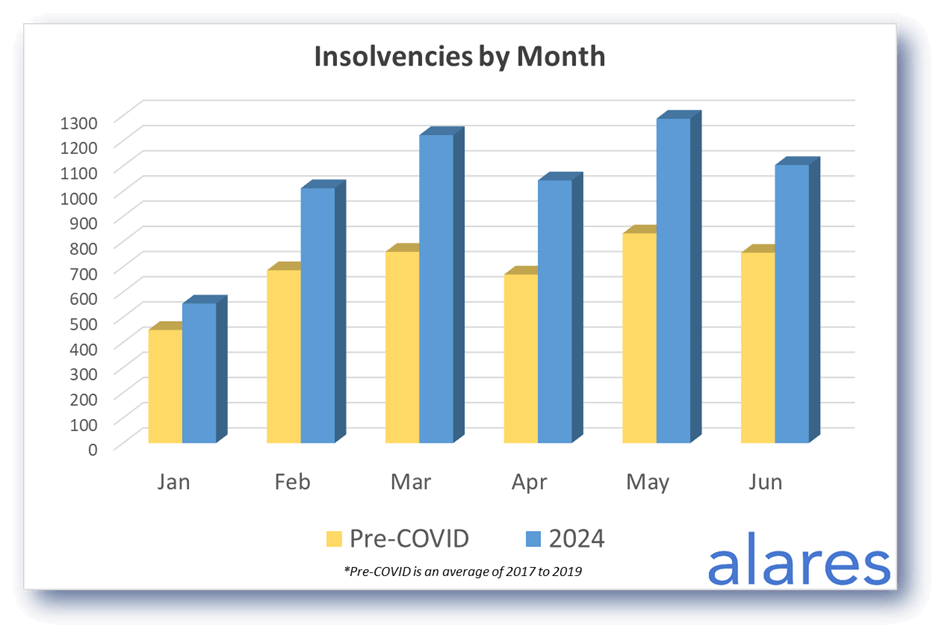

- Insolvencies still tracking ~50% above historical levels.

- The ATO remains the dominant player with Small Business Restructuring continuing to account for a significant percentage of all appointments.

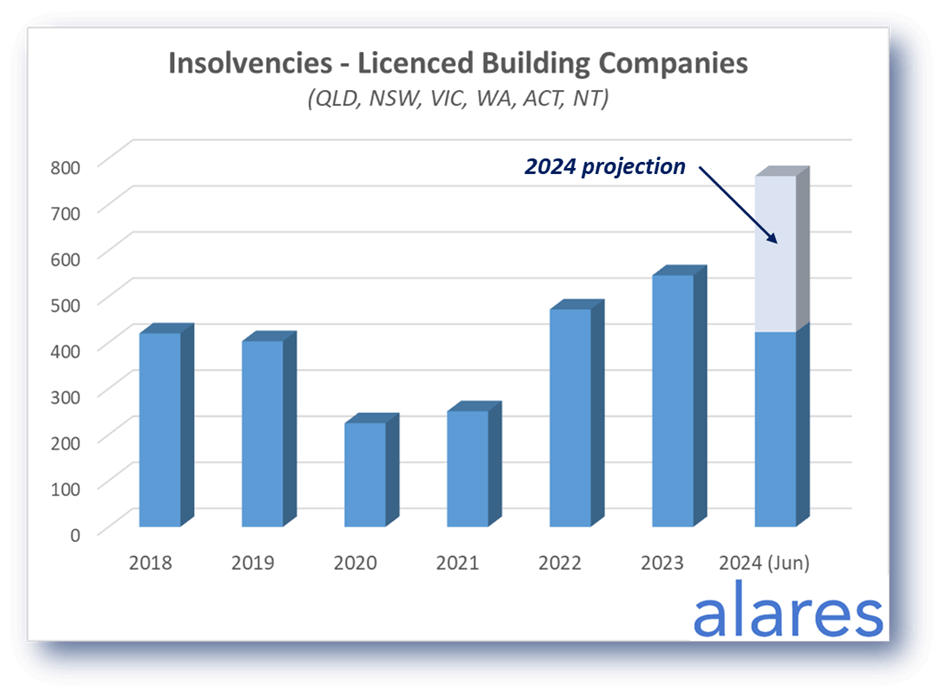

- The building and construction industry continues to face significant insolvency challenges.

Insolvencies remain ~50% above historical levels

This continues the trend so far throughout 2024.

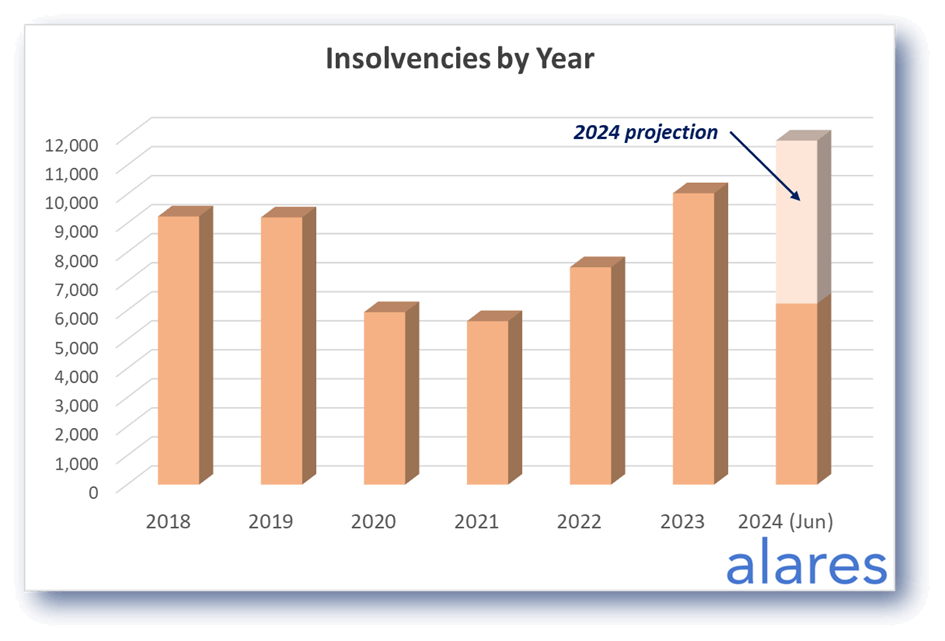

On a yearly level, insolvencies in 2024 are projected to reach an all-time high

There is clearly a “catch up” taking place from the COVID years in 2020 to 2022. During these years combined we saw about 8,000 fewer insolvencies than the historical run-rate.

This suggests the current increase in insolvencies will continue through the remainder of 2024, and potentially into next year. The key question remains what will happen once the “catch up” is complete?

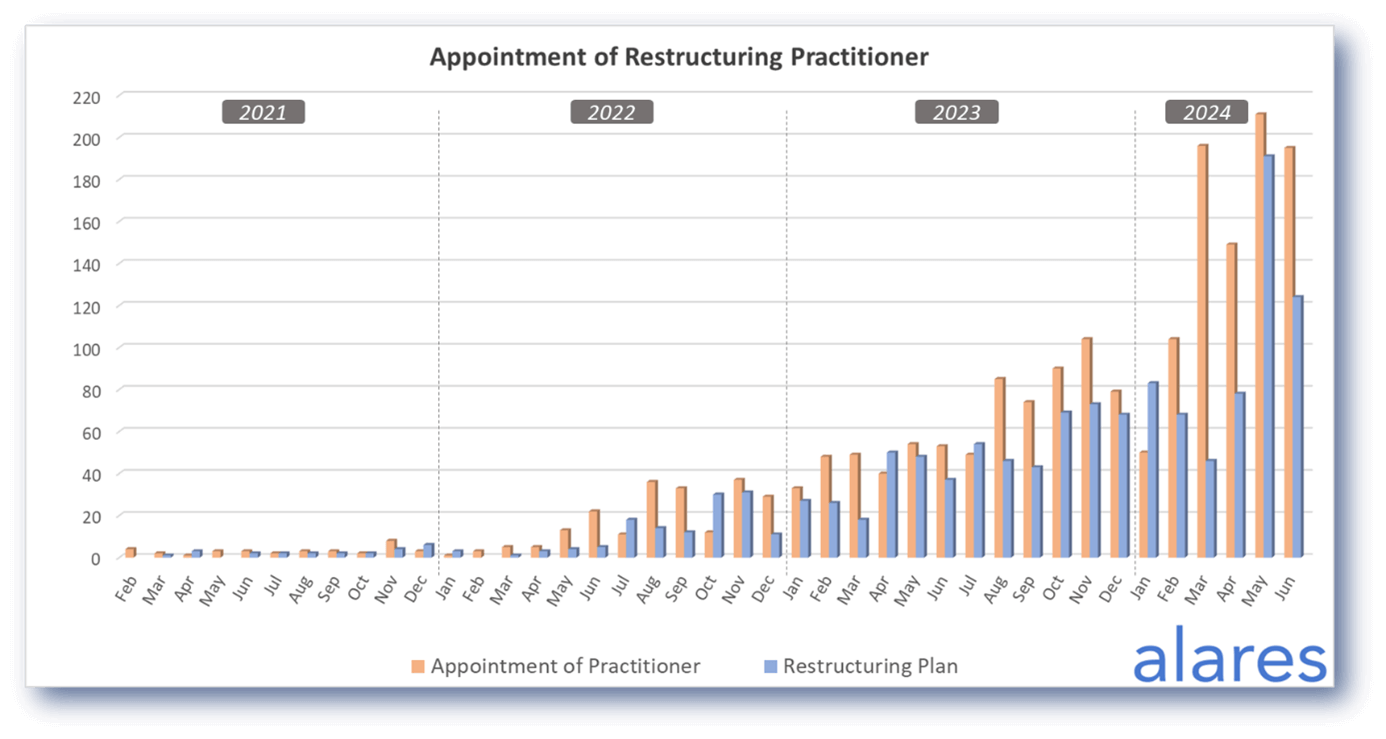

Small business restructuring appointments continue to increase, amid pressure from the ATO

SBR appointments in June accounted for nearly 20% of all insolvency appointments, and remain a key avenue for small businesses to deal with legacy debts and remain operational.

The building and construction industry has been particularly hard hit in 2024

Insolvencies among licenced building companies so far in 2024 (as at end June) are already on par with full-year totals in 2018 and 2019. The full-year projection for 2024 is expected to well exceed historical highs.

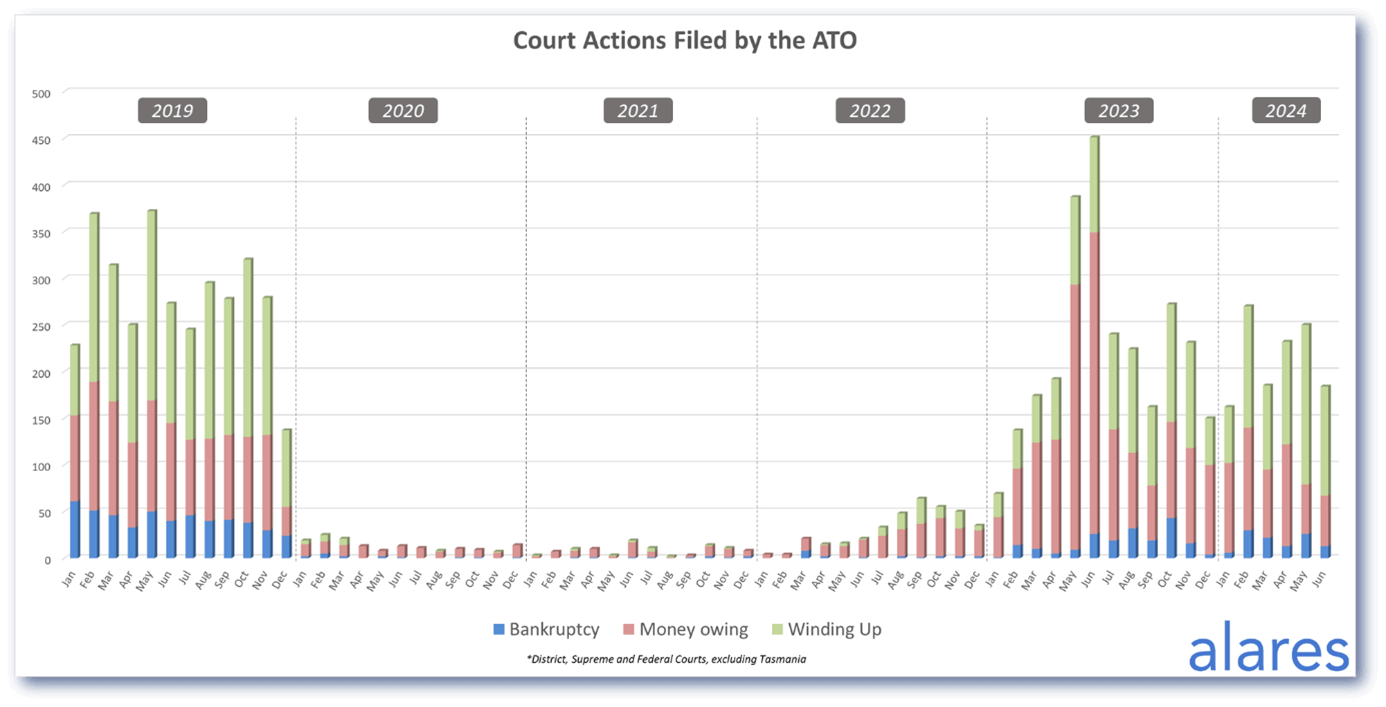

The ATO remains the dominant driver through the ongoing collection of legacy tax debts

In addition to direct Court recovery action (winding ups, bankruptcy petitions and money owing claims), the ATO continues to issue directors penalty notices and warning letters in record numbers.

Furthermore, the number of businesses currently listed with reportable tax debts sits at more than 27,000 (more than $100,000 in tax overdue by more than 90 days without meaningful engagement with the ATO).

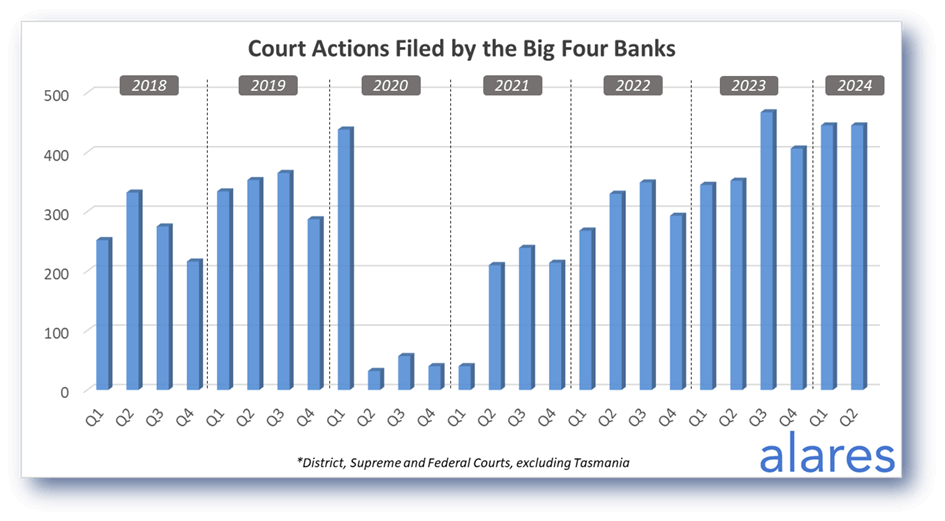

Court recoveries from the big four banks continue to track well above historical levels

Higher interest rates are continuing to bite as more businesses and individuals struggle to meet their repayment obligations.

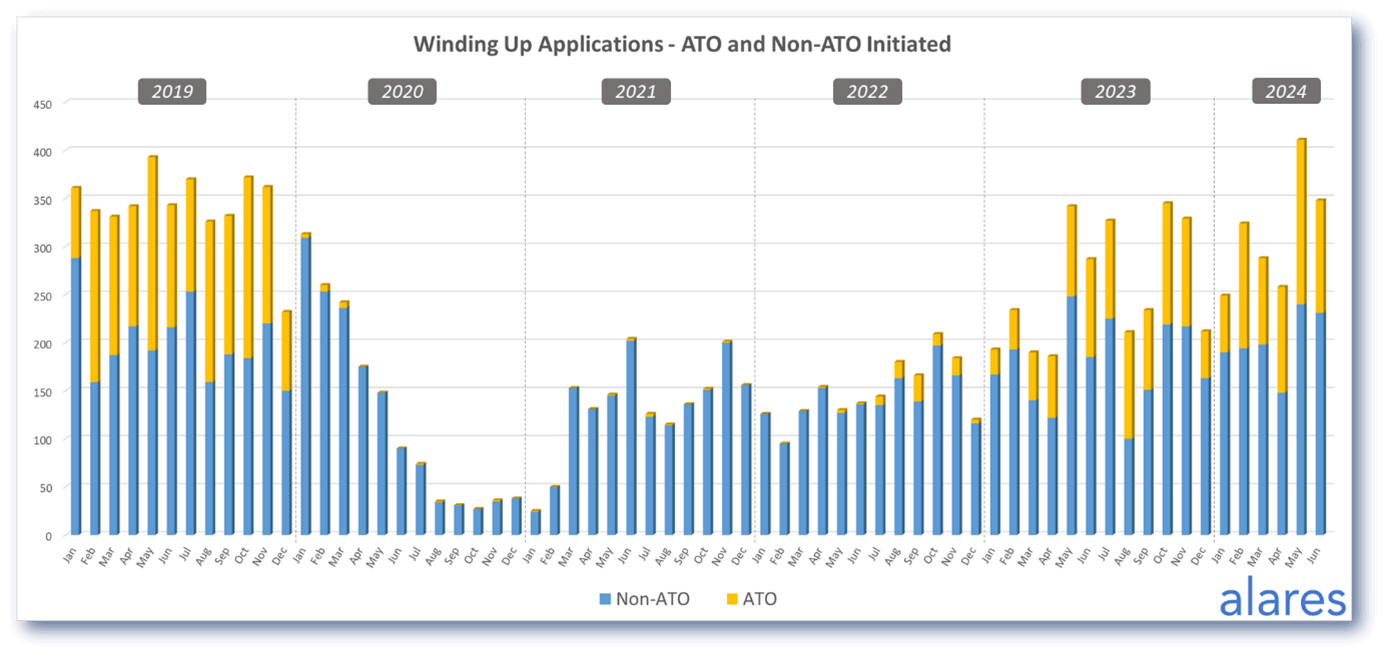

Winding up applications remain high, in line with historical levels

Credit providers across the board are remaining diligent with recoveries.

Alares provides critical credit risk data that is NOT captured by other providers

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners