This piece was written and provided by Alares.

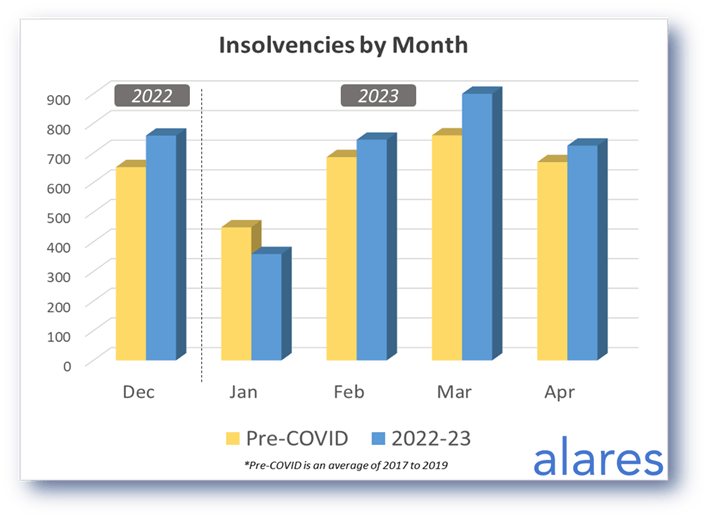

Insolvencies in April continued to track above pre-COVID levels as the ATO continues to ramp up its Court recoveries.

Key highlights in April:

- Insolvencies remain above pre-COVID levels.

- The ATO continues to increase its Court activity.

- The major lenders had a relatively slow month in April ahead of their typical busy season in May and June.

Insolvencies remained above pre-COVID levels

April is typically a slow month, however insolvencies continue to track above historical levels.

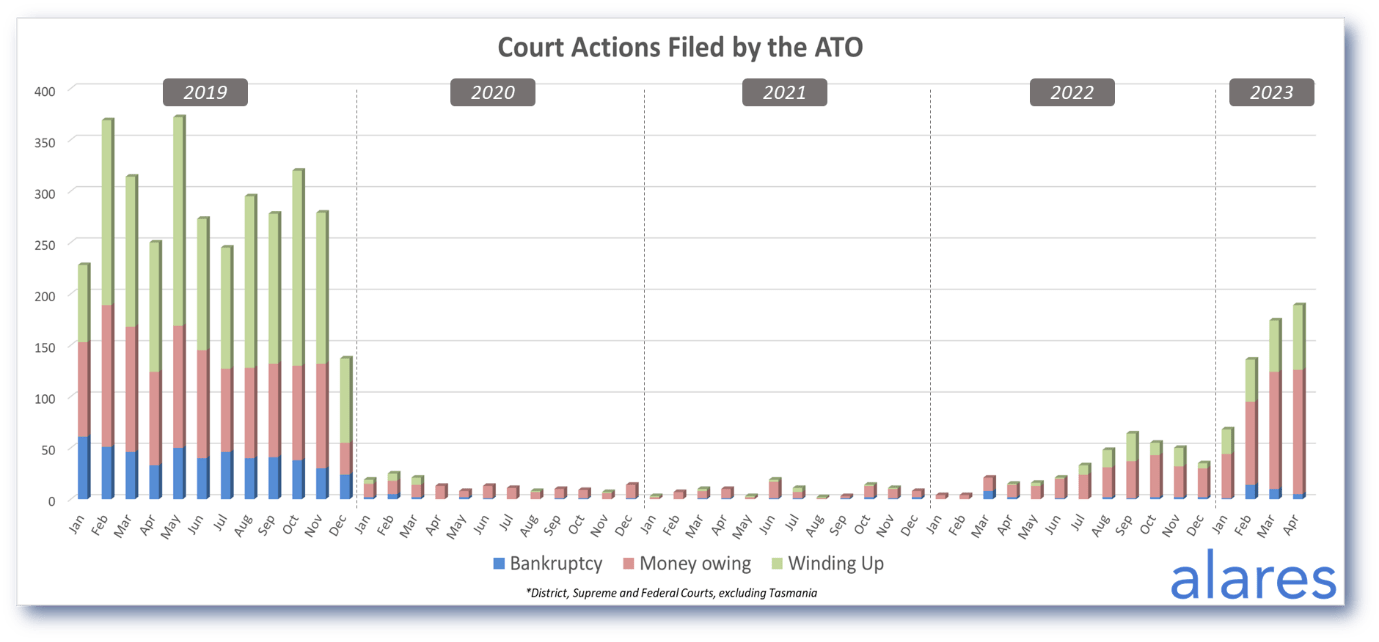

The ATO continues to ramp up its Court recoveries, maintaining its upward trajectory

The total number of ATO initiated Court actions continues to increase towards historical levels. Will this continue for the remainder of the financial year?

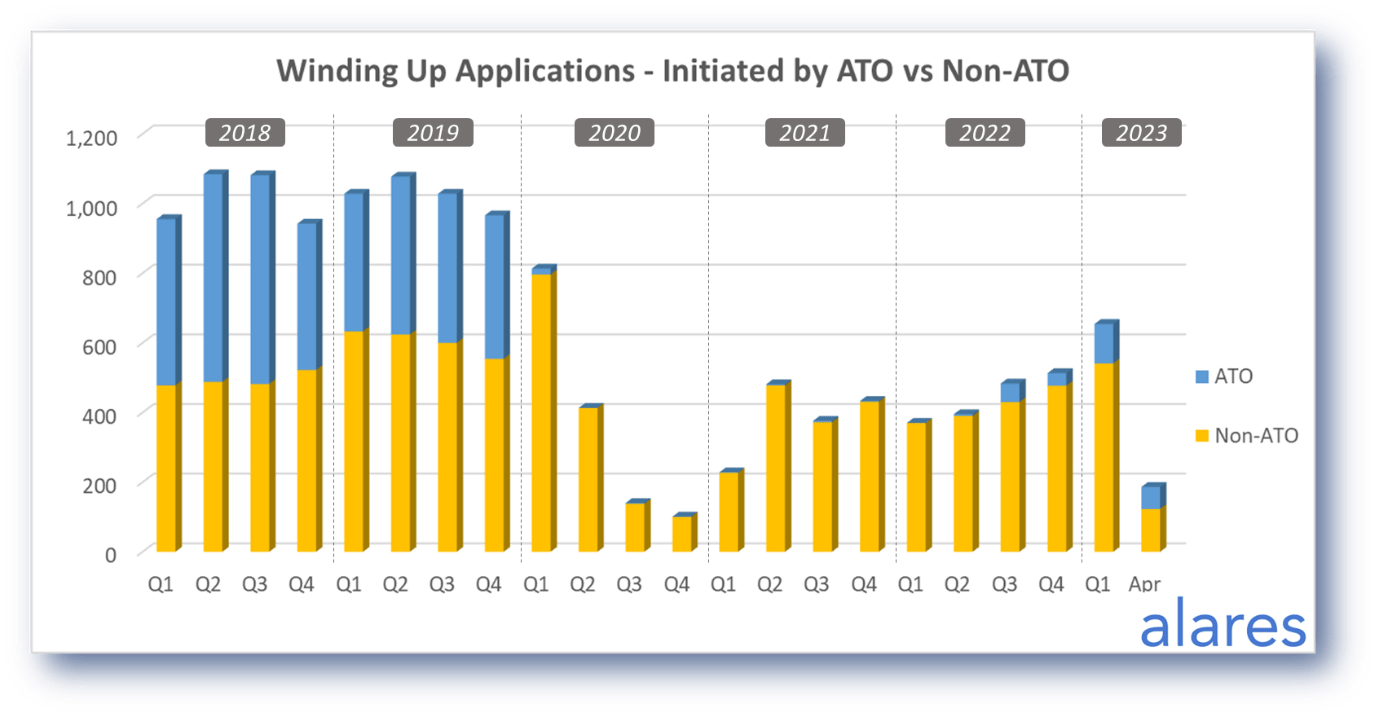

Winding up applications in April were relatively low

This is not unusual as May and June have historically dominated the Q2 numbers.

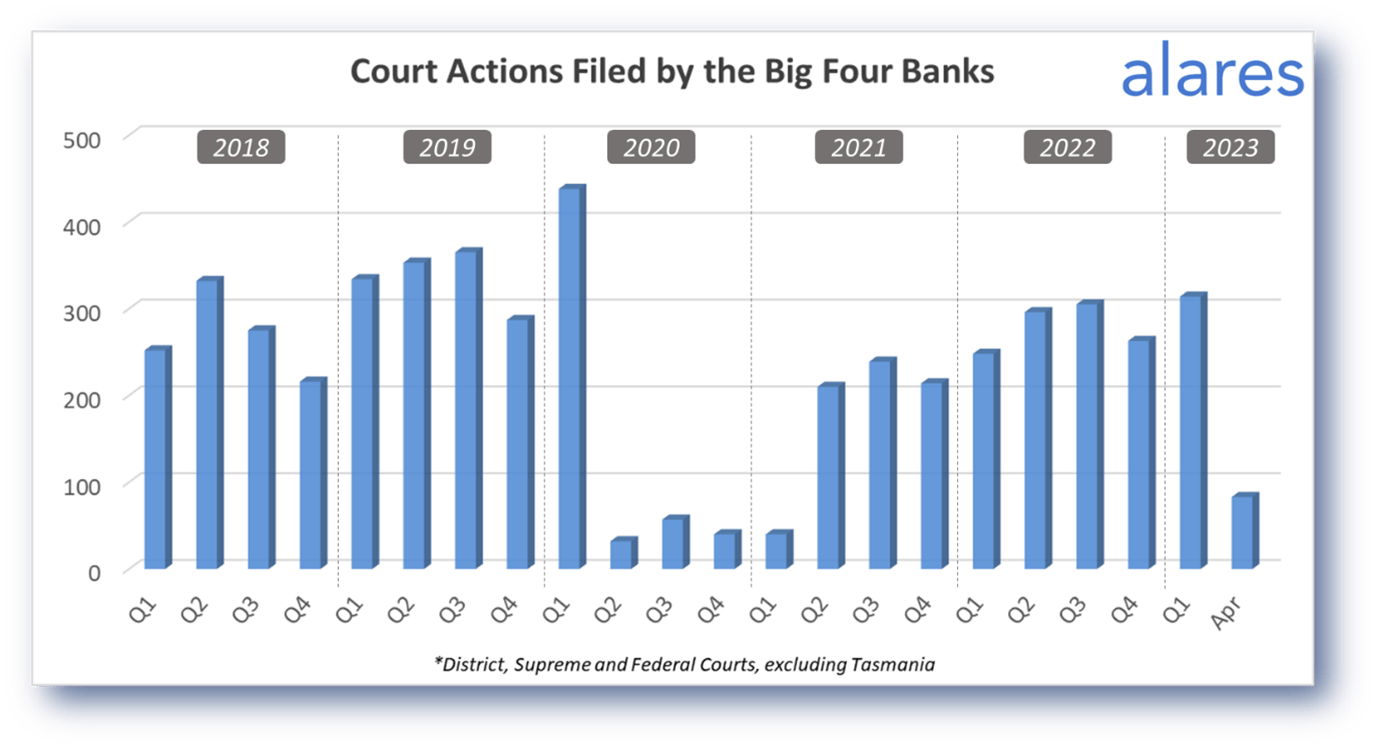

The big four banks also had a relatively quiet month in April

Court recoveries from the big banks have historically peaked in the middle of the year – all eyes will be on the May and June numbers to see if this trend continues.

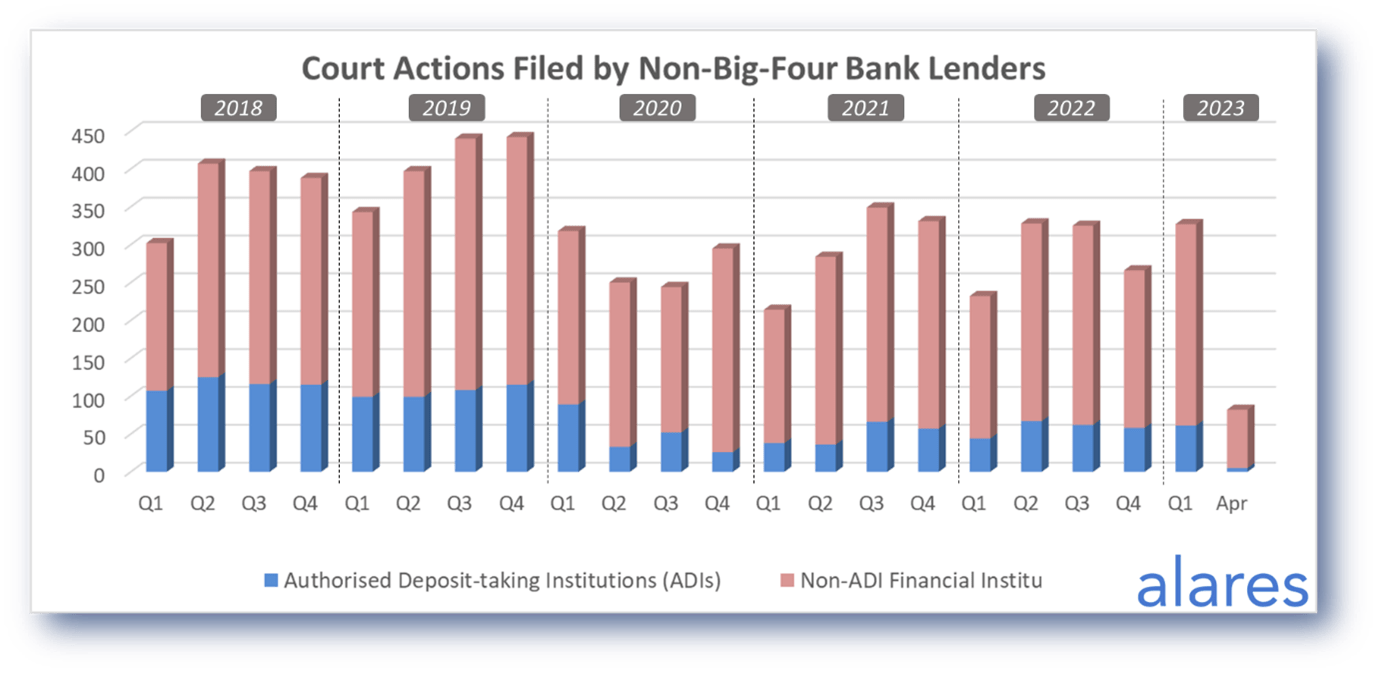

Similarly, the non big-four money lenders took a momentary breather in April

This is again in-line with the trend from prior years.

Alares provides key credit risk insights that are NOT captured in credit reports

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners