This piece was written and provided by Alares.

As we enter the second quarter of the calendar year, insolvencies remain well above pre-COVID levels as the ATO continues to ramp up its recovery activities.

Key highlights in March:

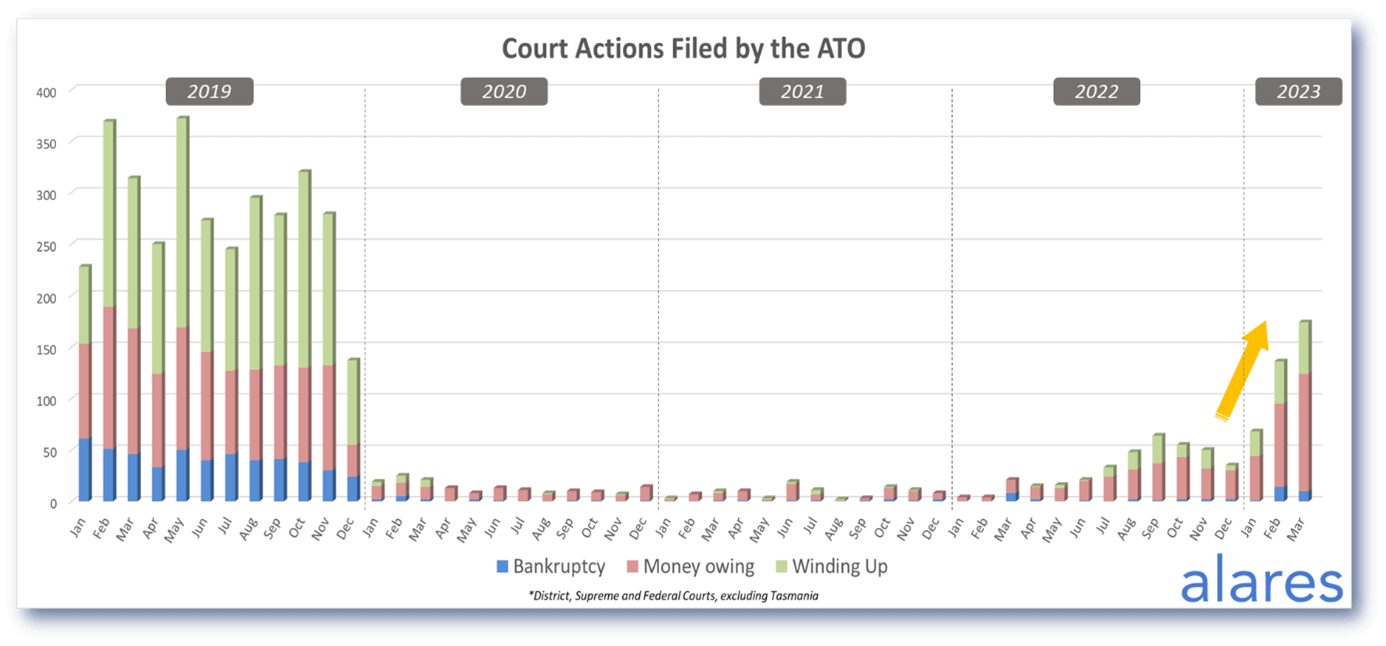

- The ATO continues to significantly increase its Court activity.

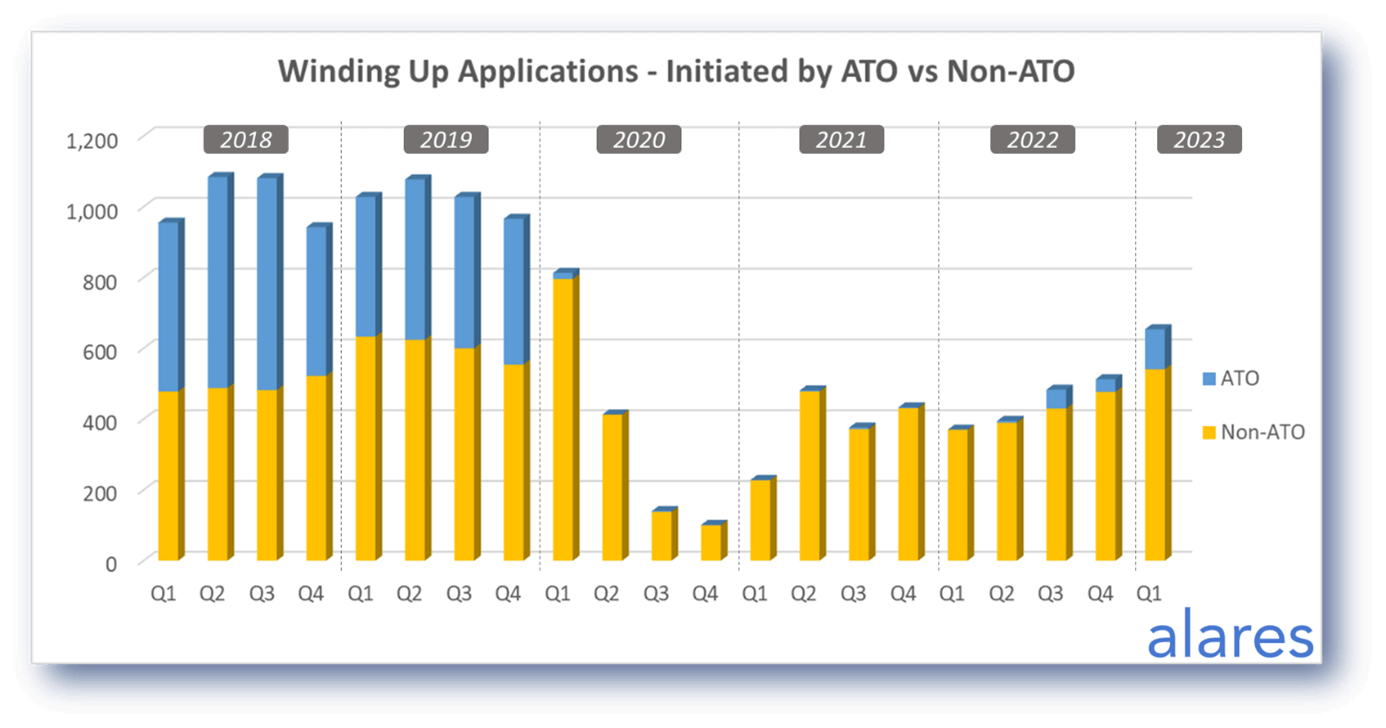

- Winding Up applications again continue to trend upwards.

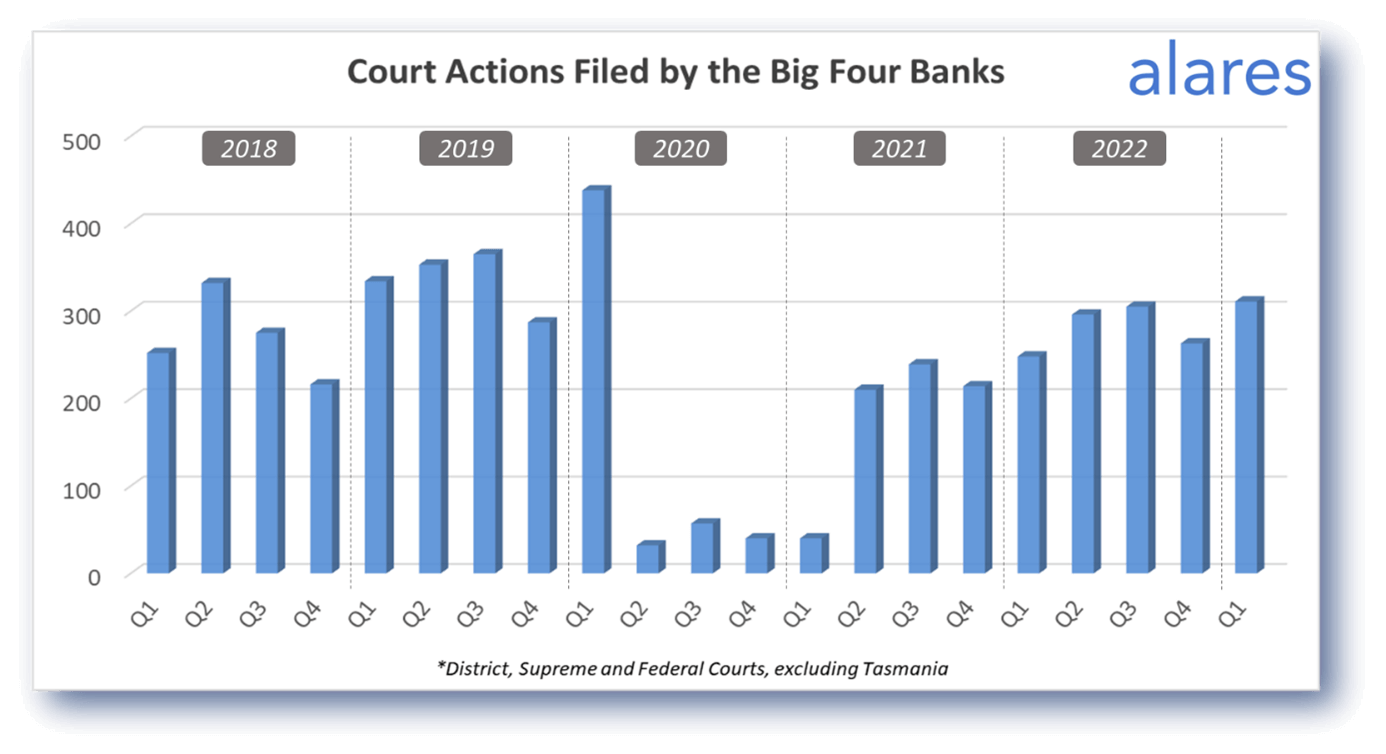

- The big-four banks and non-bank lenders continue a steady pace of Court recoveries.

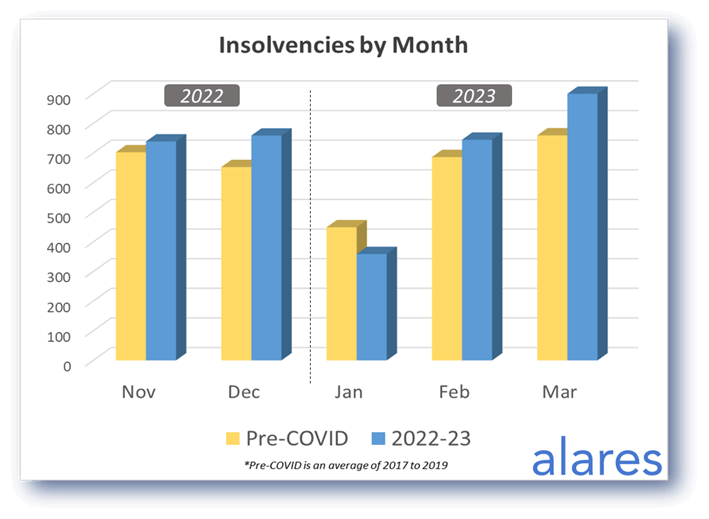

Insolvencies increased in March

Monthly insolvency numbers remain well above historical levels.

The ATO continues to ramp up its Court recoveries, maintaining a sharp upward trend since January

The total volume of ATO Court activity in March was more than half of the ATO’s historical levels. Will this trend continue in April? Stay tuned to find out.

Winding up applications continue their upward trajectory

Winding ups have been trending upwards since the start of 2022. Non-ATO winding ups are back in-line with historical levels. With the ATO now also joining the party, what will this mean for insolvencies in the coming months?

The big four banks have maintained a steady pace of Court activity to start the year

Court recoveries from the big banks have historically peaked in the middle of the year. The coming months will show whether this trend continues in 2023.

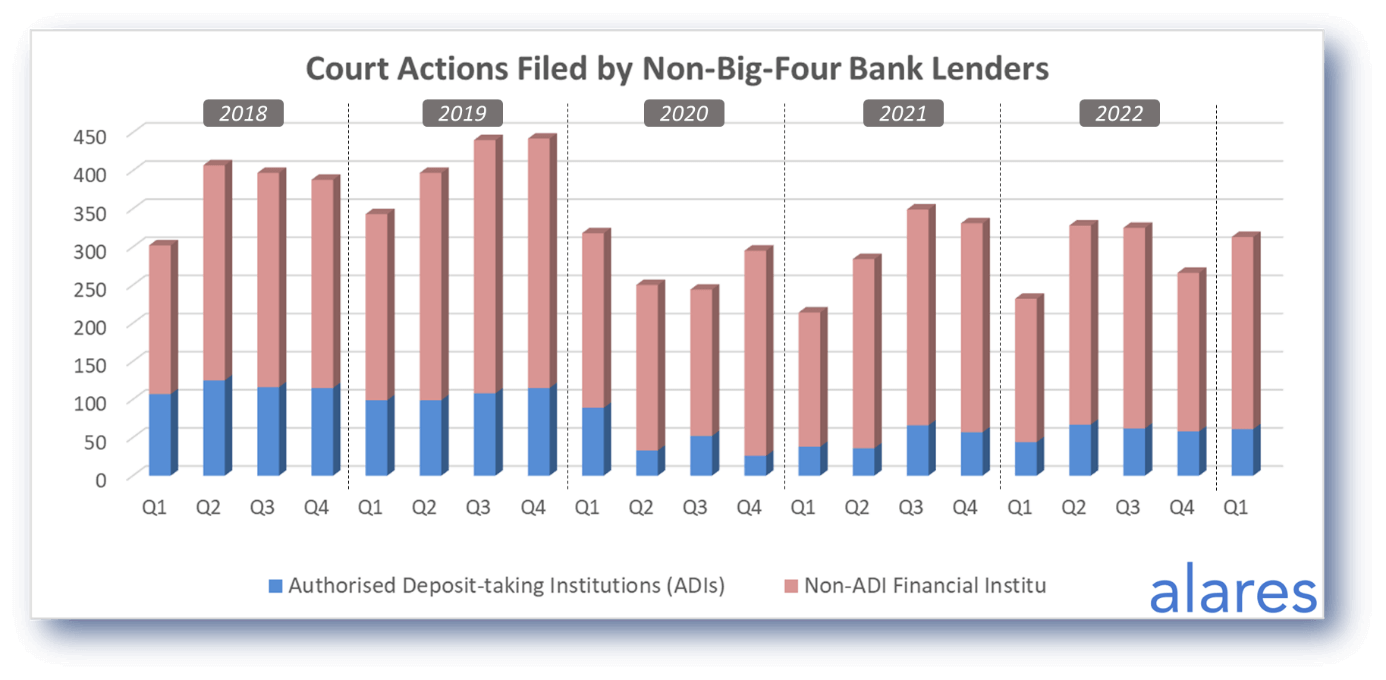

Similarly, the non big-four lenders are holding a steady level of Court recoveries

Total Q1 numbers were well inline with historical averages, with the peak mid-year season coming up.

Alares provides key credit risk insights that are NOT captured in credit reports

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners