This piece was written and provided by Alares.

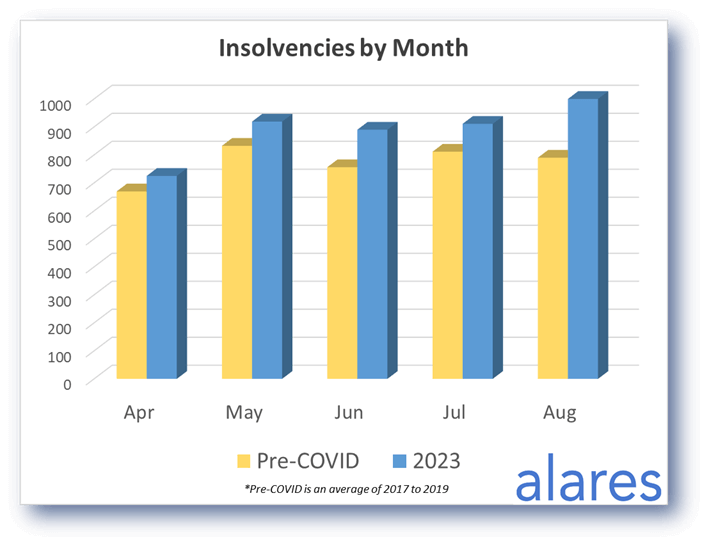

Insolvencies in August were the highest we have seen so far in 2023 and also showed the highest increase above pre-COVID levels.

Are these increased insolvencies simply a “catchup” from the COVID lull, or are we seeing a broader impact on business from higher rates, inflation, labour shortages etc. Stay tuned to see how these trends continue to evolve.

Key highlights in August

- Highest monthly insolvencies so far in 2023.

- ATO Court activity back in-line with historical levels.

- The big four banks remain very active with Court recoveries.

Insolvencies in August well above pre-COVID levels

Insolvencies in August were the highest so far in2023, well above pre-COVID monthly totals.

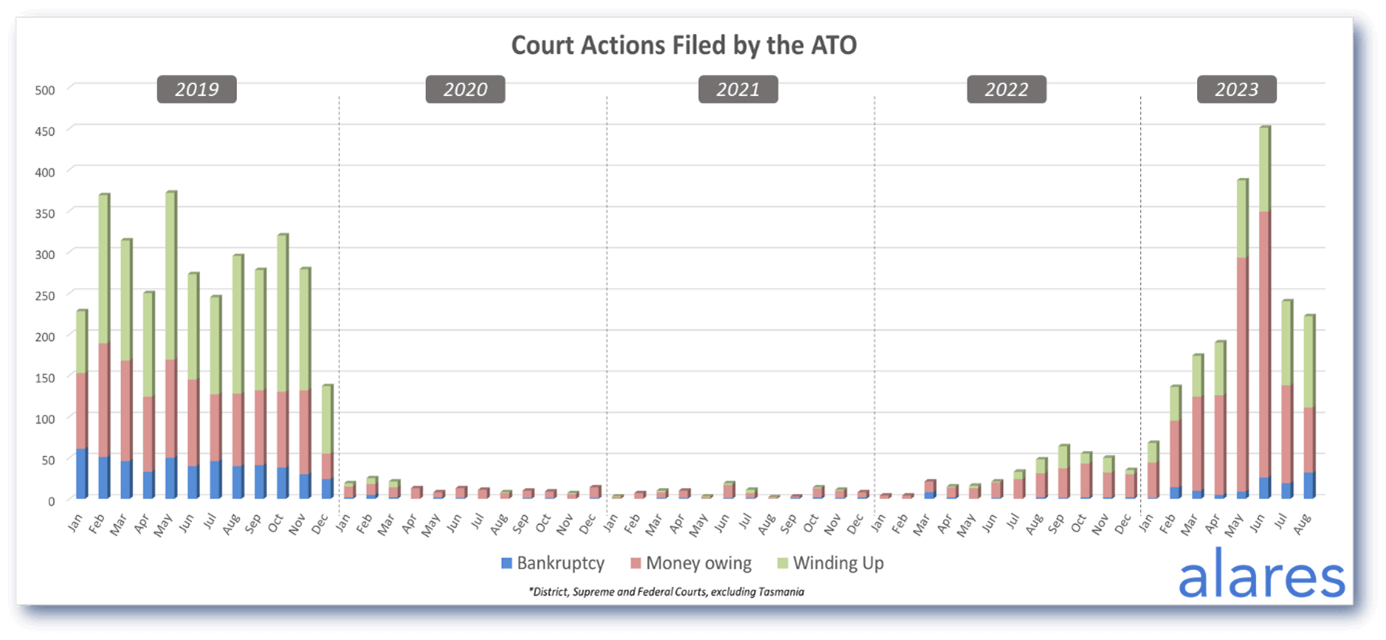

ATO Court activity in August remained similar to July after a major ramp-up in May and June

The sharp peak in May-June is gone (specifically money owing claims against individuals), but ATO Court activity remains active and in-line with pre-COVID levels.

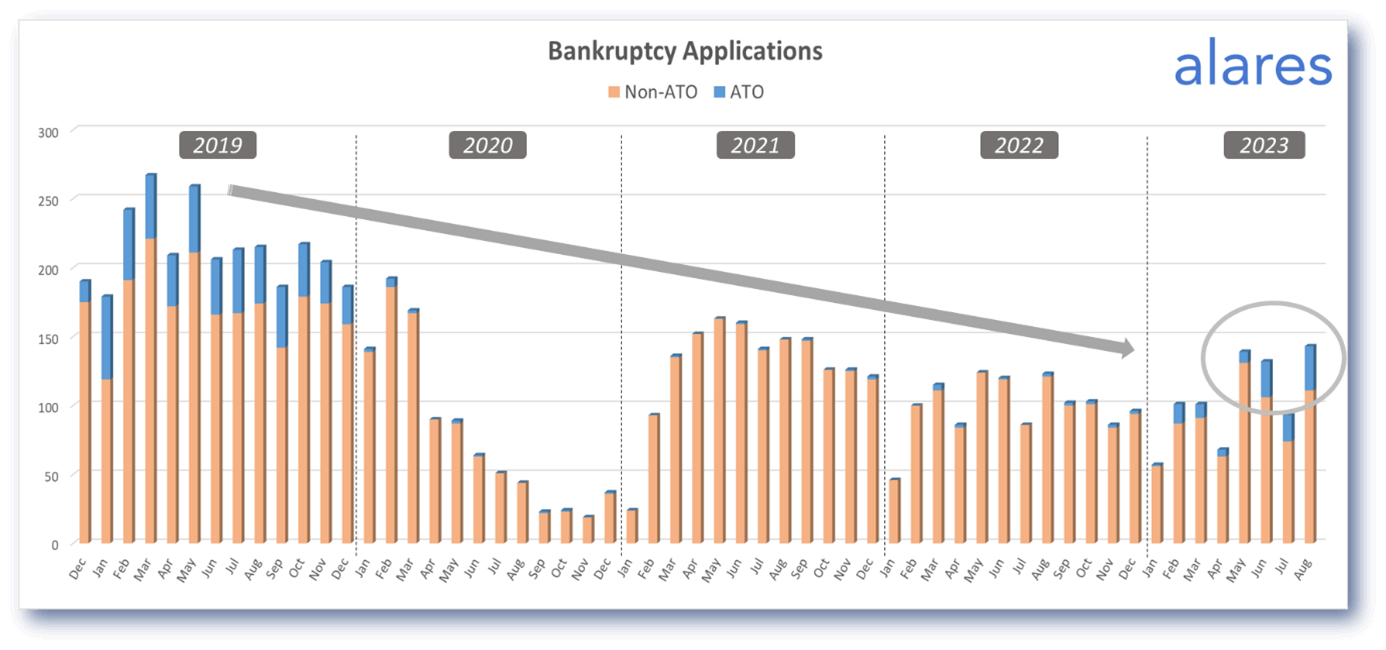

Creditor initiated bankruptcy sequestrations are showing first signs of a potential increase

Creditor-initiated bankruptcy applications have generally been trending downwards for many years. However the last few months have shown the first signs that this trend may be changing. This also coincides with a recent increase in ATO-initiated bankruptcy filings.

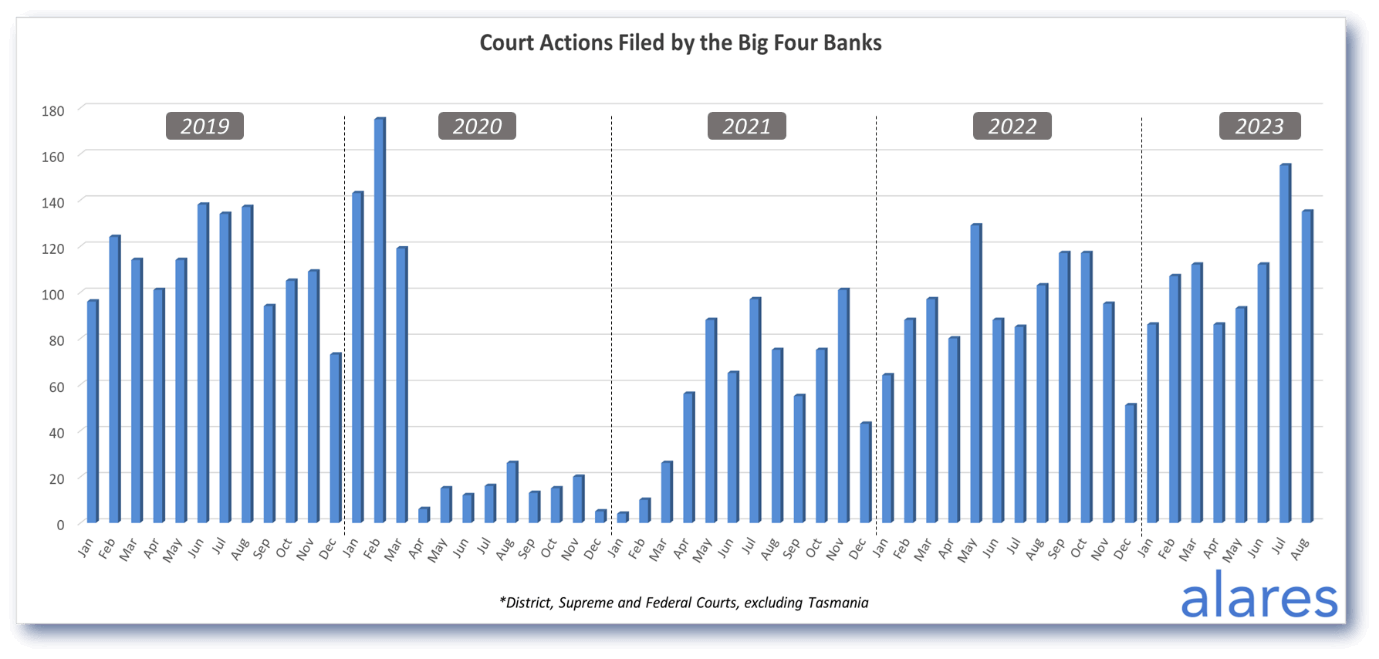

The big four banks remained active in August, following a busy month in July

The big banks have remained diligent in their Court recoveries as borrowers continue to face pressure from higher rates.

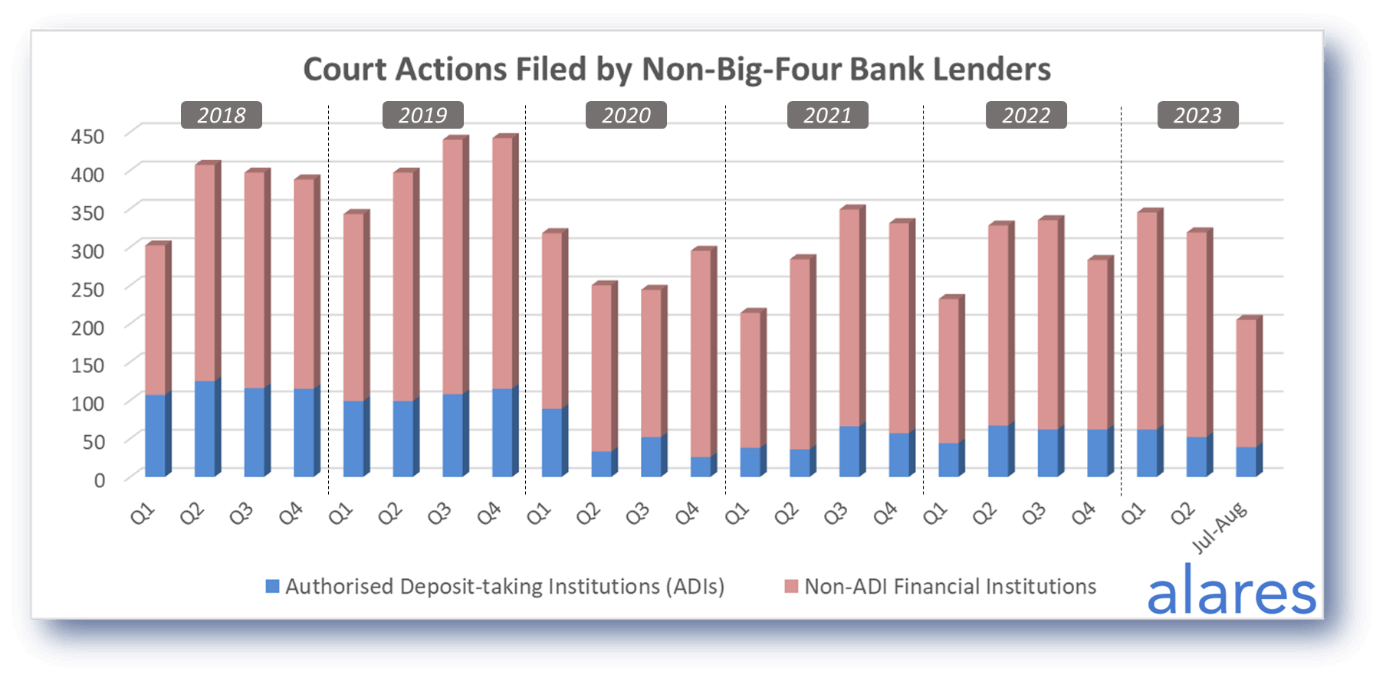

While the big four banks increased their Court recoveries, the non-big four lenders remained steady

So far in 2023 we have still not seen any major changes to Court recoveries from the non-big four lenders.

Alares provides critical credit risk data that is NOT captured by other providers

For better due diligence on your customers and suppliers, please get in touch.

Patrick Schweizer

Director, Alares

w: www.alares.com.au

e: patrick@alares.com.au

m: +61 418 739 921

Our Principal Partners